Briefly noted: existing home sales appear to be bottoming near 30 year lows as prices continue to firm – by New Deal democrat Last month I wrote that existing home sales “are likely in the process of bottoming, as they have been in the range of 3.79 million to 4.10 million for the past five months:” That continued to be the case in December, as sales declined -3,000 on an annualized basis to 3.78 million: On a longer term basis, existing home sales are at the lowest level in almost 30 years, and down over -40% from their post-pandemic peak: With so many people locked in to mortgages of 3% or so, inventory continues to be anemic, so potential buyers are bidding on the relatively few homes available. This is keeping prices close to

Topics:

NewDealdemocrat considers the following as important: 2024, 30 year low, Bottoming, Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Briefly noted: existing home sales appear to be bottoming near 30 year lows as prices continue to firm

– by New Deal democrat

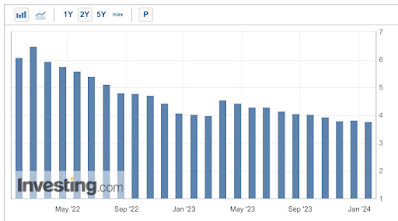

Last month I wrote that existing home sales “are likely in the process of bottoming, as they have been in the range of 3.79 million to 4.10 million for the past five months:”

That continued to be the case in December, as sales declined -3,000 on an annualized basis to 3.78 million:

On a longer term basis, existing home sales are at the lowest level in almost 30 years, and down over -40% from their post-pandemic peak:

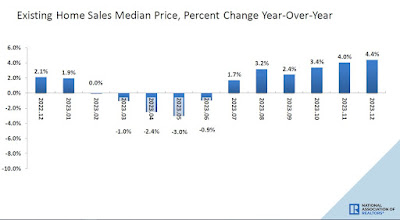

With so many people locked in to mortgages of 3% or so, inventory continues to be anemic, so potential buyers are bidding on the relatively few homes available. This is keeping prices close to their highs. Prices have been higher YoY for the past six months, currently up 4.4%:

This is in contrast to new homes, where builders can control sizes, amenities, rebates, and prices to generate demand. In that market prices are down about 10% YoY and sales are down about 25% from just before the Fed started raising rates. So the bifurcation of the two markets continues.

Existing home sales try to find a bottom, while severe bifurcation with new home market continues, Angry Bear by New Deal democrat