In a recent piece in Newsweek that got some attention, I made the case that the United States is currently experiencing a housing bubble. The next logical question is obvious: are other countries? After all, the 2008 meltdown was a global crisis; the US was not alone in its housing bubble. In order to try to detect housing bubbles ideally we would like some sort of systematic framework that we can deploy. The problems with using this approach when it comes to hosuing bubbles,...

Read More »Quantifying the Impact of Vaccine Failure on Earnings Per Share

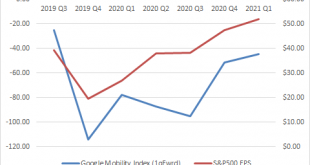

In a post last week, I raised the possibility that the vaccines might not get the virus under control this winter. Since the markets still seem to be pricing in vaccine success, this could have implications for investors. How might we think this through in more depth? One way to do this is by looking at the Google Mobility Index and seeing if it is any good at explaining EPS growth in the S&P. Here I take an aggregate construction from the index that encompasses all of the...

Read More »Double Bubble Trouble

Two weeks ago I wrote a piece for Newsweek outlining potential troubles in the junk bond market. I pointed out that there is a strong possibility that enormous junk bond issuance is floating companies that otherwise would have gone bankrupt due to the lockdown measures. Here is that piece: The Next Financial Crisis is Coming But that is not the only bubble on the horizon. The lockdowns and work-from-home appears to have driven investors pretty kooky because we also have what...

Read More »Vaccine Failure, Market Expectations and Inflated Valuations

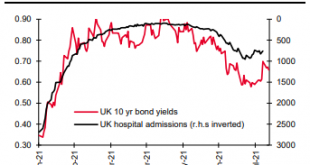

For the last year and a half the biggest sentiment driver in markets has undoutedly been COVID-19. This is perfectly reasonable as the virus is probably the biggest single driver of variables that matter in financial markets – from inflation expectations to earnings. Yet it has been striking that most financial analysts have been outsourcing their analysis of the trajectory of the virus to those in public health. In theory this is reasonable. Many are assuming that the public...

Read More »Inflation, Real Earnings and Recessions

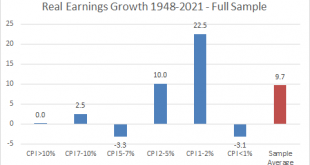

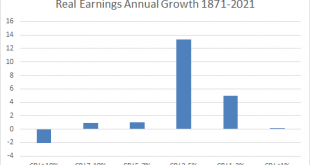

In my previous post, I laid out some issues with the methodology being used to explore the relationship between inflation and asset prices. One issue that I raised was with respect to the observation that inflation below 1% seemed to lead to lower stock market earnings. In the previous post I pointed out that this was likely misleading: it was unlikely that the low price growth itself was giving rise to such poor earnings; it was far more likely that this was mainly being driven...

Read More »Prolegomena to a Discussion of Inflation, Asset Returns and Real Earnings

Many today are examining the impact that inflation has on asset prices. One of the best papers on the topic is by Harvey et al and it is well worth a look. What I am going to write here does not refute these sorts of analyses, but I think it raises issues that at least serve to lower our confidence in the findings. The issues that I want to explore are as much methodological as they are empirical, but these two aspects can be approached simultaneously. When analysing equity...

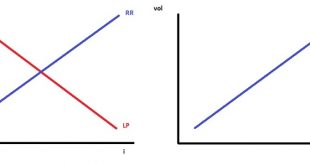

Read More »Why Lower Yield Treasuries Are More Attractive Than Higher Yield

In what follows, I want to draw out some implications of an interesting post by Greg Obenshain at Verdad Capital. In the post, Obenshain laid out data showing a number of things about Treasury bonds. Most notably, that they are a great investment if you are worried about the prospect of a recession or depression – and this is so no matter at what starting yield you are investing. One of the exhibits Obenshain showed, however, did not get sufficient attention. I think that it may...

Read More »New Review of My Book

A nice review of my book by Marc Morgan has appeared in American Affairs. Morgan works with Thomas Piketty at the World Inequality Lab at the Paris School of Economics. He is doing interesting work on profit accounting and determination. I would also note that Morgan attended the same secondary school (high school) as me in Dublin. Apparently, Christian Brothers College, Monkstown — although not a very prominent school in any meaningful sense — is creating a lot of heterodox...

Read More »How Far Can We Push This Thing? Some Optimistic Reflections on the Potential For Economic Experimentation

Readers are probably aware that there is quite a lot of discussion of Modern Monetary Theory (MMT) and the potential for fiscal experimentation batting around at the moment. Others have weighed in on this already, and I have little to add. It is striking, however, that most of the push-back — where there is push-back — is not focused on trying to discredit the idea that we should engage in fiscal experimentation. Indeed, the notion that we should engage in fiscal experimentation seems...

Read More »Some Reviews of My Book

I have come across two academic reviews of my book which can be found here and here. There is also a nice popular review in the Irish Times that can be found here. Advertisements

Read More » Philip Pilkington: Fixing Economists

Philip Pilkington: Fixing Economists