Summary:

It appears that the Greeks have given a bloody nose to the EU, turning in a resounding NO vote in Sunday's referendum. Though exactly what they have rejected is unclear. The ballot paper is, to say the least, complicated. The UK's Telegraph published this translation from Greek Analyst:The ballot paper of the #greferendum question upon which the Greek people are called to vote on. (Translated) pic.twitter.com/hPGJcp49Gs— The Greek Analyst (@GreekAnalyst) June 29, 2015 And the paper asked, "Does this make sense to you?"No, frankly, it doesn't. Neither of the documents referred to are current. The EU negotiators withdrew the June 25th offer as soon as the referendum was announced, replacing it with a subtly altered version from the "institutions" and dangling the carrot of debt restructuring if Greeks vote to accept the terms. No doubt they thought that this would force the Greek government to cancel the referendum. They were wrong. But the entire bailout programme expired on June 30th anyway, rendering the June 25th offer obsolete.So the Greeks have rejected an offer that no longer exists. Perhaps the No vote is best seen as a protest against seemingly unending depression, unemployment and misery. I have considerable sympathy for this, though it will undoubtedly annoy Greece's creditors. .But there has been a much more interesting development in recent days.

Topics:

Frances Coppola considers the following as important: EU, Greece, IMF, sovereign debt

This could be interesting, too:

It appears that the Greeks have given a bloody nose to the EU, turning in a resounding NO vote in Sunday's referendum. Though exactly what they have rejected is unclear. The ballot paper is, to say the least, complicated. The UK's Telegraph published this translation from Greek Analyst:It appears that the Greeks have given a bloody nose to the EU, turning in a resounding NO vote in Sunday's referendum. Though exactly what they have rejected is unclear. The ballot paper is, to say the least, complicated. The UK's Telegraph published this translation from Greek Analyst:The ballot paper of the #greferendum question upon which the Greek people are called to vote on. (Translated) pic.twitter.com/hPGJcp49Gs— The Greek Analyst (@GreekAnalyst) June 29, 2015 And the paper asked, "Does this make sense to you?"No, frankly, it doesn't. Neither of the documents referred to are current. The EU negotiators withdrew the June 25th offer as soon as the referendum was announced, replacing it with a subtly altered version from the "institutions" and dangling the carrot of debt restructuring if Greeks vote to accept the terms. No doubt they thought that this would force the Greek government to cancel the referendum. They were wrong. But the entire bailout programme expired on June 30th anyway, rendering the June 25th offer obsolete.So the Greeks have rejected an offer that no longer exists. Perhaps the No vote is best seen as a protest against seemingly unending depression, unemployment and misery. I have considerable sympathy for this, though it will undoubtedly annoy Greece's creditors. .But there has been a much more interesting development in recent days.

Topics:

Frances Coppola considers the following as important: EU, Greece, IMF, sovereign debt

This could be interesting, too:

Merijn T. Knibbe writes ´Extra Unordinarily Persistent Large Otput Gaps´ (EU-PLOGs)

Matias Vernengo writes Milei’s Psycho Shock Therapy

Merijn T. Knibbe writes In Greece, gross fixed investment still is at a pre-industrial level.

Matias Vernengo writes Argentina on the verge

The ballot paper of the #greferendum question upon which the Greek people are called to vote on. (Translated) pic.twitter.com/hPGJcp49Gs— The Greek Analyst (@GreekAnalyst) June 29, 2015 And the paper asked, "Does this make sense to you?"

No, frankly, it doesn't. Neither of the documents referred to are current. The EU negotiators withdrew the June 25th offer as soon as the referendum was announced, replacing it with a subtly altered version from the "institutions" and dangling the carrot of debt restructuring if Greeks vote to accept the terms. No doubt they thought that this would force the Greek government to cancel the referendum. They were wrong. But the entire bailout programme expired on June 30th anyway, rendering the June 25th offer obsolete.

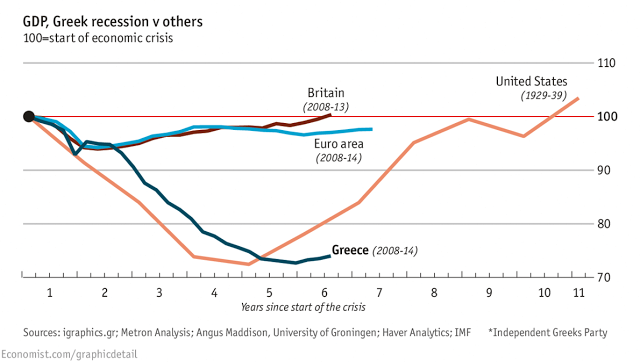

So the Greeks have rejected an offer that no longer exists. Perhaps the No vote is best seen as a protest against seemingly unending depression, unemployment and misery. I have considerable sympathy for this, though it will undoubtedly annoy Greece's creditors. .

