Here are some things I think I am thinking about. 1) Has Mr. Market Finally Lost His Mind? It seems that everyone is losing their mind over politics so I’ve been rather amazed that the financial market has held it together this long. That changed a bit in October as the MSCI All World Stock Index took a 12% dive. Now, what’s interesting about the stock market downturn is that the wheels have been in motion here for almost all of 2018. The MSCI All World Index, the only true measure of “the...

Read More »The Pragmatic Voting Guide for the 2018 Mid-Terms

Many people think that the purpose of a Constitutional Republic was to protect against the tyranny of the government, but the founders of the United States also wanted to construct a system that protected against the tyranny of the majority. The USA is not a pure Democracy because the founders believed Democracy and mob rule could be just as dangerous as tyrannical rule. It’s kind of brilliant when you think about it. The problem is, we seem to be getting increasingly polarized and our...

Read More »No, The Government Didn’t Cause Unemployment

There was a big blogosphere kerfuffle in the last few weeks between some Modern Monetary Theory (MMT) people and a bunch of economics and finance people I greatly respect (Simon Wren-Lewis, Jo Michell, Steve Keen, Frances Coppola, etc). MMT was, at times, pushing an extremist and combative narrative that I found deeply misleading so I wanted to discuss this a bit as it appears that some people are being misinformed while reputable economists and finance people are being unnecessarily...

Read More »Why Does the Stock Market Rise and Fall?

Whenever the market falls people wonder why it’s happening. There are always lots of creative stories and they’re probably right to some degree, but the reality is that the stock market is like a mutating organism whose changing mutations have ever changing causes. We don’t really know what causes it to change each time and we can’t necessarily use past understandings to predict future changes. Still, we make up these narratives because they give us the illusion of control in an otherwise...

Read More »Funding in an Endogenous Money System (Nerdy)

(I come across this topic quite a bit and I think it’s hard for some people to understand so I am going to get a little nerdy here and see if I can clarify how financial instruments are created and used in the process of “funding” the economy’s needs). Endogenous money is an essential understanding for anyone who wants to better comprehend how the monetary system works. Okay, okay. Let me step back a second. First, what is endogenous money? Endogenous money refers to money that grows from...

Read More »Telling People Not to Panic Isn’t Good Enough

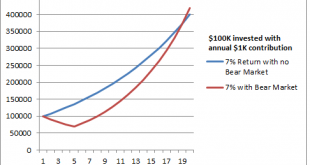

I’ve been with my wife for 17 years. And after all that time I finally figured out something really important when we’re fighting – never, never tell her to calm down when she’s mad. You see, this is very important because I am almost always the cause of her anger. Telling her to calm down after I made her mad is like shooting someone in the belly and telling them not to bleed. Read on because there’s a useful investing analogy somewhere in here…. The all world stock market is down 9.7%...

Read More »The Cost of Having a Taper Tantrum

Remember the Taper Tantrum in 2013? That was when 10 year T-Bond yields rose about 1.3% off a floor of 1.7% and stocks also fell. Over a 6 month period the All World Stock Index fell about 9% and 30 year T-Bonds fell 15%. Even a 50/50 stock/bond portfolio of US stocks and Total Bonds fell 5%. It seemed like the perfect storm where stocks and bonds both fall making it impossible to hide. But getting scared into this event turned out to be a big mistake. From the trough of the Taper Tantrum...

Read More »Debunking Passive Investing Myths on Bloomberg TV

(The fabulous Scarlet Fu and Eric Balchunas, hosts of ETF IQ)Here’s my appearance from yesterday on ETF IQ on Bloomberg TV in case you missed it. We touched on: 1) Why is the myth of passive investing important to understand? Short answer, but the longer-than-tv answer: passive has become a misnomer as anyone can construct an index fund in an active strategy and then claim to be “passively” tracking that index via an ETF. It’s easy to fall into the trap that passive is good and active is...

Read More »Three Things I Think I Think – ETF Edition

Here are some things I think I am thinking about ETFs. 1) Bloomberg ETF IQ – Let’s get this out of the way because it’s very very important. I am going to be in studio in NYC on Bloomberg ETF IQ tomorrow at 1:15 EST talking about Chicken Farming. We’ll be discussing three primary essential elements: 1. How to apply Python Dust to a chicken’s butt; 2. How to properly deal with a broody hen (useful info for men in almost any relationship); 3. How to train your chickens to respond to whistle...

Read More »How They’re Dividing Us

This is way off topic and too political for me, but it’s something I’ve spent a lot of time thinking about in recent years and since it’s Friday maybe most of you will be relaxed enough that it won’t make heads explode….Okay, probably not, but I’ll give it a go anyhow. Despite common differences and shared values Americans are becoming more politically polarized. And it seems to be happening in large part because our tribal leaders are intentionally dividing us for their own political...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism