I see where failing GOP presidential candidate Ron DeSantis is trying to salvage his campaign by pivoting to Marxism. He is calling for the state of Florida to investigate Belgium-based AB InBev on the basis of their recent Bud Light advertisements using a trans character. DeSantis seems to believe that AB InBev breached legal duties to shareholders and that as governor of Florida, “all options are on the table.” Ostensibly, the basis for the nanny...

Read More »Ron DeSantis doesn’t understand capitalism

I see where failing GOP presidential candidate Ron DeSantis is trying to salvage his campaign by pivoting to Marxism. He is calling for the state of Florida to investigate Belgium-based AB InBev on the basis of their recent Bud Light advertisements using a trans character. DeSantis seems to believe that AB InBev breached legal duties to shareholders and that as governor of Florida, “all options are on the table.” Ostensibly, the basis for the nanny...

Read More »The Innocents

Per the Heritage Foundation (Heritage), each year, American civilians use firearms defensively between 500,000 and 3 million times. Which is saying that they have been exercising their relatively newly lawful Second Amendment Right to bear arms for the purpose of self-defense a lot. Further research might indicate that the number is well below 700,000 (might even be as low as 11). As Heritage does make note, there is no way of really knowing. After...

Read More »The Innocents

Per the Heritage Foundation (Heritage), each year, American civilians use firearms defensively between 500,000 and 3 million times. Which is saying that they have been exercising their relatively newly lawful Second Amendment Right to bear arms for the purpose of self-defense a lot. Further research might indicate that the number is well below 700,000 (might even be as low as 11). As Heritage does make note, there is no way of really knowing. After...

Read More »Jobless claims: close but no cigar for the red flag

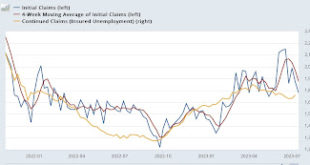

Jobless claims: close but no cigar for the red flag – by New Deal democrat Initial claims declined -9,000 to 228,000 last week, and the four week average declined -9,250 to 237,500. Continuing claims, with a one week delay, rose 33,000 to 1.754 million: More importantly for forecasting purposes, initial claims are up 7.0% YoY, the four week average up 10.6%, and continuing claims up 30.8%: Just as importantly, the average for July so far...

Read More »Jobless claims: close but no cigar for the red flag

Jobless claims: close but no cigar for the red flag – by New Deal democrat Initial claims declined -9,000 to 228,000 last week, and the four week average declined -9,250 to 237,500. Continuing claims, with a one week delay, rose 33,000 to 1.754 million: More importantly for forecasting purposes, initial claims are up 7.0% YoY, the four week average up 10.6%, and continuing claims up 30.8%: Just as importantly, the average for July so far...

Read More »Conflicts of Interest on Company Prescription Plans

This is interesting. Companies, large companies, and public institutions hire consulting firms to research drug coverage for their employees. This is what companies and institutions do, get the experts to come in, use their expertise and knowledge of the process or the market, to get the best efficiencies or deals at lower costs. The way STAT reports it, the consultants are playing both sides. The consultants sign on with the companies for a fee. In...

Read More »Conflicts of Interest on Company Prescription Plans

This is interesting. Companies, large companies, and public institutions hire consulting firms to research drug coverage for their employees. This is what companies and institutions do, get the experts to come in, use their expertise and knowledge of the process or the market, to get the best efficiencies or deals at lower costs. The way STAT reports it, the consultants are playing both sides. The consultants sign on with the companies for a fee. In...

Read More »A Writer and a Friend . . .

Spencer England departed a year or so ago, Barkley Rosser from Econospeak recently, and now my friend Dan . . . Daniel Robert Crawford, 75, died peacefully at his home, surrounded by hisfamily, July 17, 2023. He was born October 30, 1947 to Robert and RuthCrawford in Oakland, CA. Dan’s family of origin was a Navy family so theymoved several times before settling in Cuyahoga Falls, Ohio. Dangraduated with Honors in 1965 from Cuyahoga Falls...

Read More »A Writer and a Friend . . .

Spencer England departed a year or so ago, Barkley Rosser from Econospeak recently, and now my friend Dan . . . Obituary Daniel Robert Crawford, 75, died peacefully at his home, surrounded by hisfamily, July 17,2023. He was born October 30, 1947 to Robert and RuthCrawford in Oakland, CA. Dan’s family of origin was a Navy family so theymoved several times before settling in Cuyahoga Falls,...

Read More » The Angry Bear

The Angry Bear