My 2017 presentation on Ireland and the Eurozone has been uploaded to YouTube. See the previous post for the link to the full conference, which includes the Q&A. [embedded content] Advertisements

Read More »Presentation on the Irish Economy

On Monday of this week I gave a presentation on the current state of the Irish economy at a conference on the future of Europe at the LBJ School of Public Affairs. My presentation begins around the 33 minute mark and is followed by some Q&A. It can be accessed here: Presentation on the Irish economy div{float:left;margin-right:10px;} div.wpmrec2x div.u > div:nth-child(3n){margin-right:0px;} ]]> Advertisements

Read More »Book Launch in Parliament Earlier This Year

On Tuesday 16th of March 2017 Robert Skidelsky and I launched my book The Reformation in Economics in the Clement Attlee room in the House of Lords. It has taken some time to upload these videos of Robert’s and my comments. Most of the speeches were captured but I have included my own text below (I did not end up sticking to the written comments verbatim). On a separate note, Brian Romanchuk has written a short review of the book here. [embedded content] [embedded content] Hi...

Read More »To What Extent Is Economics an Ideology and to What Extent Is It a Useful Theory?

By Philip Pilkington, a macroeconomist working in asset management and author of the new book The Reformation in Economics: A Deconstruction and Reconstruction of Economic Theory. The views expressed in this interview are not those of his employer Ever since the Enlightenment many societies have moved away from justifying their existence and formulating their aims through recourse to religious language. Gone are the days of the ‘Great Chain of Being’ which justified the natural and...

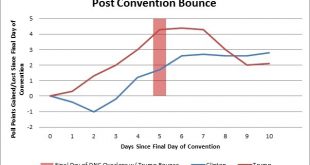

Read More »Why the Pollsters Totally Failed to Call a Trump Victory, Why I (Sort Of) Succeeded – and Why You Should Listen to Neither of Us

The views expressed in this article are the author’s own and do not reflect the views of his employer. The election of Donald Trump as president of the United States will likely go down in history for any number of reasons. But let us leave this to one side for a moment and survey some of the collateral damage generated by the election. I am thinking of the pollsters. By all accounts these pollsters – specifically the pollster-cum-pundits – failed miserably in this election. Let us...

Read More »Achtung! My Book is Coming Out Soon: Here Is a Brief Overview and Some Media Links

Hi everyone – or, at least, whoever is left out there. As you probably know, this blog has been shut down since October 2014 and I have pretty much fallen off the face of the planet. Actually I’ve been working in investment where I’ve found a job that allows me to pursue non-mainstream economic research. Some of you may recall that I was writing a book during the last days of this blog. I’m happy to say that this book is now fully completed and has been accepted for publication by...

Read More »The International Labour Organisation… Almost Correct

I have an article up on Al Jazeera this week. It may be the last journalistic article I write for some time as I start a new job next week. But this one deserves some brief discussion because the material it deals with is hugely important to the politics of the moment. In the article I discuss a joint report by the ILO, the OECD and the World Bank. The ILO have clearly spearheaded this one. It has their fingerprints all over it. The ILO are pretty fantastic really. They are one of the...

Read More »The Economic Consequences of the Overthrow of the Natural Rate of Interest

For quite a few months I have, on this blog, been alluding to a paper that I had written which showed that the natural rate of interest is implicitly dependent on the EMH in its strong-form in order to be coherent. I have finally published this paper (in working paper form) with the Levy Institute and it can be read here: Endogenous Money and the Natural Rate of Interest: The Reemergence of Liquidity Preference and Animal Spirits in the Post-Keynesian Theory of Capital Markets Some...

Read More »Noah Smith Fumbles Argument, Endorses Post-Keynesian Endogenous Money Theory

Economists say the darnedest things sometimes. They often say things that are factually inaccurate. Noah Smith put his foot in it recently when he claimed in a Bloomberg article: It seems like the only people who don’t instinctively believe in credit-fueled growth are academic economists. Now, this seems odd to me. In the article he notes that Post-Keynesians and Austrians do in fact think that credit fuels economic growth. Given that many of these economists hold academic positions...

Read More »Keynes’ Theory of the Business Cycle as Measured Against the 2008 Recession

In this post I will explore Keynes’ theory of the business cycle. He discusses his views in Chapter 22 of the General Theory and I think they hold up pretty well today. At the beginning of the chapter he notes that the business cycle — so-called, because it is not really a “cycle” at all despite what Keynes says in the chapter — is a highly complex phenomenon and that we can only really glean some very general features of it. Keynes opens with a very clear quote on what he thinks to...

Read More » Philip Pilkington: Fixing Economists

Philip Pilkington: Fixing Economists