– by New Deal democrat Today, New Deal democrat offers a Big Picture hypothesis. This is Housing Week, but there is no significant data today, and I’m going to wait for new home sales to be reported on Wednesday before commenting on how existing home sales fit in. In the meantime, let me unpack a Big Picture look. Since the Fed began actively managing interest rates over 60 years ago, expansions and recessions have followed a typical pattern. The unemployment rate decreases until ultimately inflation increases. Real wages and income ultimately fall behind inflation. At the same time, the Fed hikes interest rates to fend off the higher inflation. Consumers react by cutting back, unemployment increases, and the economy topples into recession.

Topics:

NewDealdemocrat considers the following as important: politics, recession forecast, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

– by New Deal democrat

Today, New Deal democrat offers a Big Picture hypothesis.

This is Housing Week, but there is no significant data today, and I’m going to wait for new home sales to be reported on Wednesday before commenting on how existing home sales fit in. In the meantime, let me unpack a Big Picture look.

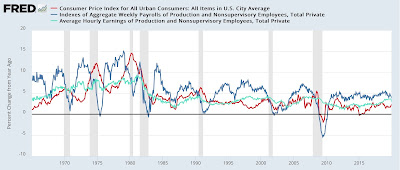

Since the Fed began actively managing interest rates over 60 years ago, expansions and recessions have followed a typical pattern. The unemployment rate decreases until ultimately inflation increases. Real wages and income ultimately fall behind inflation. At the same time, the Fed hikes interest rates to fend off the higher inflation. Consumers react by cutting back, unemployment increases, and the economy topples into recession. The Fed reacts by cutting rates while Inflation decreases, consumer spending, mainly on durable goods financed by loans, increases again, and the cycle repeats.

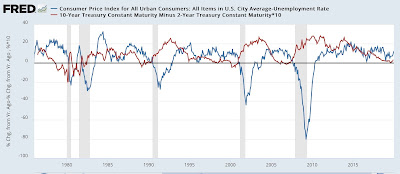

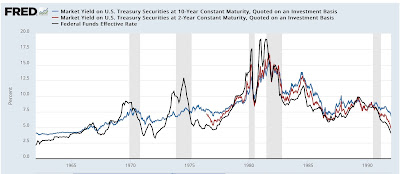

We can capture most of this paradigm by comparing the YoY change in the Phillips curve, i.e., the inflation rate minus the unemployment rate (blue in the graph below) with the Treasury yield curve, as represented by the 10 year minus 2 year spread (red):

As the economy gets “tight,” i.e., lower unemployment and higher inflation, represented by peaks in the blue line, the Fed tightens, causing the yield curve to invert, i.e., the red line goes below zero. The blue line plummets below zero, more or less coincident with the onset of a recession, and the responding Fed interest rate cuts cause the yield curve to re-normalize, i.e., head back above zero. The economy responds to easy money and lower inflation by starting back into recovery, as unemployment declines towards the inflation rate.

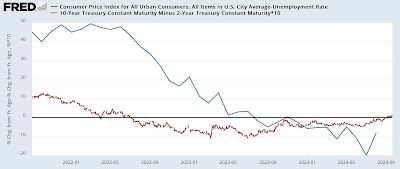

Now let’s zero in on the post-pandemic expansion:

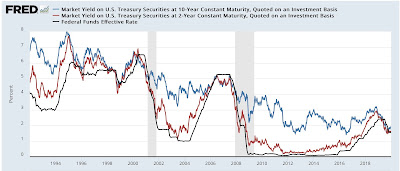

The economy was at its tightest in 2022. The Fed reacted by raising interest rates sharply, causing the yield curve to invert. The YoY change in unemployment now exceeds the inflation rate. The yield curve has just begun re-normalization with the Fed’s first rate cut.

If you go back and look at the historical record, this is typical of an economy just tipping into recession.

But when we disaggregate the two curves, some important differences appear.

First of all, as I and others have noted, the increase in the unemployment rate appears to be much more a historically high spike in new entrants to the labor force, rather than existing workers being knocked out of jobs.

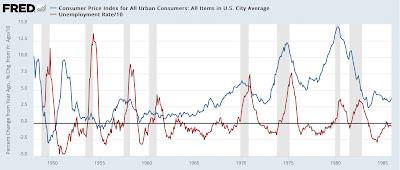

Now let’s disaggregate inflation (blue in the graphs below) and unemployment (red):

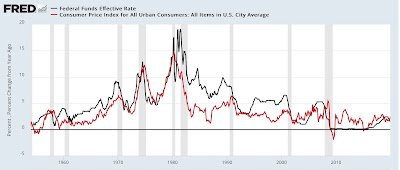

In every expansion except for the two immediate post-WW2 ones, inflation has always risen significantly in the year or more before the ensuing recession. The unemployment rate follows higher with a delay, usually because the Fed has begun hiking rates.

