In this post we discuss debt in the current context, and consider where the very high levels of debt will take us. And as importantly, who wins and who loses. Transcript is available for download.... Digital Financial Analytics BlogDebt And Power – With Michael Hudson Martin North

Read More »Open Letter — Developing and emerging countries need capital controls to prevent financial catastrophe

Open letter signed by many economists.Critical Macro FinanceDeveloping and emerging countries need capital controls to prevent financial catastrophe Posted by Jo Mitchell

Read More »What the Government Needs to Do Next to Tackle the Crisis — James K. Galbraith

Tax rebates, tax cuts and business bailouts will not solve this crisis. Here’s what’s needed. NETWhat the Government Needs to Do Next to Tackle the Crisis James K. Galbraith | Lloyd M. Bentsen Jr. Chair in Government/Business Relations and Professor of Government at the Lyndon B. Johnson School of Public Affairs, The University of Texas at Austin

Read More »Lars P. Syll — On the non-neutrality of money

One of Keynes’s central tenets — in clear contradistinction to the beliefs of mainstream economists — is that there is no strong automatic tendency for economies to move toward full employment levels in monetary economies. Money doesn’t matter in mainstream macroeconomic models. That’s true. But in the real world in which we happen to live, money does certainly matter. Money is not neutral and money matters in both the short run and the long run.... "New Keynesianism" isn't Keynesian. It...

Read More »Bill Mitchell – Some lessons from history for the design of a coronavirus fiscal intervention

This post continues my thinking and analysis of the issues relating to the design of a fiscal intervention by the Australian government to ameliorate the damaging consequences of the coronavirus dislocation. Today, I delve a little bit back in history to provide some perspective on the current fiscal considerations. Further, I consider some of the problems already emerging in the policy response. And finally, I consider the lessons of history provide an important guide to the sort of...

Read More »Nathan Tankus — What if The Federal Reserve Just … Spent Money?

Nathan Tankus is a go-to guy on the institutional side of MMT. Following Scott Fullwiler, I also highly recommended subscribing to his new blog if you are into the nitty gritty and don't want to miss anything since I will only be linking it selectively. Nathan offers a free and a premium service. Like MMT legal scholar Rohan Grey, Nathan is an up-and-comer and is already becoming a star. The MMT bench is broadening and deepening. Please support Nathan if you are interested and able. Here is...

Read More »Wired — The Doctor Who Helped Defeat Smallpox Explains What’s Coming

Epidemiologist Larry Brilliant, who warned of pandemic in 2006, says we can beat the novel coronavirus—but first, we need lots more testing. Worth watching.WiredThe Doctor Who Helped Defeat Smallpox Explains What's Coming

Read More »Federal Reserve to buy around USD75bn of Treasuries on Tue, Wed, Thurs, Fri

Not good.... Thats another $300B this week non-Risk assets they are going to add to banks ... and so far no fiscal response from Treasury to create new issues... who are they buying them from?.. risk asset prices going down...New York Federal Reserve to buy around USD75bn of Treasuries on Tue, Wed, Thurs, Fri https://t.co/AcqIAaPz8L— ForexLive (@ForexLive) March 23, 2020

Read More »The Bank of England remembers its wartime roots — Claire Jones

Hidden in last Thursday’s announcement from the Bank of England that it intends to buy another £200bn-worth of mostly government bonds was this line:The MPC will keep under review the case for participating in the primary market.It might sound like dull techno-speak, but the mere possibility of the Old Lady of Threadneedle Street buying bonds directly from the government (i.e., in the primary market) is a big deal. Since gaining independence, central banks have liked to see themselves as...

Read More »Dirk Ehnts, Warren Mosler – A Euro Zone Proposal for Fighting the Economic Consequences of the Coronavirus Crisis

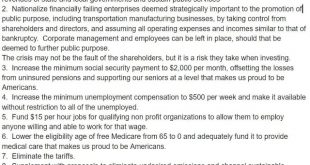

The Coronavirus Crisis has caused economic havoc. In this article, Warren Mosler and Dirk Ehnts discuss policy proposals that are informed by Modern Monetary Theory (MMT). Brave New EuropeDirk Ehnts, Warren Mosler – A Euro Zone Proposal for Fighting the Economic Consequences of the Coronavirus CrisisWarren's draft proposal for the US from his Twitter feed:

Read More » Mike Norman Economics

Mike Norman Economics