Read More »

Medicare4All Rallies Shows Big Support for Universal Health Care

Dan sent this article to me and I scan-read it as it is done in generalities. This not a criticism of the content as much as my pointing out it is done in brevity. The push is big for some form of Single Payer healthcare if one were to call it “insurance.” At some point and with the implementation of Single Payer healthcare, insurance could conceivably disappear. Medicare for All Rallies in 50 Cities Show Big Support for Universal Health Care,...

Read More »Has The Arab Spring Finally Come To A Full End?

Has The Arab Spring Finally Come To A Full End? Arguably the Arab Spring ended a long time ago. It was, after all, Spring 2011, to be precise in terms of when the spring was. It had arguably started a bit earlier, in December 2010 when an informal street vendor in Tunisia set fire to himself and died as a result of unhappiness over corrupt authorities demanding bribes from him he could not pay. This led to massive demonstrations against the...

Read More »Housing sales decline, while price surges continue

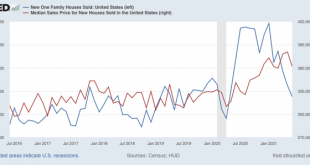

Housing sales decline, while price surges continue So I take a little one-day road trip on my vacation and come back to find much weeping and gnashing of teeth and generalized whining about a big decline in new home sales. Well, what exactly were they expecting? The new home sales data is particularly volatile and heavily revised. So, in June, it was volatile, and May was revised substantially downward (blue in the graph below). Prices also...

Read More »New Housing Starts Higher in June, Building Permits 5.3% Lower

RJS, MarketWatch 666, New Housing Starts Reported Higher in June, Building Permits 5.3% Lower The June report on New Residential Construction (pdf) from the Census Bureau estimated that new housing units were being started at a seasonally adjusted annual rate of 1,643,000 in June, which was 6.3 percent (±11.5 percent)* above the revised May estimated annual rate of 1,546000 units started, and was 29.1 percent (±11.2 percent) above last June’s pace...

Read More »Natural Gas Prices at a 31 month High

Commenter and Blogger R.J.S. brings the latest on Natural Gas and the impact on it from the heat wave. Focus on Fracking blogspot Natural gas prices rose every day this week in surging to a new 31 month high, as yet another continental heat wave loomed…after ending last week unchanged at $3.674 per mmBTU as strong export demand offset cooler weather and a bearish storage report, the contract price of natural gas for August delivery opened the week...

Read More »Comments on existing home sale prices

Comments on existing home sale prices Existing home sales were reported yesterday. Since, although they are about 90% of the market, they have much less effect on the economy than new home sales, I normally don’t pay that much attention.But I did want to emerge from my vacation hideaway to make a few comments. 1. Inventory is up 11% YoY. Inventory follows prices, and as prices rise, more and more people decide now is a good time to sell...

Read More »Open thread July 27, 2021

Tags: open thread

Read More »Private Equity invests in “Primary Care” Medicine

I am adding a brief comment here (it fits and is on topic) rather than going back to the earlier post which I believe to be titled correctly; “Little Good can Come from Private Equity in the Healthcare Industry.” As my source of information I had identified two different articles taken from Modern Healthcare and also MedPage Today. Both I read religiously and from both I get email notifications. My three points to my titling are as follows:...

Read More »Weekly Indicators for July 19 – 23 at Seeking Alpha

by New Deal democrat Weekly Indicators for July 19 – 23 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. No visible impact on the economy yet due to the Delta wave. In March 2020, the first indicator to tip over was restaurant reservations. I would expect that to be the first item to suffer now as well. As usual, clicking over and reading will not only bring you up to the virtual moment, but bring me a penny or two...

Read More » The Angry Bear

The Angry Bear