If you’ve been reading my work for any of the last 10 years you know that I’ve sounded like a broken record for much of that time – the USA isn’t bankrupt, interest rates aren’t going to rise significantly and inflation is contained. All of this was based on an operational understanding of the monetary system within the context of a reserve currency issuing economy that was recovering from an unprecedented debt crisis resulting from an asset bust. One of the big conclusions from this view...

Read More »How to do Apolitical Analysis

I got an interesting email the other day: …Your writing is incomprehensibly objective and apolitical. I was wondering if you could provide some tips as to how you think about things and arrive at more empirical conclusions”. Well, this person is being a bit overly generous. We email a lot so maybe he feels indebted to me and has become behaviorally biased!?! Still, it’s something I think about a lot and make a serious effort to be aware of. I don’t always succeed here, but I think it’s...

Read More »10 Years and 10 Lessons from the Financial Crisis

10 years. It feels like yesterday. Then again, sometimes when I look at the economic data it feels like it never even happened. Whether you feel like the crisis is a distant memory or still lingering I think we can all agree that these kinds of big events serve as important lessons for understanding how we will navigate the future. So, 10 years later, here are 10 big lessons I take away from the financial crisis: Fear wins in the short-term and loses in the long-term. This is probably the...

Read More »Potential Problems with Narrow Banking

Here’s an interesting post from John Cochrane on “narrow banking”. Narrow banking is the idea that we could create banks that take a “narrow” type of risk by investing only in very high quality assets like Central Bank reserves or government bonds. This would back the bank’s balance sheet with virtually risk free assets. The argument is that this would be ideal compared to modern banks because there would be no risk of runs and no need for bailouts. As the Cochrane post discusses, the...

Read More »10 Years of Pragmatic Capitalism

A little over 10 years ago I sent out a research note to my clients saying that the financial crisis was entering a new stage and that policymakers were behind the curve. I remember becoming bearish when the yield curve inverted in 2006 and becoming worried that it was a sign of strain in the banking system as it always had in the past. I’d long been bearish on housing, but the way the crisis evolved and spread through the financial system took me by surprise. Still, I was well versed in...

Read More »My View On: The FIRE Movement

There was an interesting article in the NY Times this weekend titled “How to Retire in Your 30s With $1 Million in the Bank”. The Times tells the story of a growing movement called FIRE – Financial Independence Retire Early. The basic gist of the movement is this: Don’t let money control your life. Value happiness over materialism. Don’t get caught up in the rat race. I think these are all wonderful ideas and worth striving for. But I also think reality is much more complex than that and...

Read More »Three Things I Think I Think – Fatty’s Got Some Opinions

Here are some things I think I have an opinion about: 1) Fat Shaming Works for Me. I liked this thoughtful Tweet by Dr. Mike Simpson: I do not condone body shaming. But, as a physician, I also cannot condone people pretending that obesity is healthy. Beauty may be skin deep, but fat deposits go all the way to your internal organs. Be healthy, live well! pic.twitter.com/PJ4dN0E83g — Mike Simpson, M.D. (@DrMikeSimpson) August 30, 2018 I’ve talked quite a bit about the economic and health...

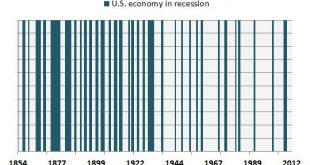

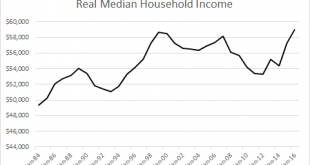

Read More »Why Political Extremism Will Get Worse

Is it just me or does it seem like our politics are becoming increasingly polarized? The rise of the Tea Party, the Alt-Right, Donald Trump, Antifa, Bernie Sanders and the Social Democrats are all extremist responses to what seems like a world that has left many people behind. There are several reasons for this and I believe it will only get worse. This is the most important chart in all of economics and politics: Any layperson can understand this chart and so some version of this chart...

Read More »Ending Stock Buybacks Won’t Save the Economy

Here’s a whopper of an article: So. Much. Hyperbole. The basic gist of the article is that the US economy is struggling because of inequality, unstable employment and sagging productivity. And if we eliminate stock buybacks then all will be right in the world. This is misleading at best and very wrong at worst. First, there’s this assumption that the economy needs to be “saved”. As if the US economy is on the brink of death with its record setting GDP and low unemployment. I fully admit...

Read More »Would the Stock Market Crash if Trump was Impeached?

Donald Trump says the stock market will crash if he is impeached: “I’ll tell you what, if I ever got impeached, I think the market would crash,”¹ Now, I don’t have any superpowers, but if there’s one thing I am really good at it’s avoiding political bias in my analysis. I always try to start with objective and empirical truths when analyzing something. So, let’s see if we can navigate this political minefield and parse this thing out from the ground up. First, it’s important to understand...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism