– by New Deal democrat There was good news and not so good news in this morning’s two important data releases. I’ll start with the good news. Both total industrial production and its manufacturing component increased a sharp 0.9% in May. Even after downward revisions of -0.4% in March and -0.3% in April, both were still up 0.5% compared with where we thought we were one month ago: The only fly in the ointment is that both are still down, by -0.2% and -0.8% from their respective 2022 peaks. Total production and manufacturing production are both also up slightly YoY, after being negative YoY for most of 2023: In the 20th century, negative YoY readings such as were had in 2023 would almost always have meant recession. Since the

Topics:

NewDealdemocrat considers the following as important: Hot Topics, Production and Real Retail, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

– by New Deal democrat

There was good news and not so good news in this morning’s two important data releases.

I’ll start with the good news. Both total industrial production and its manufacturing component increased a sharp 0.9% in May. Even after downward revisions of -0.4% in March and -0.3% in April, both were still up 0.5% compared with where we thought we were one month ago:

The only fly in the ointment is that both are still down, by -0.2% and -0.8% from their respective 2022 peaks.

Total production and manufacturing production are both also up slightly YoY, after being negative YoY for most of 2023:

In the 20th century, negative YoY readings such as were had in 2023 would almost always have meant recession. Since the Great Recession, however, there were two other instances, in 2016 and 2019, where such negative comparisons were *not* coincident with recessions.

But if there was good news on the production side, on the consumption side retail sales disappointed, only up 0.1% in both nominal and real terms. And April was revised downward by -0.2%, in we are -0.1% below where we thought we were one month ago:

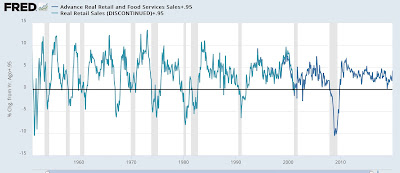

We are also down, by -0.95% YoY. In the entire history of real retail sales going back 75 years, there have only been 8 occasions where such downturns did not immediately foreshadow a recession:

But two of those, in December 1959 and June 1979, occurred within half a year of a recession, and two more, in September 1987 (stock market crash) and October 2002 (compared with post-9/11 sharp rebound in October 2001), were one month special circumstances. That leaves only 4 boba ride false signals before the pandemic, and even one of those, in February 2003, was only for one month.

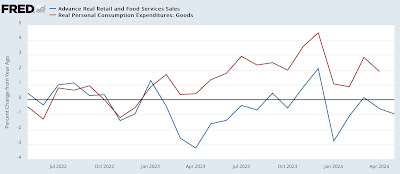

In other words, the negative YoY retail sales for four of the first five months of this year (blue in the graph below) is now a real concern, although it has not been confirmed by the similar metric of real personal spending on goods (red):

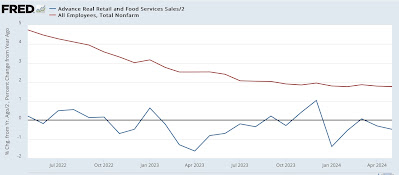

Since we are now over three years past the last pandemic stimulus, I suspect real retail sales are also giving a more accurate signal for employment (red in the graph below) in the months ahead, as they did for decades before the pandemic:

Consumption has historically led employment, and this suggests weaker monthly employment reports in the months ahead.

In sum, the short leading indicator released today, real retail sales, was not so good, and given the past few months as well, must be regarded as raising a caution flag for the economy; while the coincident measure of production suggests the economy remains healthy right now.

The Bonddad Blog

Industrial production for March is positive, but the overall trend remains flat, Angry Bear, by New Deal democrat

Real retail sales back to negative YoY, Angry Bear, by New Deal democrat