The Senior Loan Officer Survey makes an important turn – by New Deal democrat The Senior Loan Officer Survey is a long leading indicator, telling us about credit conditions that typically turn worse a year or more before the economy turns down, and improve just at the economy is ready to turn up. The one downside is that the information is only reported Quarterly, and with a one a one month lag. Which is a way of saying that data for Q4 of last year was only reported yesterday. And yesterday’s report was pretty important. Because, for the first time in several years, it was almost entirely positive. There are two series that have a long enough record to give us a lot of information. The first is whether banks are tightening or

Topics:

NewDealdemocrat considers the following as important: Hot Topics, Loan Officer Survey 2024, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

The Senior Loan Officer Survey makes an important turn

– by New Deal democrat

The Senior Loan Officer Survey is a long leading indicator, telling us about credit conditions that typically turn worse a year or more before the economy turns down, and improve just at the economy is ready to turn up.

The one downside is that the information is only reported Quarterly, and with a one a one month lag. Which is a way of saying that data for Q4 of last year was only reported yesterday.

And yesterday’s report was pretty important. Because, for the first time in several years, it was almost entirely positive.

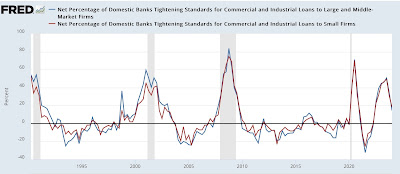

There are two series that have a long enough record to give us a lot of information. The first is whether banks are tightening or loosening standards. Since tightening is shown as an increase, this is one of those series where higher means worse. In Q4, more banks tightened than loosened standards, the percentage of banks so doing decreased sharpl:

This is what happens coming out a reecssions.

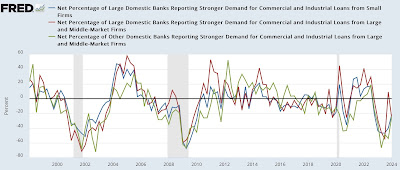

The second series, demand for commercial and industrial loans, is almost as positive (and confusingly, in this one higher does mean better. Two of of three measures also showed improvement:

Again, demand has decreased, but not nearly as sharply as before, and this is typically what has happened coming out of recessions.

It has been a long time since the long leading indicators have turned up. But led by interest rates, it appears that has begun to happen.

Strong demand for loans, but accommodation ends, Angry Bear, by New Deal democrat