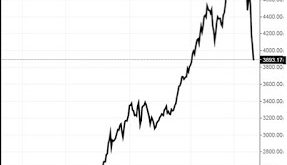

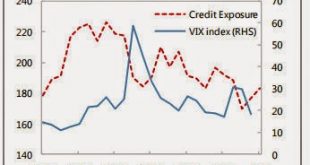

While all eyes are focused on Greece, there is a potentially far more important crash going on.Via Sober Look comes this pair of charts:China's stock market is crashing. It's very evidently a bubble bursting. The question is, what will be the knock-on effect to the Chinese economy, and indeed to the whole of South East Asia, Brutal sell-offs of this kind are rarely without economic cost, especially when the bubble is debt financed (as this one is). I can't see this ending well.Related...

Read More »Update on Greece With Frances Coppola

Jun 26 – Greece, like so many other nations and governments after the 2008 financial crisis, received a series of large bailouts as its economy sank into disarray. Now, years later, Greece’s creditors are asking for those loans to be paid back... http://www.financialsense.com/subscribe

Read More »Update on Greece With Frances Coppola

Jun 26 – Greece, like so many other nations and governments after the 2008 financial crisis, received a series of large bailouts as its economy sank into disarray. Now, years later, Greece’s creditors are asking for those loans to be paid back... http://www.financialsense.com/subscribe

Read More »Morality in the Greek crisis

I know I keep saying that economics is not a morality play. But when it comes to Greece, I can find no other satisfactory explanation for what is going on. The harsh treatment meted out to Greece over the last five years makes no economic sense whatsover. It has driven Greece into a deep depression that not only makes its government budget unsustainable but renders its debt unpayable: it has not only caused poverty and distress among Greece's population, but it has driven businesses into...

Read More »Mario Draghi and the Holy Grail

In a reply to a comment on my recent post about Target2 and ELA, I said this:There are no "Greek euros" or "German euros". There are only European euros. So the ECB is not exchanging Greek and German euros at par. Both countries are using the same currency, which is produced by the Eurosystem. The NCBs are not autonomous entities, they are part of the Eurosystem. They do not create their own currencies : collectively, they create the single currency.This is how a single currency works. If...

Read More »Goldilocks and the Griffin

The UK is forcing universal banks like HSBC to ring-fence their retail operations from their global and investment banking businesses – a sort of watered-down Glass-Steagall arrangement. The ring-fence will come into force in 2019, and banks are currently working out how to implement it. HSBC is creating a completely separate UK retail entity with its own capital, management and head office. As part of this process, it conducted a review of possible locations for the unit's new head...

Read More »Oh dear, Professor Sinn……

Hans Werner Sinn has apost on Project Syndicate which purports to explain why the plans of Greek finance minister Yanis Varoufakis are much cleverer than anyone has realised. I don’t disagree that Mr. Varoufakis’s plans are clever: indeed I have written several posts on Forbes explaining just how clever they are. But Professor Sinn’s explanation, sadly, is very wide of the mark. Here is Professor Sinn’s description of Mr. Varofakis’s strategy: Plan B comprises two key elements. First, there...

Read More »An anthem for Europe

The final paragraphs of Greek prime minister Alexis Tsipras's op-ed in Le Monde read thus:Europe, therefore, is at a crossroads. Following the serious concessions made by the Greek government, the decision is now not in the hands of the institutions, which in any case – with the exception of the European Commission- are not elected and are not accountable to the people, but rather in the hands of Europe’s leaders.Which strategy will prevail? The one that calls for a Europe of...

Read More »How do you say "dead cat" in Latvian?

This, my third post on Latvia, looks at its recovery from the 2008-9 recession.Latvia is often held up as the "poster child" for harsh austerity measures as the means of returning to strong economic growth. In order to hold its currency peg to the Euro, it embarked on a brutal front-loaded fiscal consolidation in 2009, sacking public sector workers, slashing public sector salaries, cutting benefits and raising taxes. Between 2010 and 2013 it cut its fiscal deficit from 10% of GDP to a...

Read More »Reflections on death and immortality

This week saw the deaths of the great mathematician John Nash and his wife Alicia in a car crash and the suicide of terminally-ill businessman Jeffrey Spector in Switzerland with the help of Dignitas. This post is written in their memory, and also in memory of my friends and musical colleagues Gavin Williams, who died last week, and Lindsay Purcell, who died at the beginning of April. May they rest in peace. This post is unashamedly long. After all, death is forever. From time...

Read More » Francis Coppola

Francis Coppola