Everyone has been so transfixed by Yanis Varoufakis's "Plan B" revelations that his defence of the ECB's Mario Draghi passed unnoticed. Here it is, transcribed from the Lamont tape by Peter Spiegel at the FT:Mario Draghi has handled himself as well as he could, and he tried to stay out of this mire, the political mire, impressively. I have always held him in high regard. I hold him in even higher regard now, having experienced him over the last six months. Having said that, the European...

Read More »Lies, damned lies, and Greek statistics

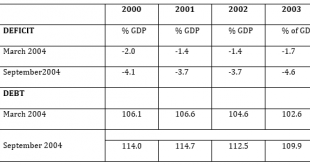

Guest post by Sigrún DavídsdóttirThe word “trust” has been mentioned time and again in reports on the tortuous negotiations on Greece. One reason is the persistent deceit in reporting on debt and deficit statistics, including lying about an off market swap with Goldman Sachs: not a one-off deceit but a political interference through concerted action among several public institutions for more then ten years.As late as in the July 12 Euro Summit statement "safeguarding of the full legal...

Read More »When reason departs

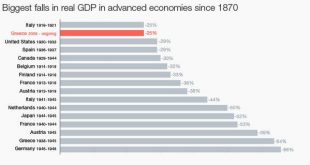

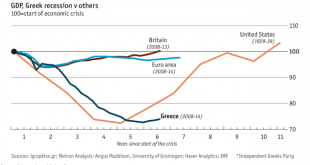

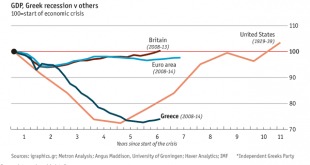

In my last post, I pointed out that Greece's current depression is by no means the worst since World War II, as is often stated, and that the US's Great Depression was not the worst depression in history either. For reference, I'm putting up Tony Tassell's chart again.I'm frankly appalled by the comments on that post. The arguments used to justify the prevailing views amount to the following.1. The other countries in the list aren't rich Western countries, so they don't count.Eh???2....

Read More »Not such a Great Depression

We're used to hearing that the current Greek depression is the longest and deepest since World War II, aren't we? And that the worst depression in history was the US's Great Depression?Via the FT's Tony Tassell comes this chart:Looks like the fall of the Iron Curtain, the collapse of the Soviet Union and the first Gulf War did far more damage. Not to mention the numerous wars and crises in Africa. The current Greek depression just about makes it on to the bottom of this chart, and the other...

Read More »The Great Greek Bank Drama, Act II: The Heist

The banks are re-opening, though just for transactions, so people can pay their bills and their taxes, pay in cheques, that kind of thing. The cash withdrawal limit has been changed to a weekly limit of 420 EUR per card per person, enabling households to manage their cash flow better. But the capital controls remain: money cannot leave the country without the agreement of the Finance Ministry. And the banks remain short of cash: although the ECB has raised the funding limit by 900m EUR, that...

Read More »The Great Greek Bank Drama, Act I: Schaeuble’s Sin Bin

Greece's banks have been closed since 29th June. The closure followed the ECB's decision not to increase ELA funding after talks broke down between the Greek government and the Eurogroup.The closure is doing immense economic damage. The cash withdrawal limit of 60 euros per bank card per day is restricting spending in the Greek economy to a trickle. Media generally focus more on the hardship that the cash limit causes for households: but far worse is the inability of businesses to...

Read More »There are controls, and then there are controls….

Guest post by Sigrún DavídsdóttirNow that Greece has controls on outtake from banks, capital controls, many commentators are comparing Greece to Iceland. There is little to compare regarding the nature of capital controls in these two countries. The controls are different in every respect except in the name. Iceland had, what I would call, real capital controls – Greece has control on outtake from banks. With the names changed, the difference is clear.Iceland – capital controlsThe controls in...

Read More »Tsipras in the crucible

The atmosphere in the Greek standoff is turning ugly. On Tuesday, after new Greek finance minister Euclid Tsakalotos turned up to Eurogroup talks with nothing but hastily-drafted notes written on hotel paper, Eurozone leaders told the Greek government in no uncertain terms that if it did not produce credible proposals by Sunday 12th July Greece would be thrown out of the Eurozone. "We have a Grexit scenario prepared in detail", said European Commission president Jean-Claude Juncker.The...

Read More »Who would win and who would lose from Grexit?

Guest post by Tom StreithorstVladimir Illych Lenin may well be the most destructive political theorist of the 20th century. His glorification of a conspiratorial party as agent of a glorious future legitimised mass murder from Bolshevik Russia to Nazi Germany to Cambodia's Khmer Rouge. Nonetheless, he did invent an analytical tool political scientists and economists should use more often: “Kto Kovo”, or “who beats whom”. In examining any policy, Lenin suggests the first...

Read More »A New Deal for Greece

It appears that the Greeks have given a bloody nose to the EU, turning in a resounding NO vote in Sunday's referendum. Though exactly what they have rejected is unclear. The ballot paper is, to say the least, complicated. The UK's Telegraph published this translation from Greek Analyst:The ballot paper of the #greferendum question upon which the Greek people are called to vote on. (Translated) pic.twitter.com/hPGJcp49Gs— The Greek Analyst (@GreekAnalyst) June 29, 2015 And the paper asked,...

Read More » Francis Coppola

Francis Coppola