[unable to retrieve full-text content]

Read More »FX Crises and the Trajectory of Interest Rates

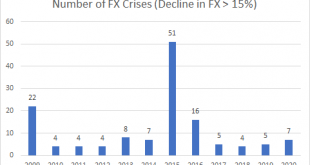

In this post, I want to get a sense of foreign exchange crises since 2008. The data that I am using is taken from the World Bank. It is not perfect. It is a bit spotty and could be improved upon. It is also annual data, so it will not pick up intrayear crises. But it is solid enough that it should give us a good first cut on the dynamics of foreign exchange crises. The first question to ask is simple enough: how many foreign exchange crises were experienced in this time period? For...

Read More »Is China Facing a Minsky Moment?

As Evergrande looks about to default on its debt many are asking whether this might be a Lehman moment for China. That is, are we about to see a wave of defaults that bring down the Chinese financial system as we did in Western countries in 2008? Much of the discussion is based on a misunderstanding. The Western financial system as it stood in 2008 was a largely laissez-faire system. There were, of course, regulations in place and there were also protections – most notably, deposit...

Read More »Inflation, the Quality Factor and Distribution

In a previous post I undertook a very simple analysis to show that factor investing during inflation helps investors to stop from simply treading water – at least, if history is any guide. An interlocutor asked if I’d looked into quality factors and I said that I would get around to it. In fact, there is something very interesting in the quality factor analysis – something that highlights an aspect of inflation that is not properly appreciated by most economists and investors....

Read More »Investing During Inflation

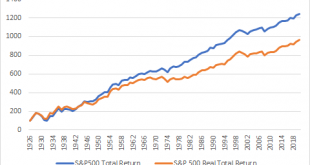

Recently I have been looking at whether inflation might be in the pipeline. The jury is still out on that, but caution would be wise given the current situation. That leads to a rather obvious question: what should investors do during an inflation? First off, if we are to be naive stock investors, how much does inflation impact stock market returns? We can see the impact in the following chart. But this chart simply does not capture the pain investors feel during proper...

Read More »Podcast on Inflation and Labour Shortages

I appeared on the Bullhouse podcast again to discuss some of the recent work I have done on inflation. I also talk about how the impact of COVID19 and the policy responses to it risk resulting in major labour shortages and a return to a 1970s-style inflationary regime. Podcast: Inflation and Labour Shortages

Read More »Forecasting Future Inflation Using Private Sector Indices

In our last post we saw that private sector indices for used car prices and for rent prices were highly predictive of future changes in the corresponding CPI component indices. The next logical step is obvious: we should use this information to build an aggregate CPI index that factors in this forward-looking information to get a prediction of inflation over the next six months. In all honesty, I was a little reticent to do this. Not to put too fine a point on it, but it is a...

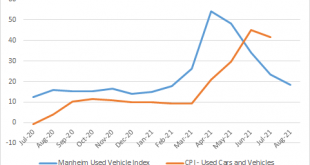

Read More »Using Private Sector Data to Forecast Future CPI Moves

Back in early August, my old colleague James Montier and I released a White Paper on inflation. In it we argued that our baseline scenario was that we would see transitory inflation caused by the extreme supply shocks caused by the lockdowns. We drew an analogy to the end of rationing in Britain after WWII, where we saw temporary price increases in the markets for rationed goods. Further, we argued that any sustained inflation would require a wage-price spiral. That is, in order...

Read More »Podcast Appearence on the Bullhouse

Yesterday I appeared on the Bullhouse podcast with Kenna for a very interesting discussion about a wide range of financial and economic topics. We discussed a number of different topics. Some of these were as follows: Whether there is a property bubble in the US and internationally right now.The potential bubble in the junk bond market and its implications.Why the risks in the market for rental properties are idiosyncratic this time around.How real estate is now a financial...

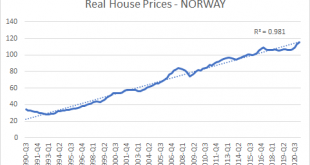

Read More »Systematic Detection of Housing Bubble – Part II: Linear Trends and Points-Based Detection

In the last piece on detecting housing market bubbles, I an through some of the problems with using standard-scoring. Here I will provide two solutions; one complex, the other simple. But before we move forward with this, we must understand one other problem when it comes to determining whether a housing bubble is indeed a housing bubble. This problem is not, like standard-scoring, related to how we manipulate the data. Rather it is related to how we define a housing bubble itself....

Read More » Philip Pilkington: Fixing Economists

Philip Pilkington: Fixing Economists