Portland Not Burned To The Ground Over this past weekend, I was in Portland visiting for the first time family who gathered for a reunion, with my second daughter, Caitlin, with two of my grandsons, having moved there in January from San Francisco (she is a psychiatrist with the VA system). I had been through a few times in a car but never stopped. So curious to check it out. I generally liked the place and had a good time. I also decided to...

Read More »One Thousand Words, Version 2

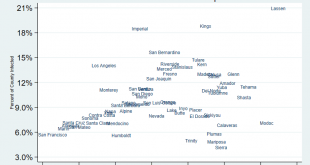

Click on image to enlarge . . . Tags: California Vote

Read More »Light Pollution endangering the Environment

This is a C&P from Treehugger, a site Slate was sponsoring about a decade or so ago. Interesting place which writes various articles on tiny homes, environment, etc. The article is about light pollution and how it impacts the environment. When I was the VP for the Township Planning Commission, we had passed an ordinance which regulated light pollution. We were intent on keeping lighting on site rather than allowing it to spray the area with...

Read More »The Global Impact of the Fed’s Pivot on Asset Purchases

by Joseph Joyce The Global Impact of the Fed’s Pivot on Asset Purchases Federal Reserve Chair Jerome Powell announced last month that the Fed would slow its purchases of bonds, most likely by the end of this year. The timing of the cutback will depend on several factors related to the economy, and last week’s disappointing employment report if repeated could push back the date. The financial markets will now begin anticipating the impact of...

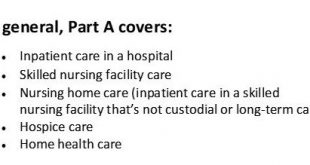

Read More »About Medicare and the Costs of It

Everybody talks about Medicare, Medicare4All, Medicare Advantage. Few talk about costs or what Medicare consists of for those who qualify for it. How can someone be in favor of Medicare4All, if you do not understand what regular Medicare consists and what it costs. I am guessing most people believe it would be free. What if it isn’t and you paid what many people pay today for Medicare and its supplements? Some Absolutes: Traditional...

Read More »Six hundred Louisiana Toxic Chemical Sites

I found this part of RJS’s report to be particularly interesting about the potential environmental risks in Louisiana resulting from a buildup of waste within the state. This has been accumulated over the years. There does not appear to be an effort to eliminate the waste and chemicals. ____________ Focus on Fracking: natural gas price at a 33 month high; US crude supplies at a 23 month low; Ida shuts down Gulf, MarketWatch 666, Blogger RJS...

Read More »nat. gas prices at 33 MO high; crude supply at 23 MO low; Ida shuts down Gulf

Focus on Fracking: natural gas price at a 33 month high; US crude supplies at a 23 month low; Ida shuts down Gulf Blogger RJS, MarketWatch 666 Oil Prices Oil prices ended slightly higher this week as oil traders apparently judged that Hurricane Ida’s damage to oil production was greater than the storm’s damage to refining and to fuel demand . . . after rising more than 10% last week as Chinese virus cases fell to zero, a quarter of Mexico’s...

Read More »Open thread Sept. 7, 2021

Spending and Producing

Spending and Producing When a framing becomes ubiquitous you forget it’s a framing. This is what popped into my head when I read a headline this morning about the infrastructure bills pending in Congress: Democrats Hit the Road to Sell Big Spending Bills as Republicans Attack. Yes, they are proposals to spend money; that’s one way to look at it. But they are also proposals to produce infrastructure and social services—the spending...

Read More »Monday Medical News Clips from My In-Box

Quite a few commentaries about Covid and a lasting impact from Covid as it migrates to various organs in both the old, young, and healthy. Of course, there are more articles than what I listed here. Waning Immunity Is Not a Crisis, Right Now – The Atlantic Waning is not disappearance, though. Even if vaccinated people sometimes do get infected and sick, it will happen less often, and less severely. That, in turn, makes it much harder for the...

Read More » The Angry Bear

The Angry Bear