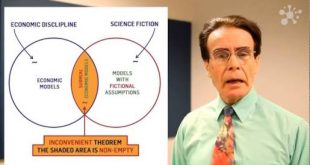

Krugman’s dangerous lack of methodological reflection How do we do useful economics? This is an important question that every earnest economist ought to pose — and try to answer. Here’s one answer, from Nobel laureate Paul Krugman: In general, what we really do is combine maximization-and-equilibrium as a first cut with a variety of ad hoc modifications reflecting what seem to be empirical regularities about how both individual behavior and markets depart...

Read More »The truth about banks

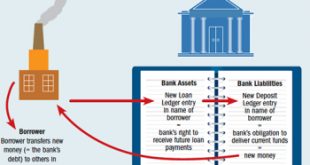

The truth about banks When faced with the Great Recession in 2008, macroeconomics was initially unprepared to contribute much to the analysis of the interaction of banks with the macro economy. Today there is a sizable body of research on this topic, but the literature still has many difficulties … In modern neoclassical intermediation of loanable funds theories, banks are seen as intermediating real savings. Lending, in this narrative, starts with banks...

Read More »On the scaling property of randomness

On the scaling property of randomness I thought hard and long on how to explain with as little mathematics as possible the difference between noise and meaning, and how to show why the time scale is important in judging an historical event. The Monte Carlo simulator can provide us with such an intuition. We will start with an example borrowed from the investment world … Let us manufacture a happily retired dentist, living in a pleasant sunny town. We know a...

Read More »Did Brexit kill British austerity?

Did Brexit kill British austerity? This is the end of the disastrous experiment that was austerity, which was an ignominious failure that I opposed from the outset … It is clear that the rising number of immigrants has put pressure on public services but this was mostly because Osborne under-invested in services in order to shrink the state. They paid their taxes, but Slasher didn’t invest that money in new schools, houses and hospitals … When a negative...

Read More »‘Financial engineering’ –a costly pseudoscientific mistake

Note that the economist Robert Lucas dealt a blow to econometrics by arguing that if people were rational then their rationality would cause them to figure out predictable patterns from the past and adapt, so that past information would be completely useless for predicting the future … If rational traders detect a pattern of stocks rising on Mondays, then, immediately such a pattern becomes detectable, it would be ironed out by people buying on Friday in anticipation of such...

Read More »Mainstream economics — going for the wrong kind of certainty

Mainstream economics — going for the wrong kind of certainty In science we standardly use a logically non-valid inference — the fallacy of affirming the consequent — of the following form: (1) p => q (2) q ————- p or, in instantiated form (1) ∀x (Gx => Px) (2) Pa ———— Ga Although logically invalid, it is nonetheless a kind of inference — abduction — that may be factually strongly warranted and truth-producing. Following the general pattern ‘Evidence...

Read More »The loanable funds fallacy

The loanable funds fallacy The loanable funds theory is in many regards nothing but an approach where the ruling rate of interest in society is — pure and simple — conceived as nothing else than the price of loans or credit, determined by supply and demand — as Bertil Ohlin put it — “in the same way as the price of eggs and strawberries on a village market.” The currently dominant intermediation of loanable funds (ILF) model views banks as barter...

Read More »Why Brexit voters ignored the ‘experts’

By the time British citizens went to the polls on June 23 to decide on their country’s continued membership in the European Union, there had been no shortage of advice in favor of remaining. Foreign leaders and moral authorities had voiced unambiguous concern about the consequences of an exit, and economists had overwhelmingly warned that leaving the EU would entail significant economic costs. Yet the warnings were ignored. A pre-referendum YouGov opinion poll tells why:...

Read More »Paul Krugman — nothing but a die-hard neoclassical economist

Paul Krugman — nothing but a die-hard neoclassical economist In his review of Mervyn King’s The End of Alchemy: Money, Banking, and the Future of the Global Economy — on which I had a post up yesterday — Krugman writes: Is this argument right, analytically? I’d like to see King lay out a specific model for his claims, because I suspect that this is exactly the kind of situation in which words alone can create an illusion of logical coherence that dissipates...

Read More »Paul Krugman vs. Mervyn King on Keynes

Paul Krugman vs. Mervyn King on Keynes Most self-described Keynesians are Part 1ers. They don’t necessarily believe that workers and consumers are perfectly rational, or deny that sudden shifts in behavior can happen, but irrationality and volatility are at the fringes of their worldview. King argues, however, that this is all wrong; he is, basically, a Chapter 12er, asserting that economic decisions always take place under conditions of “radical...

Read More » Lars P. Syll

Lars P. Syll