All the best stuff in life takes time – love, friendship, wealth, etc. We want all of these things to happen immediately, but the reality is that they all take a lot of work. They take discipline and patience. There really are no shortcuts. The financial markets reminded us of this in 2018. The global stock market finished down about 10% and the US stock market was down about 4.5%. Amazingly, after all the constant fear mongering about bonds, the Barclays Bond Aggregate finished…positive...

Read More »Trump Didn’t Cause the Stock Market Downturn

Warning – this is going to piss half of you off and make the other half think I am a Trumper. Sorry to disappoint all of you in advance. There’s been a lot of angst and finger pointing in recent weeks about the downturn in the stock market. The easiest target, and the most vocal, has been Donald Trump. I think I’ve been pretty balanced with Trump over time. I said he wasn’t responsible for the 2017 stock bull market and while I’ve poked some fun at him here and on Twitter and derided him...

Read More »It’s Not Time to Panic (Yet)

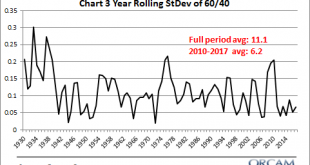

So, the market’s finally gotten a little interesting. It’s been a while. I feel like we’ve been sleepwalking through years of stable and steady market returns. In fact, the last few years have been unusually stable. The 3 year rolling standard deviation of a 60/40 stock/bond portfolio has been just 6.2 since 2010. The average since 1930 is 11.1. So, we’ve been spoiled by high and stable returns in the post-crisis period and now it looks like the party is ending. But does that mean we...

Read More »Let’s Talk About QE and Assflation

I was on Twitter talking about how Donald Trump knows nothing about monetary policy and how Jerome Powell and the Fed should ignore him. It’s true. Trump really knows nothing about this stuff. For instance, take a look at some of his old Tweets on QE. They’re basically a rambling mess of hyperinflation predictions. The Fed’s reckless policies of low interest and flooding the market with dollars needs to be stopped or we will face record inflation. — Donald J. Trump (@realDonaldTrump)...

Read More »The Counterproductive Nature of Annual Forecasts

The annual parade of Wall Street forecasts are starting to rollout. I will be honest – I love these things like a fat kid loves cake. It’s fun to try to predict and plan for the new year and there’s no better way to do that than to read what a whole bunch of smart people are predicting. The problem is, annual forecasts are worthless and I would argue even counterproductive. Let me explain why. I’ve talked a lot about how I like to think about all financial assets as bonds. I know, I know,...

Read More »The Worst Narrative In Cryptocurrencies

Successful investing is often more so about how to avoid bad ideas than it is about finding the right ideas.¹ In the last year there has been no place worse to be than cryptocurrencies with most of them down 85%+. Despite this I still see lots of optimists pushing cryptos based on narratives that are fundamentally wrong. For instance, here’s one I see all the time: “Governments are big bad terrible entities that will print money and ruin society and we can create a better form of...

Read More »3 Reasons to Hold Long Bonds as Short Rates Rise

As short rates rise the tendency for novice bond investors is to believe that the short end of the curve suddenly makes it irrational to hold any long-term bonds. While it’s true that the risk/reward of short-term bonds improves in this environment it doesn’t mean that long bonds serve no purpose in diversifying a portfolio. Here’s a very good video from Cathy Jones, Schwab’s Chief Fixed Income Strategist outlining three reasons why you shouldn’t abandon long-term bonds as short rates...

Read More »John Bogle is Wrong About Index Funds

It takes an unusually stupid person to disagree with John Bogle so I’m happy to announce that you’re reading that unusually stupid person. I’ve disagreed with Bogle on numerous occasions in recent years: 1) No, ETF’s aren’t dangerous. 2) There’s no such thing as passive investing. 3) Home bias is bad. So, I’m back for more. This time, Bogle says concentration in index fund assets is bad. Specifically: “Most observers expect that the share of corporate ownership by index funds will continue...

Read More »The Economics of Le’Veon Bell’s Gamble

The Le’Veon Bell drama has created some financial excitement in the NFL. For those who aren’t familiar with this situation, here’s the short version: Bell, who plays for the Pittsburgh Steelers, is one of the NFL’s top running backs (arguably, THE top RB). Bell was given a franchise tag in 2017 and then again in 2018. The franchise tag is a contract that the team can give to one player on their team that gives them exclusive rights to that player for one season. This guarantees their...

Read More »Pop Quiz, Hotshot

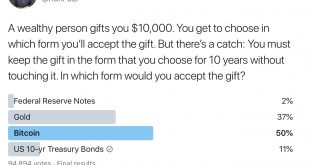

Okay, so you all know I am all about operational reality. And although the financial markets and the economy aren’t exactly like the physical world there are certain operational and fundamental aspects to it all. So, I was intrigued by this Tweet by Ron Paul and the lop-sided responses: Okay, so Ron Paul has a certain type of follower, but let’s go through this because it’s good practice. Federal Reserve Notes – Good ‘ol cash. Nothing gives you greater optionality. Heck, you can even buy...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism