The short leading indicators and the 2020 Presidential election forecast As I pointed out on Sunday, polls and poll aggregations really aren’t forecasts, they are nowcasts. They tell you who would win and by how much *if the election were held today.* They don’t tell you whether or by how much that is likely to change over the next few months. Further, candidates, campaigns, and voters react to them, and so change the dynamics. And in the case of several...

Read More »Initial claims: a jolt of bad news, as Mitch McConnell and the GOP dawdle on an emergency benefit extension

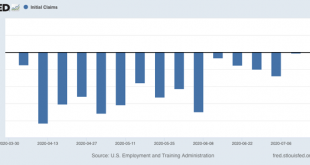

Initial claims: a jolt of bad news, as Mitch McConnell and the GOP dawdle on an emergency benefit extension This morning’s report on initial and continuing claims, which give the most up-to-date snapshot of the continuing economic impacts of the coronavirus on employment, was a jolt of bad news, as claims increased by over 100,000 to the worst level in 4 weeks. The trend of slight improvement to “less awful” since the end of March was broken, and there...

Read More »School openings need….

Via Diana Ravitch’s blog on a Time magazine article What the U.S. Can Learn from 3 Countries About Reopening: TIME Magazine just published a story about school reopening in Denmark, South Korea, and Israel, with lessons for the U.S. Lesson #1 from Denmark: Get the virus under control before reopening schools. Unlike Denmark, the United States is bungling that, and the virus is spreading in the south and west. Perhaps states that have taken the necessary...

Read More »The 2017 Tax Cuts and Irish Jobs Act

The 2017 Tax Cuts and Irish Jobs Act Brad Setser has more to say about how the lack of enforcement with respect to transfer pricing in the Big Pharma sector has not only cost us Federal tax revenues but perhaps in American jobs in his “The Irish Shock to U.S. Manufacturing?” (May 25, 2020): America’s production of pharmaceuticals and medicines peaked in 2006, back before the global financial crisis. Output now is about 20 percent below its 2006 level....

Read More »Open thread July 21, 2020

Brad Setser on Offshoring Life Science Production and Transfer Pricing

Brad Setser on Offshoring Life Science Production and Transfer Pricing I just posted a discussion of an interesting proposal from Biden written by Alex Parker who mentioned some February 5, 2020 testimony from Brad Setser. The gist of this testimony was noted back in a March 26, 2019 blog post entitled When Tax Drives the Trade Data: I often hear that pharmaceuticals are one of America’s biggest exports. But that isn’t what is in the actual trade data...

Read More »Selection

Selection by Ken Melvin The times they are a changing. And they are changing at pandemic speed. Five months ago is ancient history. Now is a but a fleeting interval. From now, the future. What will our world look like six months from now? What will it look like in three years? So much for being the ‘Greatest Nation Ever Known’. We just got rolled by a virus whilst beset with incompetent leadership, inadequate healthcare, a global warming crisis, and a...

Read More »The 2020 Presidential election nowcast based on State polling: Trump support deteriorating even in red States

The 2020 Presidential election nowcast based on State polling: Trump support deteriorating even in red States For the past four weeks I have posted a projection of the Electoral College vote based solely on State rather than national polls (since after all that is how the College operates) that have been reported in the last 30 days. Here’s how it works: – States where the race is closer than 3% are shown as toss-ups. – States where the range is between...

Read More »Is McConnell trying to destroy the economy for Biden?

Paul Waldman asks the question I’ve been worrying about for a few weeks: Do Republicans even want to help the American economy through this crisis? . . . But McConnell knows what’s happening. He has surely looked around and realized that with the pandemic surging, there is simply no way the economy is going to come roaring back before November. He’s seen the polls showing Trump trailing presumptive Democratic nominee Joe Biden by 10 points or more. He...

Read More »Biden Proposes Ending the GILTI Loophole

Biden Proposes Ending the GILTI Loophole Alex Parker covers an interesting and important tax policy issue: Former Vice President Joe Biden’s recent proposal to secure medical supply chains in the wake of the COVID-19 pandemic includes tweaks to the 2017 federal tax overhaul, reigniting the debate about whether its international provisions are pushing manufacturing facilities offshore …Former Vice President Joe Biden’s recent proposal to secure medical...

Read More » The Angry Bear

The Angry Bear