Personal income, spending, and prices: consumer remains strong, inflation close to 2% target no matter how you measure it – by New Deal democrat I am on the road today, so I will have to keep this brief. In June nominal personal income rose 0.3%, and spending rose 0.2%. Since PCE inflation rose less than 0.1%, real income rose 0.2% and real spending rose 0.1%. Since spending on services tends to rise even during recessions, the more important component to focus on is real spending on goods. This rose 0.2% to its highest level ever except for last December: As indicated above, PCE inflation was also subdued. The core measure rose 0.2%. On a YoY basis, PCE inflation is 2.5%, and core PCE inflation is 2.6%: Both of these are at

Topics:

NewDealdemocrat considers the following as important: Income and spending, prices, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Personal income, spending, and prices: consumer remains strong, inflation close to 2% target no matter how you measure it

– by New Deal democrat

I am on the road today, so I will have to keep this brief.

In June nominal personal income rose 0.3%, and spending rose 0.2%. Since PCE inflation rose less than 0.1%, real income rose 0.2% and real spending rose 0.1%.

Since spending on services tends to rise even during recessions, the more important component to focus on is real spending on goods. This rose 0.2% to its highest level ever except for last December:

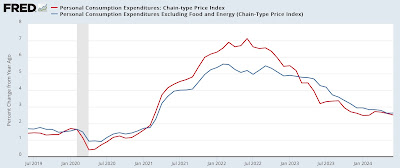

As indicated above, PCE inflation was also subdued. The core measure rose 0.2%. On a YoY basis, PCE inflation is 2.5%, and core PCE inflation is 2.6%:

Both of these are at their lowest levels since the pandemic.

Finally, with the usual one-month delay, real manufacturing and trade sales rose sharply, by 0.9%, also to their highest level ever except for last December:

The two big takeaways from this month’s report are that the consumer remains strong, and inflation, no matter how you measure it, is close to the Fed’s 2% target. Again, if that is indeed a target rather than a ceiling, the Fed has no reason not to proceed with at least several small interest rate cuts.

Real income and spending in May a nice rebound, but watch the caution flags in manufacturing sales and goods spending, Angry Bear by New Deal democrat