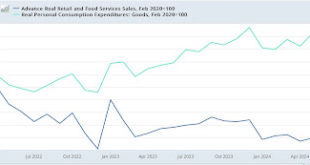

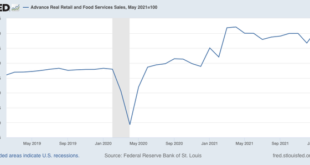

– by New Deal democrat The second point of economic data released this morning, retail sales, were also positive. On a nominal basis, retail sales in July rose 1.0%. After adjusting for inflation, they rose 0.8% to the highest level so far this year. The below graph norms both real retail sales (dark blue) and the similar measure of real personal consumption of goods (light blue) to 100 as of just before the pandemic: Since the end of...

Read More »Real retail sales back to negative YoY

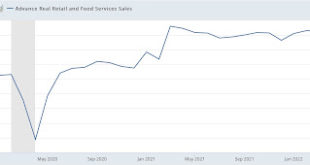

– by New Deal democrat The Bonddad Blog Here is today’s update on one of my favorite indicators: retail sales. In April they were unchanged on a nominal basis. Adjusted for inflation they declined -0.3% for the month. They are also down -6.2% from their 2021 peak and -2.9% since January 2023: On a YoY basis, they have also returned to the negative side, down -0.3% (note two graphs below adds 0.3% to show at the zero line): Here is...

Read More »Real retail sales rebound, forecast a continued “soft landing” for jobs growth

– by New Deal democrat The Bonddad Blog As per usual, real retail sales is one of my favorite indicators, because it gives so much information about the consumer, and since consumption leads employment, it helps forecast the trend in the latter as well. And the news this morning was good, as nominally retail sales increased 0.7% in March, while February’s number was revised higher by 0.3% to 0.9%. After accounting for 0.4% inflation in...

Read More »Real retail sales mildly positive, but still suggest further deceleration in job gains

Real retail sales mildly positive, but still suggest further deceleration in job gains – by New Deal democrat Before proceeding further, I should mention – and should have mentioned as to jobless claims – that we are in that part of the year where seasonality often wreaks havoc, so outsized gains or losses should be taken with a grain of salt. This is particularly true as to YoY comparisons of retail claims, because last year November and...

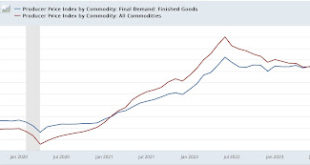

Read More »Real retail sales consistent with continued slow growth, aided by a continuing decline in commodity prices

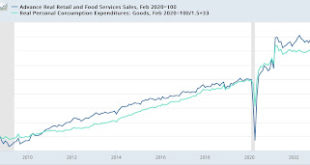

If you have been following NDd, you will note one of the biggest issues with the economy is supply chain. Most notably shortages of raw material, components, and finished products. Similar occurred in 2008 and my own belief is this is a recurrence of similar. I believe much of this could have been prevented. Beyongd that remark, I will let NDd tell you how falling costs impacts the economy. Real retail sales consistent with continued slow growth,...

Read More »Real retail sales continue to be weak

Real retail sales continue to be weak; continue to forecast weakening jobs reports – by New Deal democrat As usual, retail sales is one of my favorite metrics because it tells us so much about the consumer and, indirectly, the labor market and the total economy. Nominally, retail sales rose 0.6% in August. So did consumer inflation, and the difference rounded to -0.1% for the month. Here’s what the past 2.5 years since the 2021 stimulus...

Read More »Negative May and YoY real retail sales add to the foreboding signals of a recession next year

Negative May and YoY real retail sales add to the foreboding signals of a recession next year Nominal retail sales for the month of May declined -0.3%, and April was revised down by -0.2% to +0.7%. This reduces April’s number, after inflation to +0.4%, followed by a “real” decline in May of -1.2% after rounding. YoY real retail sales were up 8.1%, but because inflation in the past 12 months has been 8.5%, real retail sales YoY is down -0.4%. Here...

Read More »Real retail sales in March continue to show a weaker consumer sector, forecast weaker jobs reports

Real retail sales in March continue to show a weaker consumer sector, forecast weaker jobs reports For the past few months, I have suspected that a sharp deceleration beginning with the consumer sector of the economy was more likely than not. The retail sales report for March was consistent with that suspicion. Nominally retail sales rose +0.5% in March, but since consumer prices rose 1.2%, real retail sales declined -0.7%. Further, they are...

Read More »Real retail sales for February: not recessionary, but not healthy either

Real retail sales for February: not recessionary, but not healthy either Let’s take a look at the February update for one of my favorite indicators, real retail sales. For the past few months, I have suspected that a sharp deceleration beginning with the consumer sector of the economy was more likely than not. At the moment, the verdict on that forecast is mixed. In February, nominal retail sales rose +0.3%. Since consumer inflation rose 0.8%,...

Read More » Heterodox

Heterodox