The yellow caution flag on retail consumption is up – by New Deal democrat Retail sales declined -0.1% in June, but since consumer inflation also declined -0.1%, real retail sales were unchanged for the month. There was an upward revision to May which helped out the comparisons slightly, but for the entire first half of this year real retail sales have been treading water at a level below last year. The below graph is normed to 100 as of right before the pandemic, and shows the similar measure of real personal consumption of goods (light blue) as well: There’s been a general slight downtrend in real retail sales ever since the burst of pandemic stimulus spending in early 2021, that fortunately has not been confirmed by the broader measure

Topics:

NewDealdemocrat considers the following as important: Retail sales, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

The yellow caution flag on retail consumption is up

– by New Deal democrat

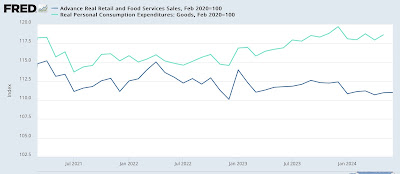

Retail sales declined -0.1% in June, but since consumer inflation also declined -0.1%, real retail sales were unchanged for the month. There was an upward revision to May which helped out the comparisons slightly, but for the entire first half of this year real retail sales have been treading water at a level below last year. The below graph is normed to 100 as of right before the pandemic, and shows the similar measure of real personal consumption of goods (light blue) as well:

There’s been a general slight downtrend in real retail sales ever since the burst of pandemic stimulus spending in early 2021, that fortunately has not been confirmed by the broader measure of real personal spending on goods. On the other hand, real personal consumption of goods has also been lower all this year so far from its peak last December.

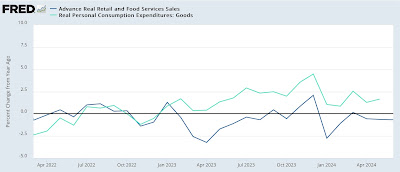

We are also down -0.7% YoY:

Although I won’t bother with the historical graph this time around, I’ve note previously In the entire history of real retail sales going back 75 years, much more often than not such downturns foreshadowed a recession within half a year.

Last month I wrote that “the negative YoY retail sales for four of the first five months of this year [ ] is now a real concern, although it has not been confirmed by the similar metric of real personal spending on goods.”

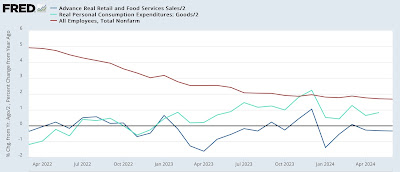

I also said that “Since we are now over three years past the last pandemic stimulus, I suspect real retail sales are also giving a more accurate signal for employment (red in the graph below) in the months ahead, as they did for decades before the pandemic [Here’s the updated graph for this month]:

“Consumption has historically led employment, and this suggests weaker monthly employment reports in the months ahead.”

It’s worth noting that in the graph above, real personal spending on goos is also lower YoY than payroll employment. It’s also worth recalling that there is good reason to believe that the payroll employment gains of 225,000-300,000 one year ago are likely to be revised significantly lower in view of the poor QCEW comprehensive census for the last two quarters of 2023.

My concluding remark last month was that, especially in view of the relatively poor numbers since the start of this year, real retail sales had to be regarded as raising a caution flag for the economy. That is if anything even more true this month, with an additional month of data, especially where an important component of the economically weighted ISM indexes released at the beginning of this month showed contraction in June.

The yellow flag is up. We’ll get important information about both the manufacturing and construction sectors tomorrow.

The Bonddad Blog

Good news on production is overshadowed by the yellow caution flag of flagging real retail sales, Angry Bear by New Deal democrat