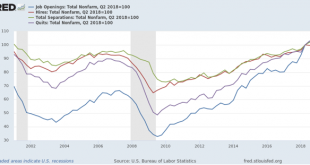

May JOLTS report is weak, consistent with last month’s weak jobs report The jobs report one month ago was poor, so as expected the JOLTS report for May, released this morning, followed suit. To review, because this series is only 20 years old, we only have one full business cycle to compare. During the 2000s expansion: Hires peaked first, from December 2004 through September 2005 Quits peaked next, in September 2005 Layoffs and Discharges peaked next,...

Read More »Scenes from the June employment report

Scenes from the June employment report As I (and everyone else) wrote on Friday, the establishment portion of the June jobs report was very good. On closer examination, though, the leading components of the report continued to show some weakness. To begin with, for months I’ve been following manufacturing, residential construction, and temporary employment as the leading sectors. As the below graph of the past 18 months shows, all were positive in...

Read More »The Expansion Of Assets With Negative Nominal Interest Rates

The Expansion Of Assets With Negative Nominal Interest Rates Buried in the Weekend section of the Financial Times is a report that the aggregate value of assets that earn negative nominal yields has substantially expanded since the beginning of 2019 and has reached a new high. So on January 1, 2019, the value of these assets was at $8.3 trillion. As of six months later it had reached $13 trillion, a more than 50 percent increase. There are fewer...

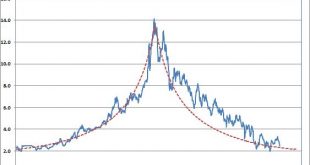

Read More »LONG BOND YIELDS

Everybody and their brother has an opinion about the direction of long bond yields so it should be OK for me to stick my two cents worth in. This chart of the composite of all long bond yields versus the long wave is one I published every month on the back cover of my monthly publication for over 20 years before I retired a couple of years ago. Basically, I thought of it as a good way to show that I was a long term bull on interest rates in a way that...

Read More »Open thread July 9, 2019

The Mutt Speech

One Mutt’s Speech for You to think about after celebrating the long Weekend from the nationalistic holiday called the Forth of July while others are fleeing terror and violence. John Winger: “Cut it out! Cut it out! Cut it out! The hell’s the matter with you? Stupid! We’re all very different people. We’re not Watusi. We’re not Spartans. We’re Americans, with a capital ‘A’, huh? You know what that means? Do ya? That means that our forefathers were kicked...

Read More »Weekly Indicators for July 1 – 5 at Seeking Alpha

by New Deal democrat Weekly Indicators for July 1 – 5 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. Lower long term interest rates continue to improve the long range forecast, while the short term forecast has deteriorated. As usual, clicking over and reading puts a penny or two in my pocket to help reward me for my efforts.

Read More »United States Women beats the Netherlands 2-0, wins its fourth World Cup

This clip is of Rose Lavelle scoring the second goal in the 69th minute of the game. The clip has been disabled and must be seen on YouTube. Click on the arrowhead first and then the “Watch this video at YouTube” and it will take you there. [embedded content] United States’ Rose Lavelle doubles lead vs. Netherlands | 2019 FIFA Women’s World Cup™ Highlights, Fox Sports, Fox News, July 2, 2019. Nothing like going in for the winning insurance goal coming...

Read More »Destroying Social Security to Save It

Connecticut Representative John Larson Proposes Plan To Destroy Social Security In Order To Save It, by Dale Coberly Connecticut Congressman John Larson introduces H. R. 860, Social Security 2100 Act which will cuts taxes, strengthen benefits, prevents anyone from retiring into poverty, and ensure Social Security remains strong for generations. larson.house.gov It sounds good, but of course he wants it to sound good. In the past we have had to be...

Read More »Lucas, Jenner, Washington, Shaw

I am thinking about modern macroeconomic methodology again. I am also thinking about the fresh water school of thought. Also I am thinking about aspirin and smallpox. I am going to attempt a nickle summary of the Lucas critique (really a half penny summary or a 5 Turkish Lira summary). Lucas argued that it was unwise to base policy on models which fit the available data, because parameters can be estimated even if they do not describe causal...

Read More » The Angry Bear

The Angry Bear