– by New Deal democrat The Bonddad Blog As usual, the new month’s data starts out with information on manufacturing and construction. To repeat what I have said often recently, these are the two sectors I am paying particular attention to for forecasting purposes this year. The ISM manufacturing index has been a good leading indicator in that sector for 75 years. The difference over time, especially the last 20 years, is that manufacturing makes up a smaller share of the total US economy. As a result, even though it had been in contraction for the last 16 months, to levels that before 2000 would always have meant recession, that didn’t happen in 2023. Notice I said “had been.” Because in March, for the first time since late 2022 the total

Topics:

NewDealdemocrat considers the following as important: manufacturing and construction, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

The Bonddad Blog

As usual, the new month’s data starts out with information on manufacturing and construction. To repeat what I have said often recently, these are the two sectors I am paying particular attention to for forecasting purposes this year.

The ISM manufacturing index has been a good leading indicator in that sector for 75 years. The difference over time, especially the last 20 years, is that manufacturing makes up a smaller share of the total US economy. As a result, even though it had been in contraction for the last 16 months, to levels that before 2000 would always have meant recession, that didn’t happen in 2023.

Notice I said “had been.” Because in March, for the first time since late 2022 the total index rose above its equipoise point of 50, to 50.3. Additionally, for the second time in three months the more leading new orders index surpassed that level, to 51.4:

Even though this data is just barely expansionary, it is probably the best news from the manufacturing sector in over a year.

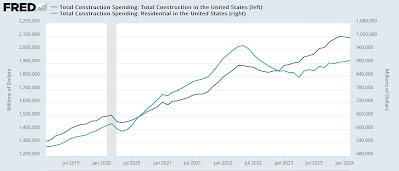

Turning to construction, for the second month in a row total construction spending (dark blue) declined, by -0.3% in February, from their all-time nominal high in December. On the other hand, the more leading residential construction component (light blue), rose 0.7% nominally, to an all-time high:

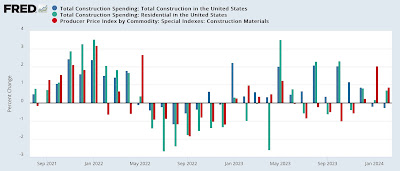

Adjusted for inflation in construction materials (red bar in the graph below), which rose 0.9% in February, however, both total and residential construction spending declined in real terms for the second month in a row:

This isn’t enough yet to call a change to a downtrend, but it does at least suggest the uptrend may have ended.

Taken together, we have slightly positive news in manufacturing and slightly negative news in construction to start the month.

Manufacturing and construction show softness to start the month, Angry Bear by New Deal democrat