Back in early August, my old colleague James Montier and I released a White Paper on inflation. In it we argued that our baseline scenario was that we would see transitory inflation caused by the extreme supply shocks caused by the lockdowns. We drew an analogy to the end of rationing in Britain after WWII, where we saw temporary price increases in the markets for rationed goods. Further, we argued that any sustained inflation would require a wage-price spiral. That is, in order for inflation to feed on itself, the price rises would have to give rise to wage rises that then spurred further price rises. Since we wrote this, it appears that there are, in fact, anomalies in the labour market. Many service sector jobs appear to be finding it hard to get workers. Some are blaming

Topics:

Philip Pilkington considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Back in early August, my old colleague James Montier and I released a White Paper on inflation. In it we argued that our baseline scenario was that we would see transitory inflation caused by the extreme supply shocks caused by the lockdowns. We drew an analogy to the end of rationing in Britain after WWII, where we saw temporary price increases in the markets for rationed goods.

Further, we argued that any sustained inflation would require a wage-price spiral. That is, in order for inflation to feed on itself, the price rises would have to give rise to wage rises that then spurred further price rises.

Since we wrote this, it appears that there are, in fact, anomalies in the labour market. Many service sector jobs appear to be finding it hard to get workers. Some are blaming this on unemployment benefits, but it seems far more likely to me that many workers are simply too frightened to return to work. It is well-established that the average person vastly overestimates the danger of the virus and so it is no surprise that a certain portion of the workforce are not willing to work. What is more, the ‘fear effect’ is even more pronounced in young people who typically work service jobs.

Anyway, we are not going to deal here with the potential for sustained, structural inflation. Needless to say, the risk is real. And the more transitory inflation we see, the greater the chance that a sustained inflation will take hold.

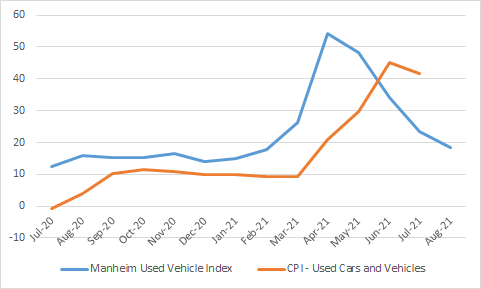

Private sector metrics of sectoral inflation have far outperformed public data in terms of predictive power. One of the core drivers of the uptick in inflation we saw in the second quarter of 2021 was used car prices. Yet if we were examining the Manheim Used Vehicle Index rather than the CPI we would have seen this two months in advance, as the chart below shows.

David Goldman – whose columns are a must read for anyone trying to get out in front of inflationary trends – spotted this in real-time.

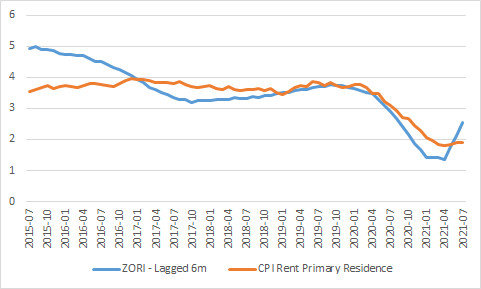

Today we are seeing a new trend emerge – one that Goldman has again been ahead of the pack on: rent price inflation. If we look at the Zillow Observed Rent Index (ZORI) we are seeing rent prices rise sharply.

We can use this information to forecast future increases in the CPI Rent Primary Residence Index. First we need to figure out how far back the CPI rent index lags the ZORI. If we lag ZORI by 6 months we get a very nice fit – yielding an RSQ of 0.6454.

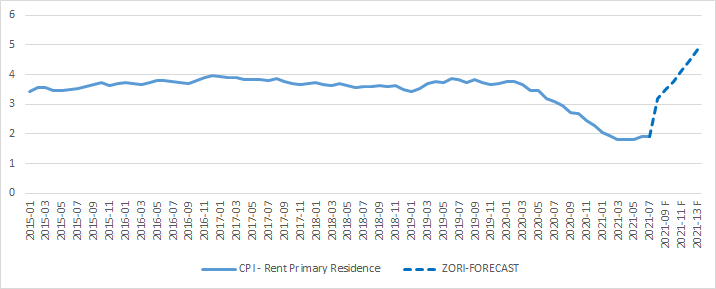

We can then use this to produce a forecast of the future CPI rent index.

So, how much of an impact will this have on the CPI index as a whole? Well, consider this: ‘Used Cars and Trucks’ makes up 2.75% of the total CPI index. And a sharp uptick in used car prices was able to have a major impact on the overall index.

‘Rent of Primary Residence’ makes up a full 7.86% of the total index – almost three times as much as used cars. That said, we should not expect rent prices to increase as sharply as used car prices and our forecast suggests that they will not. But this is still cause for concern.