Importantly, during this period of increased inflation, it has almost always exceed YoY average wage gains (light blue), and always exceeded aggregate payroll gains (dark blue):

Inflation declines sharply during recessions, setting the stage for the next expansion.

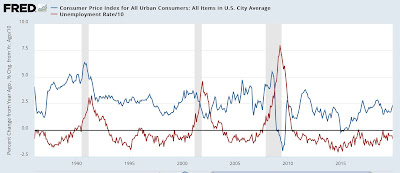

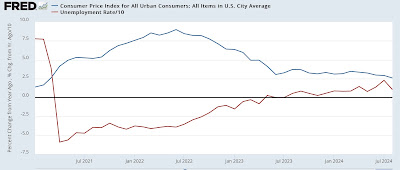

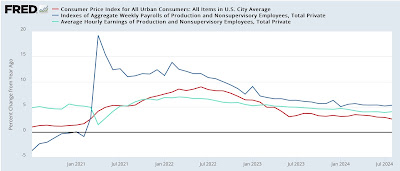

Now let’s look at this disaggregation for the present expansion:

Inflation has decelerated sharply – and as of the last report, has continued to decelerate, while the unemployment rate is only modestly higher YoY. This looks much like the pattern in a number of mid-expansion corrections, most notably 1966, 1986, and 1995. In those cases inflation declined, the Fed eased up, and there were no recessions.

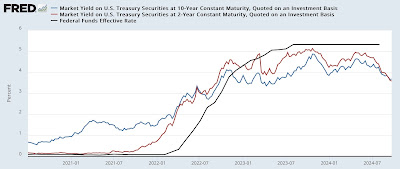

Now that we’ve disaggregated the Phillips curve, let’s do the same thing with the yield curve, and superimpose Fed rate moves (black):

The point here is fairly straightforward. Interest rates, especially shorter term interest rates, move close to in lockstep with Fed funds interest rates. In other words, the inversion and re-normalization of the yield curve has an awful lot to do with Fed interest rate hikes and decreases.

Now let’s superimpose consumer inflation (red) on those Fed interest rate changes (black):

Virtually 100% of the time before the pandemic, the Fed reacted to a decline in the inflation rate by lowering interest rates. One notable exception, 2006, is explained by the post-Katrina gas price spike which immediately abated. Thus the YoY CPI reading declined sharply for 12 months and then resumed its higher trajectory.

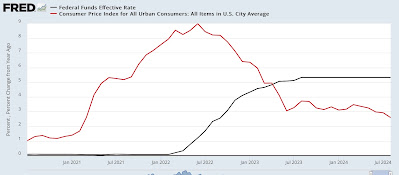

Again, here is out post-pandemic expansion:

The Fed maintained very high interest rates vis-a-vis inflation ever since mid-2023, a nearly unique situation. Which means it has a lot of room to cut now. Which means that interest rates could renormalize at lower levels fairly quickly.

Let me sum up here with some comments. I read a piece several years ago entitled:

“The Fed wants to make your recession forecast wrong.” There is no “free market” in Fed interest rates. Rather, the Fed is a human actor, like a dictator or monopolist, whose single human decisions, whether right or wrong, greatly impact the other markets. And as a human actor, the Fed has had the capacity to *learn* over time from past successes and failures. As I have repeated a number of times, human systems are inherently chaotic, because when you observe human behavior (like in job and consumer markets, or Presidential election polling), the humans always observe back, changing their behavior accordingly.

The Fed wants to avoid a recession. Unlike the 1960s and 1970s, over time it has tended to make interest rate cuts earlier. At present, we do have a weakening jobs market, but some of that weakness appears to be a false positive caused by the above-discussed spike in labor force participation. As measured by average real wages and aggregate real payrolls, consumers are in pretty good shape, as YoY growth in both continues to exceed the inflation rate:

If the Fed continues to move aggressively as consumer inflation (ex-fictitious shelter) remains fairly subdued, the housing market in particular should turn around. This is what we would expect if this is only a mid-cycle correction rather than the cusp of a recession.

The Bonddad Blog

Domestic factory orders and production vs. real imports as economic forecasting tools, Angry Bear by New Deal democrat