But there has been a much more interesting development in recent days. The second document referred to on the ballot paper is the fudged debt sustainability analysis that accompanied the June 25th offer. But this too has now been superseded. The day after the announcement, the IMF produced another, more comprehensive debt sustainability analysis. It wasn't published until July 2nd. Allegedly this was because European members of the IMF board objected to its publication prior to the referendum. And having read the IMF's new report, I'm not surprised. The report undermines the EU creditors' entire case.

On first reading, the report is highly critical of the current Greek government:

But significant changes in policies since then—not least, lower primary surpluses and a weak reform effort that will weigh on growth and privatization—are leading to substantial new financing needs. Coming on top of the very high existing debt, these new financing needs render the debt dynamics unsustainable. This conclusion holds whether one examines the stock of debt under the November 2012 framework or switches the focus to debt servicing or gross financing needs.But embedded in the text (p.4) is this admission that the programme was ALREADY off track before Syriza came to power:

The 2014 primary fiscal balance fell short of the program target by 1.5 percent of GDP.That is a considerable shortfall. And this was on top of the slippage identified in the previous programme review:

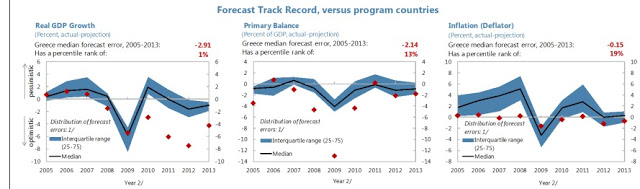

Debt/GDP was projected to fall from 175 percent of GDP at end–2013 to about 128 percent of GDP in 2020 and further to 117 percent of GDP in 2022. These were above the thresholds agreed to in November 2012, of debt coming down to 124 percent of GDP in 2020 and to “substantially below” 110 percent of GDP in 2022.In fact these charts from the IMF's report show that the programme had failed to meet targets from the start:

In 2013 the growth target was missed by a mile on the downside and the primary balance was also slightly below target. This programme has NEVER met its targets. Nor did the previous one.

Blaming the present government entirely for the failure to meet programme targets is thus unjustified. True, Greece's economic performance has significantly declined under the present government, mostly due to the uncertainty caused by its attempt to renegotiate the terms of the current programme. But if I were running this programme - and I am, among other things, a qualified and highly experienced project manager - I would have questioned the scope and assumptions long ago. A programme that is unable to meet any of its targets right from the start is not fit for purpose.

The slippage has principally been blamed on the Greeks not implementing the agreed reforms. There is some truth in this. But inadequate reforms do not fully explain Greece's terrible growth performance. Nor do they explain the deflation shown in the right-hand chart. Both of these are actually symptomatic of a severe demand squeeze caused by sharply falling real incomes. Or, if you like, by monetary tightness caused by very high real interest rates and no monetary offset from the ECB. It amounts to the same thing. The continuing fall in GDP makes the debt burden bigger, while deflation makes it more difficult to pay off. Yanis Varoufakis says Greece is in "debt deflation". These charts prove that he is right.

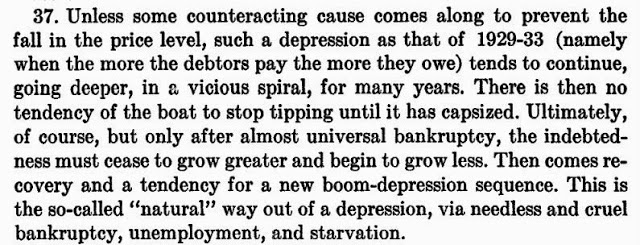

And as Irving Fisher reminds us, austerity is not the right medicine for a debt deflation. On the contrary, it makes matters worse.

Written at the height of the US Great Depression, Fisher's short paper "The Debt Deflation Theory of Great Depressions" describes how a debt crisis - be it sovereign or private - becomes an economic disaster. Fisher says that it is the combination of high debt with deflation that is particularly toxic. By itself, deflation need not be a problem at all, and a debt crisis may be quickly resolved. But when over-indebtedness is combined with deflation, a toxic spiral develops. Fisher describes it thus: "The more the debtors pay, the more they owe". And he explains how devastating the effects can be:

And in Greece today, as in the US's Great Depression, debt deflation is accompanied by bankruptcies, unemployment and starvation.

The 2012 programme makes no attempt to restore the Greek economy. Rather, it is narrowly focused on achieving debt sustainability. To achieve this, it envisaged Greece running primary surpluses of over 4% of GDP for many years from 2016 onwards and achieving the highest TFP growth in the Euro area. This, for an economy as deeply depressed as Greece, is economically illiterate. It was never remotely achievable and I think the worse of both the IMF and the previous Greek government for agreeing to such targets.

Unsurprisingly, the first objective of the present Greek government was to get the primary surplus targets reduced. And it succeeded in this aim, But crucially, it did not manage to persuade the creditors to consider further debt relief. For this the IMF must bear much of the blame. Had it supported the Greek government in its efforts to bring debt sustainability to the negotiating table, we might not now be in this dreadful situation.

