– by New Deal democrat Keep in mind NDd only talks about Real Average Wages in which he does not include supervisor wages or increases. In this regard, readers get a much better perspective of Labor wages and earnings. Since NDd was traveling, we have an additional post this week. The Bonddad Blog On Wednesday I was traveling so I didn’t get around to writing about the important CPI release. Let me start my delayed response by updating real wages and payrolls for non-supervisory employees. Historically, as I have pointed out a number of times, real aggregate payrolls (red in the graph below) have a flawless record over the past 50+ years of peaking in the months ahead of a recession (Note: I show the last 30 years below. From the late

Topics:

NewDealdemocrat considers the following as important: Hot Topics, labor, Real Average wages, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

– by New Deal democrat

Keep in mind NDd only talks about Real Average Wages in which he does not include supervisor wages or increases. In this regard, readers get a much better perspective of Labor wages and earnings. Since NDd was traveling, we have an additional post this week.

On Wednesday I was traveling so I didn’t get around to writing about the important CPI release. Let me start my delayed response by updating real wages and payrolls for non-supervisory employees.

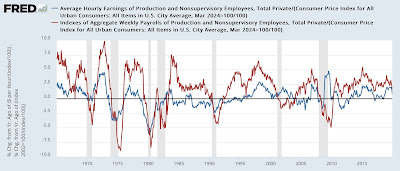

Historically, as I have pointed out a number of times, real aggregate payrolls (red in the graph below) have a flawless record over the past 50+ years of peaking in the months ahead of a recession (Note: I show the last 30 years below. From the late 1960s through early 1990s, real wages declined almost relentlessly. Happening due to the combination of the huge Baby Boom generation plus women entering the workforce applying potent downward pressure on wages. This increased aggregate payrolls and household income as there were many more two wage-earner households):

and turning negative YoY close to simultaneously with its onset. Real nonsupervisory wages (blue) have a less stellar record. They have almost always sharply decelerated or turned negative before or shortly after the onset of a recession, because inflation typically has accelerated faster than wage growth late in expansions, while the Fed has raised rates to tamp down demand:

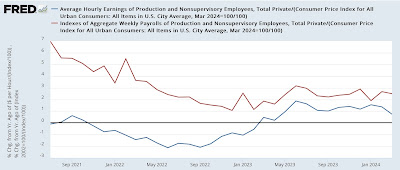

Last Friday we found out that wages rose 0.2% for the month and 4.2% YoY, continuing their pattern of slow deceleration. Aggregate payrolls rose a strong 0.7% for the month and 6.1% for the year. With Wednesday’s 0.4% increase in consumer prices, real wages actually declined by -0.1% for the month, while real aggregate payrolls rounded up to 0.4%. On a YoY basis, real wages are up 4.2%, and real aggregate payrolls rose 6.1%:

Here are the real absolute numbers, norming inflation to “1” as of last month:

Real wages have declined in the past several months, but they have not broken trend yet. Meanwhile real aggregate payrolls set yet another all-time record high. With this new high, and with real aggregate payrolls up close to 2% in the past year, continued expansion in the immediate future remains almost certain.

Are working class wages really still a malady? Angry Bear by New Deal democrat