Producer prices flat, commodities decline, confirming shelter as sole inflationary pressure – by New Deal democrat Once again producer prices confirmed that the only significant problem in inflation is shelter. In December commodity prices declined -1.3%. For finished goods they declined -1.2%. Even producer prices for services were unchanged: On a YoY basis, commodity prices are down -3.2%, finished goods prices down -0.2%, and producer prices for services up 1.8%: Needless to say, none of these suggest any producer inflation pressures in the pipeline at all. Here is what final goods producer prices (blue), headline consumer prices (red), and consumer prices excluding shelter (gold) look like since the energy inflection point of

Topics:

NewDealdemocrat considers the following as important: 2024, Hot Topics, Inflationary sheters, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Producer prices flat, commodities decline, confirming shelter as sole inflationary pressure

– by New Deal democrat

Once again producer prices confirmed that the only significant problem in inflation is shelter.

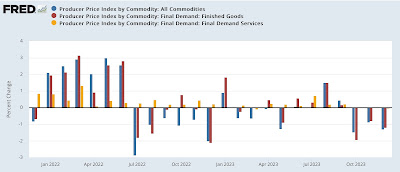

In December commodity prices declined -1.3%. For finished goods they declined -1.2%. Even producer prices for services were unchanged:

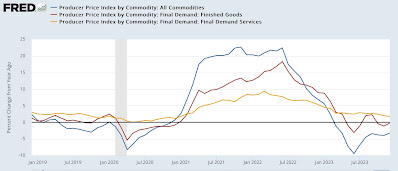

On a YoY basis, commodity prices are down -3.2%, finished goods prices down -0.2%, and producer prices for services up 1.8%:

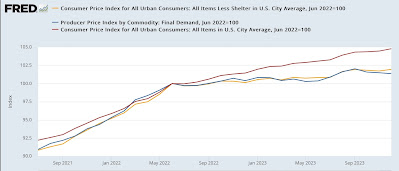

Needless to say, none of these suggest any producer inflation pressures in the pipeline at all. Here is what final goods producer prices (blue), headline consumer prices (red), and consumer prices excluding shelter (gold) look like since the energy inflection point of June 2022:

Producer prices are up only 1.4% since then, and CPI less shelter up 1.9%, vs. headline consumer prices up 4.8%.

The only real inflationary issue in the US economy is shelter as measured by the CPI. Paradoxically, high interest rates, which depress homebuilding, do not help this issue at all.

September producer prices confirm economic tailwind has ended, Angry Bear, by New Deal democrat