The IMF has now now admitted that watering down the primary surplus targets makes the debt unsustainable:

In particular, if primary surpluses or growth were lowered as per the new policy package—primary surpluses of 3.5 percent of GDP, real GDP growth of 1½ percent in steady state, and more realistic privatization proceeds of about €½ billion annually—debt servicing would rise and debt/GDP would plateau at very high levels (see Figure 4i). For still lower primary surpluses or growth, debt servicing and debt/GDP rises unsustainably. The debt dynamics are unsustainable because as mentioned above, over time, costly market financing is replacing highly subsidized official sector financing, and the primary surpluses are insufficient to offset the difference.As FT Alphaville's Joseph Cotterill puts it, this means that the private sector really doesn't want the Greek debt it unloaded on to the public sector back any time soon. Or indeed ever.

But even these new policy targets are unrealistic. For a sovereign to run a substantial primary surplus AND achieve positive growth, either the external sector or the private sector must be in deficit. This implies that either Greece must also run a substantial trade surplus or Greek households and businesses must take on debt. The second of these is highly unlikely: real incomes for Greek households are falling sharply, Greek businesses are understandably unwilling to borrow to invest and Greek banks have high and rising proportions of non-performing loans on their balance sheets. Greece must therefore run a substantial trade surplus to have any chance at all of meeting these targets. Frankly, given Greece's long-standing competitiveness problem, the damage to Greece's already weak supply side in recent years, and the fact that it is locked into the Euro at far too high a real exchange rate, the chances of this are very low.

The IMF concedes that these targets are unachievable in practice. And this is where the fun starts. The IMF's Q&A on alternative scenarios is revealing. First, on growth:

What if growth were lower—closer to the historical pattern of about 1 percent per year? .....Real GDP growth of about 1 percent would still require strong assumptions about labor market dynamics and structural reforms that yield TFP growth at the average of euro area countries. In such a scenario, Greece’s debt would remain above 100 percent of GDP for the next three decades. Doubling the maturity and grace on existing EU loans and offering similar concessional terms on new borrowing, as specified above, would be vital to preserve gross financing needs within a safe range—the average GFN during 2015-2045 would be 11¼ percent of GDP.Crikey. So even real GDP growth of 1% per annum is a tall order. And it wouldn't make much of a dent in Greece's debt/gdp anyway.

Now, about that primary surplus:

What if primary surplus targets could not exceed 3 percent of GDP over the medium term? In that case, the provision of concessional financing for a prolonged period (10 years) would keep the GFN stable and below the 15-percent threshold over the next three decades. The decline in the debt-to-GDP ratio, nevertheless, would be very gradual.So unless Eurozone creditors agree to a huge extension of existing maturities and concessions on interest payments, debt would still be unsustainable even with a persistent primary surplus of 3% of GDP for decades. And if primary surpluses were much lower than this, then in addition to concessions and rescheduling there would have to be actual losses for Eurozone governments who made the mistake of bailing Greece out in 2010:

However, lowering the primary surplus target even further in this lower growth environment would imply unsustainable debt dynamics. If the medium-term primary surplus target were to be reduced to 2½ percent of GDP, say because this is all that the Greek authorities could credibly commit to, then the debt-to-GDP trajectory would be unsustainable even with the 10-year concessional financing assumed in the previous scenario. Gross financing needs and debt-to-GDP would surge owing to the need to pay for the fiscal relaxation of 1 percent of GDP per year with new borrowing at market terms. Thus, any substantial deviation from the package of reforms under consideration—in the form of lower primary surpluses and weaker reforms—would require substantially more financing and debt relief.....

In such a case, a haircut would be needed, along with extended concessional financing with fixed interest rates locked at current levels. A lower medium-term primary surplus of 2½ percent of GDP and lower real GDP growth of 1 percent per year would require not only concessional financing with fixed interest rates through 2020 to cover gaps as well as doubling of grace and maturities on existing debt but also a significant haircut of debt, for instance, full write-off of the stock outstanding in the GLF facility (€53.1 billion) or any other similar operation. The debt-to-GDP ratio would decline immediately, but “flattens” afterwards amid low economic growth and reduced primary surpluses. The stock and flow treatment, nevertheless, are able to bring the GFN-to-GDP trajectory back to safe ranges for the next three decades.To make matters worse, the IMF suggests that as Greece's debt is nearly all held by the official sector, there is no systemic risk and hence no reason for the IMF to involve itself any further in a programme which has no chance whatsoever of returning Greece's debt/GDP to a sustainable level.

The message from the IMF to the EU negotiators is clear: "We've had enough of this. Restructure this debt NOW or we are out."

The result of the Greek referendum gives democratic legitimacy to the Greek government's demands for debt restructuring and relaxation of programme targets. But in reality, the Greek government had already won, thanks to the IMF belatedly applying its own rules. In the end, debt that can't be paid won't be, and attempts to make it payable through harsh austerity only make matters worse. If Greece's creditors don't restructure the debt and refocus the programme on restoring growth, they face large losses in the not too distant future. Indeed, given the damage done to the Greek economy by the bank closure and capital controls, that future may be closer than they think.

In their own interests, Greece's official creditors must now construct a New Deal for Greece.Related reading:

How we would have restructured Greece's debt - FT Alphaville