Repeat home sale prices continue rebound; rents continue decline – by New Deal democrat Since the Fed started raising interest rates almost two years ago, homebuilding has shifted away from single family houses to condos and apartments, the construction of which has made repeated all-time highs. This has become reflected in house price vs. apartment rental indices. Starting with apartment rents, according to the Apartment List National Rent Report, new rental prices declined seasonally in January by -0.3%: On a YoY basis, apartment rents are down 1%, as they have been for the last six months. As the report points out, because of this we can expect the CPI measure of “rent of primary residence” to continue to decline from its

Topics:

NewDealdemocrat considers the following as important: 2024, Hot Topics, Repeat home sale prices, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Repeat home sale prices continue rebound; rents continue decline

– by New Deal democrat

Since the Fed started raising interest rates almost two years ago, homebuilding has shifted away from single family houses to condos and apartments, the construction of which has made repeated all-time highs.

This has become reflected in house price vs. apartment rental indices.

Starting with apartment rents, according to the Apartment List National Rent Report, new rental prices declined seasonally in January by -0.3%:

On a YoY basis, apartment rents are down 1%, as they have been for the last six months. As the report points out, because of this we can expect the CPI measure of “rent of primary residence” to continue to decline from its current 6.5% YoY level:

The story is more complicated with regard to single family homes, which were chronically under-built ever since the Great Recession. Needless to say, this shortage was not going to be resolved either by higher prices or higher mortgage rates.

And that is what has shown up in both the FHFA and Case-Shiller Indexes for November which were reported this morning.

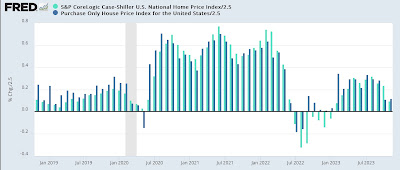

The FHFA index rose 0.3% on a monthly basis, while the Case-Shiller National index increased 0.2%. This compares with generally declining monthly prices one year ago::

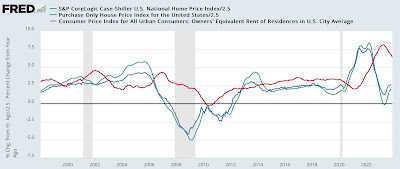

On a YoY basis, the FHFA index rose further slightly to 6.6%, and the Case Shiller index also rise further slightly to 5.2%. As the below graph shows, although this seems like a major increase, it is par for the course for YoY gains in both indexes for most of the last 25 years outside of recessions. Further, because these house price indexes lead the CPI measure of Owners Equivalent Rent, it remains likely that there is going to be further deceleration in that index, although the pace of that decline may itself decelerate:

This in turn suggests that both headline and core CPI have bottomed out on a YoY basis as well.

Repeat home sale prices may be easing back into their pre-pandemic YoY range, Angry Bear, by New Deal democrat.