– by New Deal democrat I wanted to follow up on a point I made yesterday: although manufacturing is no longer a big enough slice of the US economy to bring about an economic downturn on its own – unless for some reason the manufacturing downturn were unusually severe – when it is paired with a downturn in construction, that historically has been a reliable (but of course not perfect!) harbinger of recession. And while yesterday’s construction spending report was equivocal, there are other signs suggesting that just such a synchronous downturn may be occurring. Let me start with a refresher on the historical value of the ISM manufacturing index, especially its new orders component. This survey has been in existence for over 75 years, since

Topics:

NewDealdemocrat considers the following as important: manufacturing and construction, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

I wanted to follow up on a point I made yesterday: although manufacturing is no longer a big enough slice of the US economy to bring about an economic downturn on its own – unless for some reason the manufacturing downturn were unusually severe – when it is paired with a downturn in construction, that historically has been a reliable (but of course not perfect!) harbinger of recession.

And while yesterday’s construction spending report was equivocal, there are other signs suggesting that just such a synchronous downturn may be occurring.

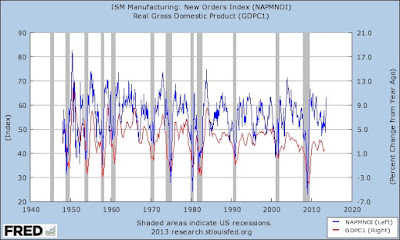

Let me start with a refresher on the historical value of the ISM manufacturing index, especially its new orders component. This survey has been in existence for over 75 years, since 1948. It has been recognized as a leading indicator almost since the start.

The ISM no longer allows FRED to update its readings, but fortunately about 10 years ago I pulled a graph of all of the new orders data, and here it is (blue, left scale):

With the exceptions of 1970, 1973, and 2008, it always turned down below 50 in advance of recessions. In those three cases it was coincident. In addition, however, there were a number of false positives; namely, in 1952, 1966, 1984, 1995, 2002, and 2012.

Here is the updated graph I ran yesterday:

Again, there were false positives in 2015-16 and 2022-23. Arguably 2019 was as well, but because the COVID pandemic intervened, we’ll never really know. This is what I have been highlighting in noting that a downturn in manufacturing no longer carries enough weight to be a leading indicator by itself.

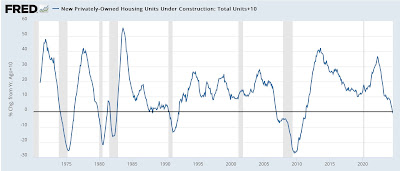

Now let’s take a look at the second element, construction, as reflected in housing units under construction, which as I typically point out each month, reflects the actual full economic activity of the housing market, vs. sales, permits, starts, or completions.

The easiest way to visualize this is YoY, which I’ve done below. Because typically it takes a 10% or more decline to signal recession, I have added 10% to the values so that -10% YoY shows at the zero line (note: data only begins in 1971):

With the exception of 2001, a downturn of 10% YoY or more has always meant recession, with the exception of a single month in 1988.

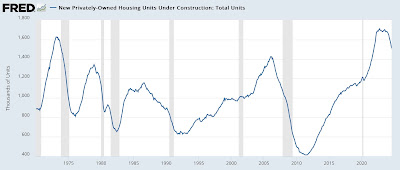

Here is the same data presented as absolute numbers:

I am showing this last graph to compare downturns with the ISM new orders data since 1971. In each case of a “false positive” in the ISM new orders – 1984, 1995, 2002, 2012, 2015-16, and 2022-23 – housing construction was either increasing or at least not declining in any significant way, i.e., by less than 5%.

So the fact that as of this past month’s housing construction report, we now have a 10% downturn in units under construction, coinciding with a significant decline in manufacturing including its new orders component, is a real cause for concern.

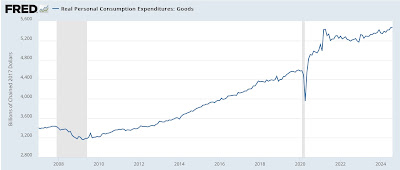

A significant positive, meanwhile, is that real spending on goods has continued to increase:

And indeed is up 2.2% YoY on a per capita basis. In the past 50 years, with the exception of 2001, this has always turned negative coincident with or before the onset of a recession:

As I wrote yesterday, tomorrow we will get the ISM services report, which will help us see how much this downturn is showing up as a slowdown in that much larger sector of the economy as well. And in Friday’s employment report, we will get an updated look at the number of employees in manufacturing and construction. As of last month, the former had turned down, while the latter was still growing. If there is a significant synchronous downturn, both sectors of employment should turn down, which would be the final warning signal that the odds of a recession as opposed to a “soft landing” have increased greatly.

The Bonddad Blog

Manufacturing remains in contraction, with construction on the brink, Angry Bear by New Deal democrat