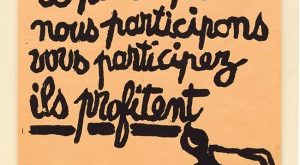

Tax avoidance — the elephant in the room [embedded content]

Read More »”If you’re not chasing after miracles, what’s the point?”

”If you’re not chasing after miracles, what’s the point?” [embedded content] One of my absolute favourites. Showing the importance of chasing miracles. Hallelujah!

Read More »Ascenseur pour l’échafaud

[embedded content]

Read More »Liturgy of St. John Chrysostom

Liturgy of St. John Chrysostom [embedded content] Tchaikovsky’s masterpiece. Purity and grandeur. Poetry and spiritual beauty.

Read More »Negative interest rates — a Kaleckian perspective

Negative interest rates — a Kaleckian perspective At any one time a range of profit rates exists in the economy. That range may become more or less extensive in a boom or a recession, or move up and down with some profits cycle. However, the market forces equalising rates of profit across the economy … are weak. So that particular ‘long run’ has never been attained. The practical reality is that a range of profit rates always exists. That practical reality...

Read More »MMT critics jumping the shark

MMT critics jumping the shark I was sent two papers by Thomas Palley the other day. I have known him for decades. He continually disappoints. He has become one of those self-styled Post Keynesians who are trying to destroy the credibility of Modern Monetary Theory (MMT) for reasons that are not entirely clear … He definitely has a set on MMT and regularly recycles the same sorts of attacks, which, continue to have the same problems. In other words, he does...

Read More »Yours truly i MMT intervju

Yours truly i MMT intervju Flamman (F): Först och främst, vad är MMT? Lars Pålsson Syll (LPS): I grunden är det en reaktion på sättet som pengar och hur de skapas beskrivs i den traditionella ekonomiska litteraturen. Där beskrivs pengar som något som man sparar genom att sätta in dem på banken, och som banken i sin tur kan låna ut genom att skapa krediter. Bankernas pengaskapande förutsätter alltså att privata individer sparar. Men den idén är fullständigt...

Read More »On tour (again)

Touring again. Guest appearances in Stockholm and Uppsala. Regular blogging to be resumed later in the week.

Read More »MMT — building on Post-Keynesian foundations

MMT — building on Post-Keynesian foundations To be sure, MMT concedes that the ability of an endogenous money supply to constrain inflation has limits. Government spending can still run up against the scarcity of real resources. Although some progressives invoking MMT seem unaware of this, Wray readily acknowledges that “just because the government can afford to spend does not mean government ought to spend more.” Government “must weigh the consequences in...

Read More »Privatisation de l’école — le fiasco suédois

Privatisation de l’école — le fiasco suédois Des études récentes démontrent que les friskolor (établissements privés sous contrat — LPS) attirent davantage les familles les plus aisées. « Les nouveaux arrivants, les personnes de milieux défavorisés ne viennent pas chez nous, confirme Mme Arsenau-Bussières. Nous avons cinq cents élèves sur liste d’attente, et leur inscription est le fait de parents qui connaissent le système. » Chercheur indépendant...

Read More » Lars P. Syll

Lars P. Syll