I guess this is the latest installment in my soft landing series. However, it might also be a warning of terrible trouble in the fairly near future (next 5 years). It is certainly proof (if more were needed) that I am clueless. The topic is the US housing market. This is highly related to the (possible) soft landing as one important surprise is that residential construction has held up in spite of high mortgage interest rates. The question for this post is whether that happened because of another speculative bubble which will burst (as the last one burst in 2006). Unfortunately for me, I have a published stated position that implies that we are headed for huge trouble. I do not want to believe this, so I want to argue that this time it’s

Topics:

Robert Waldmann considers the following as important: Featured Stories, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

I guess this is the latest installment in my soft landing series. However, it might also be a warning of terrible trouble in the fairly near future (next 5 years). It is certainly proof (if more were needed) that I am clueless.

The topic is the US housing market. This is highly related to the (possible) soft landing as one important surprise is that residential construction has held up in spite of high mortgage interest rates. The question for this post is whether that happened because of another speculative bubble which will burst (as the last one burst in 2006).

Unfortunately for me, I have a published stated position that implies that we are headed for huge trouble. I do not want to believe this, so I want to argue that this time it’s different (the slogan of every speculative bubble).

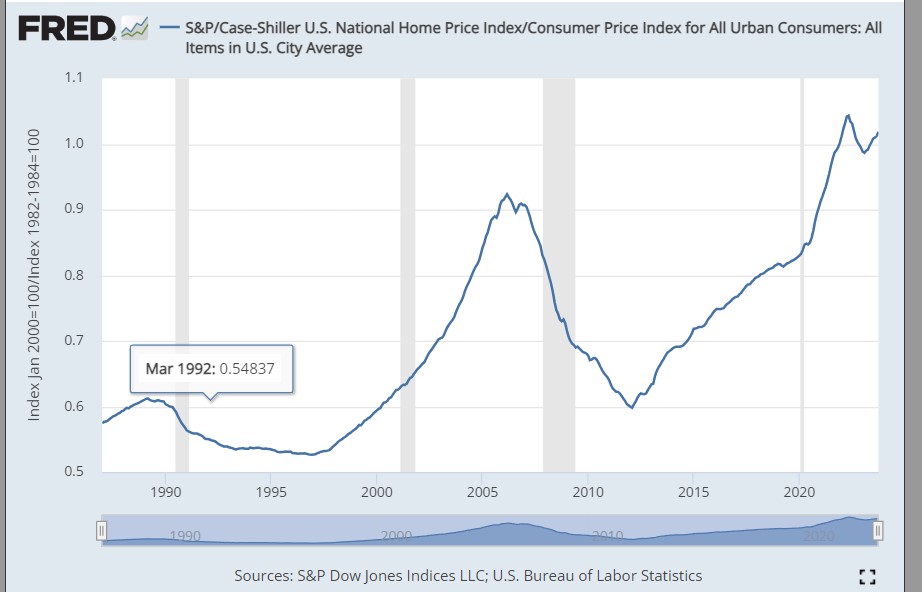

First data, the Cas Shiller Home Price index divided by the CPI

Notably the highest it’s been including in 2006. As a result, to be consistent, I would have to predict terrible GDP growth over the next 5 years (basically another great recession with the qualifier that my predicted great recession was twice as bad as the actual great recession and I gave credit for halving it to Obama et al).

The pattern (also for cruder indices which go back further than Case-Shiller) is that a high relative price of housing is very strongly correlated with a decline in that relative price over the next 5 years, which is, in turn, very highly correlated with bad to terrible GDP growth. I am going to ask you to click the link to the working paper.

This suggests a consistent story – the US can manage full employment only with extremely low real interest rates or a speculative bubble (commercial real estate, .com, housing and now housing again). People are buying new houses even with high mortgage rates, because they expect the relative price of housing to keep on going up. Looks like the naughties all over again.

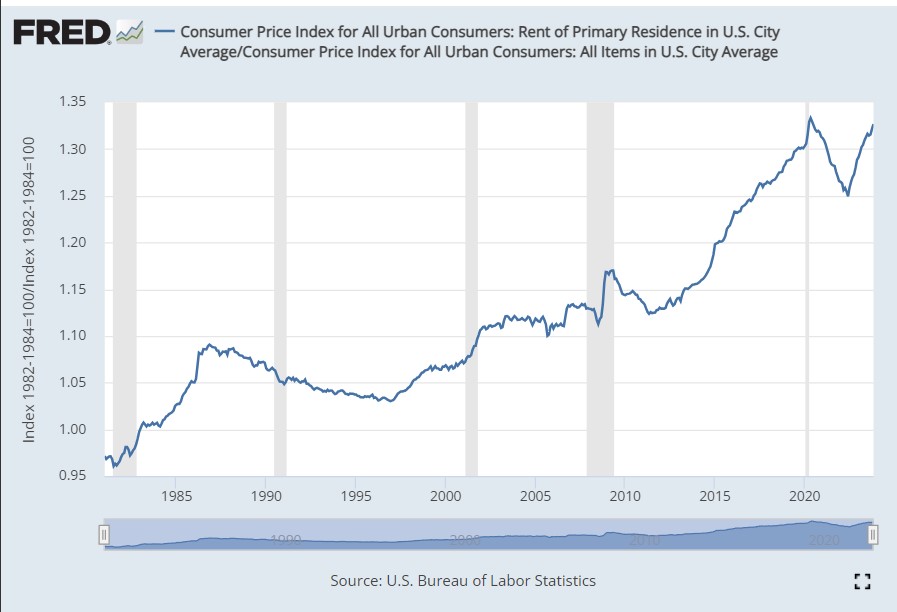

I do not, do not, want to predict this, so I will make the argument that, this time it’s different. THe key difference is that there is evidence of high actual non speculative demand for housing (maybe from work from home so want more home to work from). So more data — now the rent component of the CPI divided by the whole CPI

This time this ratio *is* different. Back during the ???-2006 bubble the ratio was normal but house prices were shooting up. Now the ratio of rent to other prices is also very high. This implies a reason to buy a house other than speculative hope that one will be able to sell for a huge capital gain — the services provided by the house are highly valuable.

One problem, of course, is that that US housing market is segmented with owner occupied and rental housing quite different. However, I am very willing to hope that, this time, what we are seeing is a shortage of housing causing lots of building even with high mortgage rates.

Now the pattern of high housing prices followed by 5 bad years (which now frightens me) was my latest published contribution to macroeconomic research. This reduces my eagerness to write that this time it is different, but I hope that this time it’s different