Read More »

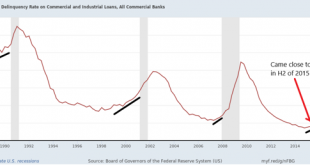

Commercial and industrial loans: another sign of a slowdown?

Commercial and industrial loans: another sign of a slowdown? There are lots of cross-currents in the economy right now. At the absolute tip of the spear is the decline in interest rates since November, which has led to an improvement in some of the housing market metrics. In the shorter-term outlook, a simple quick-and-dirty metric of initial jobless claims (new 49 year lows) and the stock market (just made new all-time highs) suggests all clear. But...

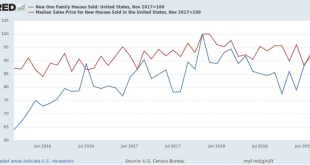

Read More »How increasing local oligopolization has distorted the housing market

How increasing local oligopolization has distorted the housing market Earlier this week new home sales for March were reported, soaring to a new expansion high bar one month (November 2017). Something else that a few other writers picked up on: the median *prices* for new homes fell to a level not seen in the past two years, off -11.8% from their peak, also in November 2017: With mortgage rates also down at approximately where they were in January...

Read More »Prisoners of Overwork: A Dilemma

Prisoners of Overwork: A Dilemma The New York Times has an illuminating article today summarizing recent research on the gender effects of mandatory overwork in professional jobs. Lawyers, people in finance and other client-centered occupations are increasingly required to be available round-the-clock, with 50-60 or more hours of work per week the norm. Among other costs, the impact on wage inequality between men and women is severe. Since women are...

Read More »Panetta and Trump: Who are You Calling Chumps?

Panetta and Trump: Who are You Calling Chumps? Leon Panetta: Trump treats Americans like we’re chumps Check out the entire interview as it was excellent. But I had to look up this old fashion word: a person who is easily tricked : a stupid or foolish person OK – Trump supporters are easily tricked. But Trump wants to pretend he is a young vigorous man! Chris Matthews did talk about young people who are more likely to check out Urban Dictionary than the...

Read More »Statistical Significance and the Sweet Siren of Self-Confirmation: A Reply to Taylor

Statistical Significance and the Sweet Siren of Self-Confirmation: A Reply to Taylor Just as Ulysses had himself chained to the mast of his ship so he wouldn’t succumb to the lure of the Sirens, John Ionnidis and others have argued we must bind ourselves to the discipline of statistical significance lest we fall victim to confirmation bias. Some researchers will want to proclaim they have found earth-shaking results even if they are enveloped in...

Read More »Free Speech, Safety and the Triumph of Neoliberalism

Free Speech, Safety and the Triumph of Neoliberalism I’m reading another article about debates over free speech on campus, this time at Williams College, an elite school in the northwestern corner of Massachusetts. A faculty petition asks to formalize and tighten the college’s policy on free speech by adopting the Chicago Principles, which state that “concerns about civility and mutual respect can never be used as a justification for closing off...

Read More »Trump Drops The Other Iran Oil Shoe

Trump Drops The Other Iran Oil Shoe US SecState Pompeo announced early today that the waivers granted to 8 nations allowing them to continue to import oil from Iran will not bee renewed when they expire in early May. I am not sure of the identity of three of those nations, but the big five are China, India, Japan, South Korea, and Turkey. None of them have made any public statement so far, nor has Iran. It has been announced that Saudi Arabia and the...

Read More »Open thread April 26, 2019

Projection is an Art, not a Science, especially for the SSA

The scary headlines of the past few days have been well-discussed below by Dale Coberly and Barkley Rosser. Data, however, is only as good as its assumptions, and the overall trend is well worth a glance. (Note: I took the 2013-2017 data from BC professor (and director of their Center for Retirement Research) Alicia H. Munnell’s Table 1 here. Year of Trustees Report: 2013 2014 2015 2016 2017 2018 2019 First year outgo exceeded income excluding interest...

Read More » The Angry Bear

The Angry Bear