SWL is still caught in the monetarist fallacy. MMT has two arguments against the golden rule, which I will call reasonable and unreasonable. The unreasonable argument is that interest rate increases do not reduce aggregate demand and inflation, and therefore fiscal policy has to play the macro stabilisation role at all times. It is an unreasonable claim because it contradicts the large amount of evidence that higher interest rates do reduce aggregate demand and inflation, evidence that you...

Read More »Trump is Fighting an American Class War – and Winning — Joel Kotkin

The most important political event this week will not be the upcoming GOP debate but Donald Trump’s expected visit with striking UAW workers as the walkout expands to other states. In that one appearance, Trump demonstrates one of the most critical parts of political change, the emergence of the populist right.…Once hostile to unions, Republicans like Florida’s Senator Marco Rubio, Ohio’s JD Vance and Missouri’s Josh Hawley have all pledged support to the strikers. Union-affiliated...

Read More »Remembering Jim Crotty — JW Mason

Perhaps the most distinctive aspect of Jim’s pedagogy and scholarship, almost alone among economists we have known, was his ability to synthesise these two thinkers in ways that gave equal weight to both, that placed them in conversation rather than in tension. Crotty’s Marx anticipates Minsky, while his Keynes is a political radical – a socialist – in ways that few others have recognized.Perhaps his most profound contribution to both traditions was the brilliant 1985 article “The Centrality...

Read More »At Least It’s Not As Bad As 1994 — Brian Romanchuk

The current Treasury bear market has been impressive, and unfortunately for the bond bulls, there is no valuation reason for it to stop. For example, the 5-year Treasury is still trading well below the overnight rate. If we look back to the 1994 bond bear market, the 5-year traded about 250 basis points above cash — versus about 100 basis points below now.The explanation for this disparity can be pinned on the Fed reaction function....Bond EconomicsAt Least It's Not As Bad As 1994Brian...

Read More »Big down day today was actually good.

Need to see liquidation and a build up in Barash sentiment.

Read More »Market to turn higher this week.

First-of-month transfers on Friday will boost market.

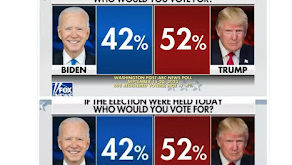

Read More »Trump up 10% over Brandon

If this thing holds Trumps going to immediately slash rates in half on day 1 in January 2025… lock it…Meanwhile all the Art degree morons are all going around saying “ the Fed is independent! … the Fed is independent!…. the Fed is independent!”

Read More »So much misinformation and ignorance to exploit.

It’s to the point of being humorous, how people ignore reality to make things fit their narrative.

Read More »It will end badly if we rely on the speculators and gamblers for a climate change solution — Bill Mitchell

I am now in a very hot and humid Kyoto having left Australia yesterday in weather that was in some places 20 or more degrees Celsius above the norm for early Spring. The heat here and back home at this time of year is rather scary given what it portends. I also do not have much time today given I have been contending with various ‘moving in’ requirements. But I read an article on the plane last night which I think marks a divide between what ‘green’ progressives think and what I think is...

Read More »Market selloff will continue.

We’re not out of the woods yet with tax drain.

Read More » Mike Norman Economics

Mike Norman Economics