It is clearly the case that experienced modellers could easily come up with significantly different models based on the same set of data thus undermining claims to researcher-independent objectivity. This has been demonstrated empirically by Magnus and Morgan (1999) who conducted an experiment in which an apprentice had to try to replicate the analysis of a dataset that might have been carried out by three different experts (Leamer, Sims, and Hendry) following their published...

Read More »Sweden’s growing housing bubble

Sweden’s growing housing bubble House prices are increasing fast in EU. And more so in Sweden than in any other member state, as shown in the Eurostat graph below, showing percentage increase in annually deflated house price index by member state 2015: Sweden’s house price boom started in mid-1990s, and looking at the development of real house prices during the last three decades there are reasons to be deeply worried. The indebtedness of the Swedish...

Read More »Probability and rationality — trickier than you may think

Probability and rationality — trickier than you may think The Coin-tossing Problem My friend Ben says that on the first day he got the following sequence of Heads and Tails when tossing a coin: H H H H H H H H H H And on the second day he says that he got the following sequence: H T T H H T T H T H Which day-report makes you suspicious? Most people I ask this question says the first day-report looks suspicious. But actually both days are equally probable!...

Read More »Microfoundational angels

Amongst the several problems/disadvantages of this current consensus is that, in order to make a rational expectations, micro-founded model mathematically and analytically tractable it has been necessary in general to impose some (absurdly) simplifying assumptions, notably the existence of representative agents, who never default.This latter (nonsensical) assumption goes under the jargon term as the transversality condition. This makes all agents perfectly creditworthy. Over...

Read More »Svensk skola — ett fullständigt haveri

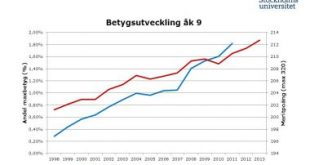

Svensk skola — ett fullständigt haveri Sen 2014 har andelen toppbetyg fördubblats från 0,25 procent till dagens 0,5 procent (knappt 500 elever). Denna andel är nästan 40 (!) gånger så stor som andelen med maximala betyg (5,0) under det relativa betygssystemet i början av 1990-talet … Det finns flera problem med denna utveckling. När betygen stiger och fler slår i taket så försvåras urvalet till vidare studier och varje enskilt betyg blir helt avgörande för...

Read More »Ricardian equivalence — hopelessly unrealistic

Ricardian equivalence — hopelessly unrealistic According to the Ricardian equivalence hypothesis the public sector basically finances its expenditures through taxes or by issuing bonds, and bonds must sooner or later be repaid by raising taxes in the future. If the public sector runs extra spending through deficits, taxpayers will according to the hypothesis anticipate that they will have pay higher taxes in future — and therefore increase their savings and...

Read More »Things sure have changed …

Things sure have changed … [embedded content]

Read More »Loanable funds theory is inconsistent with data

Loanable funds theory is inconsistent with data Loanable funds doctrine dates back to the early nineteenth century and was forcefully restated by the Swedish economist Knut Wicksell around the turn of the twentieth (with implications for inflation not pursued here). It was repudiated in 1936 by John Maynard Keynes in his General Theory. Before that he was merely a leading post-Wicksellian rather than the greatest economist of his and later times. Like...

Read More »De Niro says it all!

De Niro says it all! [embedded content] That a country that has given us presidents like George Washington, Thomas Jefferson, Abraham Lincoln, and Franklin D. Roosevelt, should even have to consider the possibility of being run by a witless clown like Donald Trump is an absolute disgrace.

Read More »Paul Romer — favourite candidate for ‘Nobel prize’ 2016

Paul Romer — favourite candidate for ‘Nobel prize’ 2016 Among Swedish economists, Paul Romer is the favourite candidate for receiving the ‘Nobel Prize’ in economics 2016. Let’s hope the prediction turns out right this time. The ‘Nobel prize’ in economics has almost exclusively gone to mainstream economists, and most often to Chicago economists. So how refreshing it would be if for once we would have a winner who has been brave enough to openly criticize the...

Read More » Lars P. Syll

Lars P. Syll