– by New Deal democrat The Senior Loan Officer Survey is a long leading indicator, telling us about credit conditions that typically turn worse a year or more before the economy turns down, and improve just at the economy is ready to turn up. The big drawback of this series is that the information is only reported Quarterly, and with a one a one month lag. As I indicated in my introductory note yesterday, data for Q1 was released yesterday. There are two series that have a long enough record to give us a lot of information: whether banks are tightening or loosening standards; and the demand for commercial and industrial loans. Let’s look at each in turn. The first series is the percentage of banks tightening lending standards, meaning

Topics:

NewDealdemocrat considers the following as important: Credit conditions, Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

– by New Deal democrat

The Senior Loan Officer Survey is a long leading indicator, telling us about credit conditions that typically turn worse a year or more before the economy turns down, and improve just at the economy is ready to turn up.

The big drawback of this series is that the information is only reported Quarterly, and with a one a one month lag. As I indicated in my introductory note yesterday, data for Q1 was released yesterday.

There are two series that have a long enough record to give us a lot of information: whether banks are tightening or loosening standards; and the demand for commercial and industrial loans.

Let’s look at each in turn.

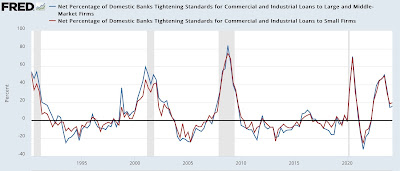

The first series is the percentage of banks tightening lending standards, meaning that a positive number means more tightening than loosening standards, i.e., positive is worse for the economy. In Q1, there was a slight increase in the percentage of banks tightening credit conditions:

Versus Q4 of last year, in Q1 there was a 1.1% increase to 15.6% in the number of banks tightening standards for large firms, and a 1.2% increase to 19.7% as to small firms. This is similar to what happened in 2002, is not a significant change q/q, and is much lower than the roughly 50% for both metrics back in Q3 of last year. As with Q4, this is consistent with coming out of past recessions.

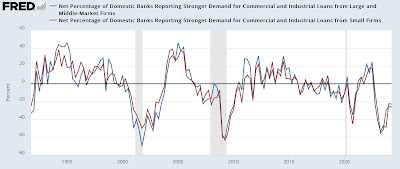

The story was similar as to the second series, demand for commercial and industrial loans (confusingly, in this one higher does mean better). There was a slight downshift q/q of -1.6% as to large firms and -0.6% as to small firms:

Again, this has been more typical of an economy coming out of a recession than going in to one.

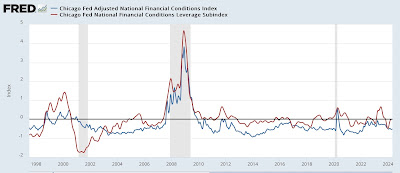

The Chicago Fed also looks at credit conditions, but their data is weekly and thus much more timely. Here the data has been much more consistently good (these series, again, are ones in which a positive number means “tightening” and so is worse for the economy):

The Index adjusted for “normal” credit conditions has never shown any tightness since the end of the pandemic lockdowns in 2020. The more leading leverage subindex did show tigh contentions after the Silicon Bank failure last year, but has been negative or neutral for the past six months. Note that the leverage index has been more prone to false positives than the adjusted financial conditions index.

Unless for some reason the Fed decides to tighten again, or there is another spate of bank failures, credit conditions are either relatively loose (the Chicago Fed indexes) or “less restrictive” (the Senior Loan Officer Survey), which do not indicate any particular credit stress in the system.

The Bonddad Blog

Credit conditions worsen, and likely to worsen further due to Debt Ceiling Debacle II, Angry Bear, by New Deal democrat.