– by New Deal democrat You may recall that last week I wrote that beginning this week and for the next 6+ months, initial claims would be up against some very tough comparisons from 2023 and would be the ultimate true test of whether there has been unresolved post-pandemic seasonality in the numbers. Well, this week’s numbers suggest the unresolved seasonality hypothesis is still with us, but with considerable ambiguity. Initial claims did decline -12,000 to 219,000, the lowest number since May 18. Similarly, the four-week moving average declined -3,500 to 227,500, the lowest since June 8. And continuing claims, with the typical one-week delay, declined -14,000 to 1.829 million, its lowest since June 15: All well and good. But when we

Topics:

NewDealdemocrat considers the following as important: Jobless, Sept 2024, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

You may recall that last week I wrote that beginning this week and for the next 6+ months, initial claims would be up against some very tough comparisons from 2023 and would be the ultimate true test of whether there has been unresolved post-pandemic seasonality in the numbers.

Well, this week’s numbers suggest the unresolved seasonality hypothesis is still with us, but with considerable ambiguity.

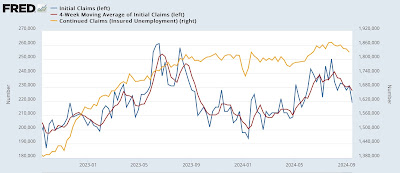

Initial claims did decline -12,000 to 219,000, the lowest number since May 18. Similarly, the four-week moving average declined -3,500 to 227,500, the lowest since June 8. And continuing claims, with the typical one-week delay, declined -14,000 to 1.829 million, its lowest since June 15:

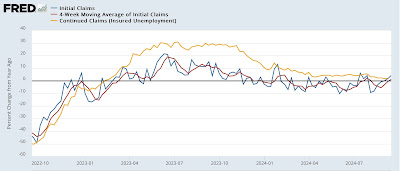

All well and good. But when we look at the YoY% comparisons, which are more important for forecasting purposes, initial claims were up 4.3%, the four-week average up 1.2%, and continuing claims up 2.0%:

The good news is that the YoY comparison for continuing claims is it second lowest in 18 months (after last week). But the higher numbers YoY move initial claims and its four-week average to neutral.

In order to warrant a “yellow flag,” the numbers would have to be higher by 10% or more. If they are higher YoY by 12.5% or more, and that poor comparison persists for at least two months, that would be a recession signal.

But here’s the thing. With a few exceptions, or the next 6 months, the comparisons for initial claims are going to be against numbers lower than 217,000. For the four week average it will be against numbers lower than 220,000. For continuing claims, the comparison range will be between 1.780 million and 1.820 million.

All three numbers are currently above that range. Because we drifted by a couple of calendar days this year, unresolved seasonality could easily mean we will get to that range next week. But of course, we don’t know that yet. On the other hand, any initial claims numbers over 235,000 and any four-week average above 242,000 will be causes for concern, as will any continuing claims numbers above about 1.975 million.

We’ll see.

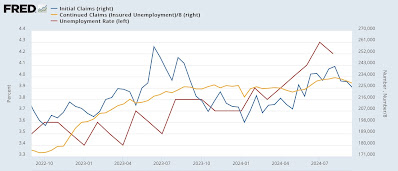

Finally, here is the comparison so far with the unemployment rate:

Under normal circumstances, the unemployment rate should be at 3.8% or even below. Above that number is almost certainly a result of the outsized entry into the labor force of recent immigrants.

The Bonddad Blog

Jobless claims: almost all good – Angry Bear by New Deal democrat