– by New Deal democrat The second point of economic data released this morning, retail sales, were also positive. On a nominal basis, retail sales in July rose 1.0%. After adjusting for inflation, they rose 0.8% to the highest level so far this year. The below graph norms both real retail sales (dark blue) and the similar measure of real personal consumption of goods (light blue) to 100 as of just before the pandemic: Since the end of the pandemic stimulus in spring 2022, real retail sales have been trending generally flat to slightly declining, while real personal consumption expenditures on goods have continued to increase. On a YoY basis, however, real retail sales are still negative at -0.3%, which while also the second best

Topics:

NewDealdemocrat considers the following as important: 2024, real retail sales, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

The second point of economic data released this morning, retail sales, were also positive.

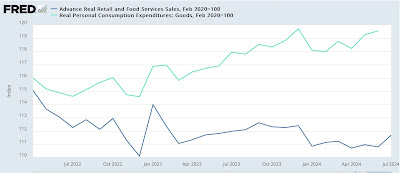

On a nominal basis, retail sales in July rose 1.0%. After adjusting for inflation, they rose 0.8% to the highest level so far this year. The below graph norms both real retail sales (dark blue) and the similar measure of real personal consumption of goods (light blue) to 100 as of just before the pandemic:

Since the end of the pandemic stimulus in spring 2022, real retail sales have been trending generally flat to slightly declining, while real personal consumption expenditures on goods have continued to increase.

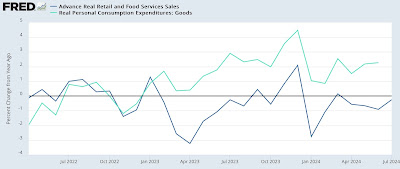

On a YoY basis, however, real retail sales are still negative at -0.3%, which while also the second best reading this year, remains problematic:

That’s becuase, although I won’t bother with the graph, a negative YoY comparison in real retail sales over the past 75 years has usually meant recession. Obviously that wasn’t the case in 2022 and 2023, but at some point the historical relationship is likely to be valid again.

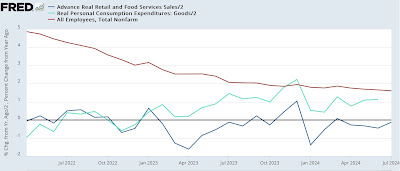

Finally, since real sales are a good if noisy short leading indicator for employment, here is the above YoY graph adding YoY payroll gains (red):

This forecasts continued weak job reports in the range of 75,000 to under 200,000 in the month immediately ahead.

Two months ago I concluded that , especially in view of the relatively poor numbers since the start of this year, real retail sales had to be regarded as raising a caution flag for the economy. Last month I concluded by saying “The yellow caution flag is up,” especially in conjunction with the negative ISM manufacturing and non-manufacturing numbers. The reversal in the latter to positive this month takes some pressure off, but the longer real retail sales go without posting a positive YoY number, the more concerned I will be.

The Bonddad Blog

Retail Sales Declined and a Slight Downtrend, Angry Bear by New Deal democrat