– by New Deal democrat I’ve written repeatedly in the past few months that I am paying especial attention to the manufacturing and construction sectors for signs of weakness now that the supply chain tailwind for the economy has ended. At the beginning of this month, one show appeared to have dropped, as the ISM report on manufacturing showed contraction for the second month in a row, declining slightly to 48.7, with the more leading new orders subindex declined sharply to 45.4, the lowest reading since last May: This morning the construction shoe at least dangled, as housing permits and starts had their most abysmal month since 2020, and units under construction their worst in two years. In fact, housing units under construction – the real

Topics:

NewDealdemocrat considers the following as important: Hot Topics, housing, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

– by New Deal democrat

I’ve written repeatedly in the past few months that I am paying especial attention to the manufacturing and construction sectors for signs of weakness now that the supply chain tailwind for the economy has ended. At the beginning of this month, one show appeared to have dropped, as the ISM report on manufacturing showed contraction for the second month in a row, declining slightly to 48.7, with the more leading new orders subindex declined sharply to 45.4, the lowest reading since last May:

This morning the construction shoe at least dangled, as housing permits and starts had their most abysmal month since 2020, and units under construction their worst in two years. In fact, housing units under construction – the real economic activity in the housing construction data – are getting close to their recession caution signal.

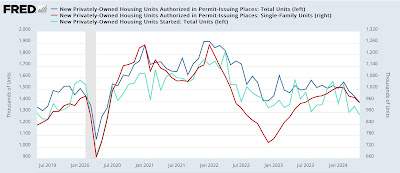

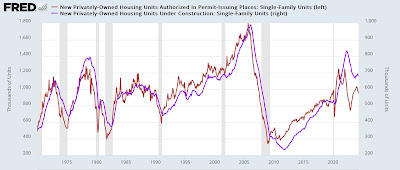

To wit, the longest leading signal in the data – permits (dark blue in the graph below) – declined -54,000 on an annualized basis to 1.386 million. Single family permits (red, right scale) which have the most signal and least noise of any of the data series, also declined, by -28,000 to 949,000 annualized. Starts (light blue), which are slightly less leading and much more noisy, declined -75,000 to 1.277 million annualized:

As noted above, total permits and starts are both at their lowest levels since 2020. Meanwhile single family permits, which rebounded last year, declined for the fourth consecutive month.

Earlier this year, while noting that I expected to see more of a decline in the actual hard-data metric of housing units under construction, I wrote that “With permits having increased off their bottom, I am not expecting such a 10% decline in construction to materialize.” And last month I concluded that “My sense is that, while housing units under construction will decline further, unless interest rates increase further, permits and starts will stabilize, and after a period so while units under construction, without crossing into recession warning territory.”

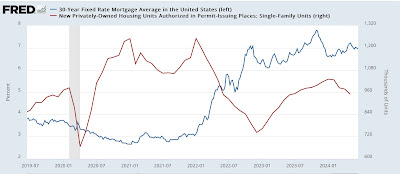

Mortgage rates did rise through April, but have stabilized since. Here’s what they look like in comparison with single family permits:

Although total permits did – by a slight margin – make a new low, I continue to suspect that they will not drift much lower, so long as mortgage rates remain in their past 12 month range.

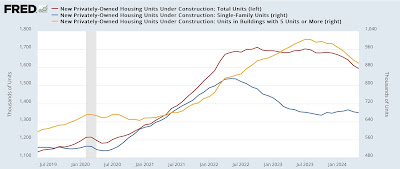

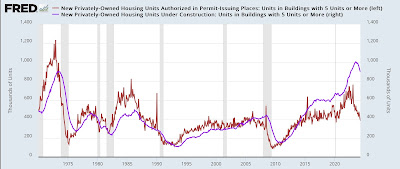

But let’s take a more detailed look at units under construction. These – especially multi-unit dwellings (gold in the graph below) levitated for over a year after permits and starts declined, before finally turning down definitively this year:

Single family units under construction (magenta in the graph below) did follow their typical pattern, slightly lagging single family permits (red):

But multi-family units, as noted above, seemed to levitate, lagging the downturn in multi-unit permits by a much longer time:

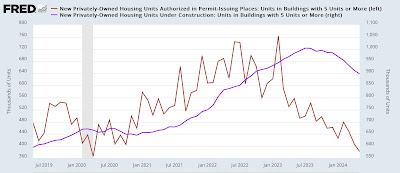

That’s becuase, as the close-up below shows, the newer multi-unit construction tends to be much larger complexes than were built in the 1960s through 1990s, and builders have not increased their workforce equivalently. So in the past 10 years it has taken much longer to finish these large multi-unit projects:

The above graphs suggest that single family units under construction will probably not decline much further, while multi-unit developments under construction, which are only down about 10% vs. the 40% decline in permits for them, are likely to decline much further.

Usually it has taken more than a 10% decline in units under construction to be consistent with a recession. In 1970 and 2001, the declines were less than that. But in the late 1980s and 2000s, it took almost a 25% decline before a recession occurred. With this morning’s report, the decline is -6.9%. Hence my statement in the opening paragraph above that the construction shoe “dangled” but not quite “dropped.”

To return to my opening comment, this year I am paying extra close attention to the manufacturing and construction sectors, because a significant turndown in both of those simultaneously would be a danger signal for oncoming recession. Together with the contraction in the ISM manufacturing index, and the relatively poor real retail sales report, the next items to watch are (1) whether real personal spending on goods, which tends to trend similarly to real retail sales, weakens substantially; and (2) whether employment in manufacturing and construction, neither of which has turned down, change direction in the next few jobs reports.

Housing construction rebounds in February, as permits and starts are stable and rebounding, Angry Bear by New Deal democrat