In our last post we saw that private sector indices for used car prices and for rent prices were highly predictive of future changes in the corresponding CPI component indices. The next logical step is obvious: we should use this information to build an aggregate CPI index that factors in this forward-looking information to get a prediction of inflation over the next six months. In all honesty, I was a little reticent to do this. Not to put too fine a point on it, but it is a pain in the rear to do this sort of forecasting. You need to strip the CPI series right down using the component weights and then rebuild it using the private sector forecasts and weighting them accordingly. But, since inflation is such a hot topic right now, I figured it was probably worth doing this

Topics:

Philip Pilkington considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

In our last post we saw that private sector indices for used car prices and for rent prices were highly predictive of future changes in the corresponding CPI component indices.

The next logical step is obvious: we should use this information to build an aggregate CPI index that factors in this forward-looking information to get a prediction of inflation over the next six months.

In all honesty, I was a little reticent to do this. Not to put too fine a point on it, but it is a pain in the rear to do this sort of forecasting. You need to strip the CPI series right down using the component weights and then rebuild it using the private sector forecasts and weighting them accordingly.

But, since inflation is such a hot topic right now, I figured it was probably worth doing this as I have not seen it done elsewhere. So, here are the findings. (See last post for forecast methodology).

First of all, here are the component forecasts using lagged Zillow Rent Price data and lagged Manheim Used Car price data.

As we can see, based on the lagged private sector indices, future rent price increases should accelerate and future used car prices increases should decelerate.

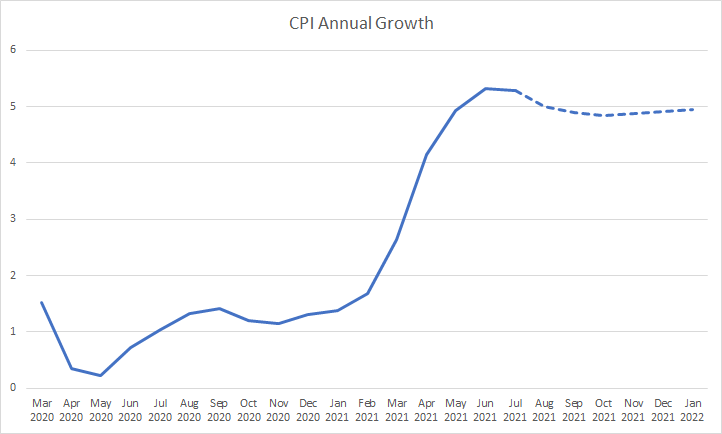

Now, here is what happens if we weight these indices and plug them back into a reconstructed CPI index.

What this tells us is that the accelerating rent prices largely offset the decelerating used car prices. This means that we should not expect CPI inflation to decelerate in the coming six months, but we should not expect it to accelerate either.

Of course, this forecast is based on forward-looking private sector indices for rents and used cars only. I have not tried to model the impact of rising house prices on the index – so-called ‘Owners’ Equivalent Rent’. I may do so in the future, but I would need to find a forward-llooking proxy for that too – probably from Zillow. I’ll see how much attention this series gets.