The “gold standard” of employment reports suggests that last summer’s job growth was even weaker than we thought – by New Deal democrat While the monthly jobs report gets all the headlines, the “gold standard” for actual employment gains and losses is the Quarterly Census of Employment and Wages (QCEW), which as its name indicates, unlike the payrolls report is not a survey but rather an actual census of about 97% of all employers, via their withholding tax reports. The downside of the QCEW is that it is reported with a serious lag (4 or more months after the end of a quarter), and it also can be revised up until a year later. Once that happens, the nonfarm payrolls data from the previous year is also revised to be in accord. Additionally,

Topics:

NewDealdemocrat considers the following as important: Job Growth, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

The “gold standard” of employment reports suggests that last summer’s job growth was even weaker than we thought

– by New Deal democrat

While the monthly jobs report gets all the headlines, the “gold standard” for actual employment gains and losses is the Quarterly Census of Employment and Wages (QCEW), which as its name indicates, unlike the payrolls report is not a survey but rather an actual census of about 97% of all employers, via their withholding tax reports. The downside of the QCEW is that it is reported with a serious lag (4 or more months after the end of a quarter), and it also can be revised up until a year later. Once that happens, the nonfarm payrolls data from the previous year is also revised to be in accord.

Additionally, unlike the monthly jobs report, the QCEW is not seasonally adjusted. The Philadelphia Fed does estimate those season adjustments several weeks later, which is helpful.

All of which is by way of introduction to the fact that the QCEW for Q3 of last year was reported on Wednesday, and it suggests that job growth was weaker than officially reported.

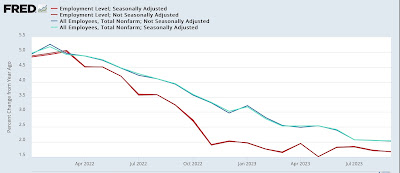

Let’s start with the comparison data. Below are both the Establishment surveyand Household survey’s employment data YoY beginning January 2022 through the end of Q3 last year:

As remarked from time to time, while the Establishment survey is larger and less noisy, the Household survey numbers have been lower compared with the Establishment survey’s ever since March 2022. As of June 2023, the Establishment survey showed a 2.1% YoY gain vs. a 1.8% gain in the Household survey. By September, that had decelerated to 2.0% and 1.7%, respectively.

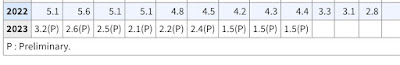

Unfortunately, the QCEW does not come with adequate graphing data, and FRED doesn’t supply it either, so the below table will have to do:

With the annual revisions, the payrolls report reflects the YoY% changes in the QCEW quite well through June of last year. But with Q3, a significant downward divergence has opened up.

This is primarily due to a much bigger than usual decline in July. To show you this, here are the non-seasonally adjusted comparison monthly numbers for the first nine months of 2023 for nonfarm payrolls (left) vs. the QCEW (right)(all number in thousands):

JAN. -2,523 -2,302

FEB. 1,129. 789

MAR. 436. 516

APR. 948. 834

MAY. 931. 1,116

JUN. 710. 828

JUL. -861. -2,122

AUG. 374. 795

SEP. 490. 791

TOTAL 2,634. 1,247

During the first six months of the year, the differences in the two measures largely netted out. The huge difference is in July, which was only partially made up in the next two months.

Let me reiterate that this is non-seasonally adjusted data. The seasonally adjusted payroll numbers for July through September (in thousands) were 184, 210, and 246, respectively.

But since the QCEW shows a net loss of -535,000 jobs in Q3 vs. the unadjusted nonfarm payrolls number, it’s at least possible that after the revisions are finalized, at least one of those three months is going to show an actual loss of jobs on a seasonally adjusted basis.

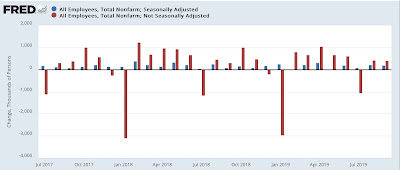

Two final caveats: First, similar declines in Q3 jobs in the QCEW numbers were reported in 2017 through 2019, which also showed up in the unadjusted payrolls report (red), but the seasonally adjusted figures (blue) showed gains:

Secondly, we had a similar episode of a big decline in the Q2 2022 QCEW report, which resulted in an estimate of seasonally adjusted job losses by the Philadelphia Fed, but which were subsequently revised away in the next Quarter’s QCEW update.

But as you may recall, I have been increasingly concerned by the relatively poor performance of YoY tax withholding, which throughout 2023 decelerated from sharply higher levels to nominally negative by the end of December. Since tax withholding dollar amounts are affected by inflation as well as wages and hours worked, they don’t measure exactly the same thing as the QCEW, so caution is certainly in order. Nevertheless, on a preliminary basis, there is reason to believe that employment was even weaker last summer than the tepid monthly payroll gains have suggested.

“Financial markets in past fiscal crises; the “gold standard” of employment reports . . . big deceleration in Q4 of last year,” Angry Bear, by New Deal democrat