I have now arrived at the part of the preparation for my panel that I have dreaded: the Great Canadian Fiscal Crisis of 1994-1995. This is an event that Canadian Establishment figures will talk your ear off about if you bring up Modern Monetary Theory (MMT). My problem with this crisis is that I spent my working life staring at charts of yields, economic data, and exchange rates, and never even noticed anything unusual during that period in Canada. It was only much later that I heard about...

Read More »Will America win from de-dollarisation? — Thomas Fazi,

Summary. You know all this if you have been following this, but it's a useful summary for those not following it closely.UnherdWill America win from de-dollarisation?Thomas Fazi, co-author with Bill Mitchell of Reclaiming the State

Read More »Western tech firms just can’t resist China’s chip market — Scott Foster

Economic warfare has its consequences, including blowback. Did anyone think this through?Asia TimesWestern tech firms just can’t resist China’s chip marketScott FosterRelatedTASS (Russian state media) IMF finally turned into tool to achieve US military goals — Lavrov [headline too narrow, there's much more]

Read More »William Mitchell — The inflation backtracking from the central bankers and others is gathering pace

Remember all the hype from central bankers last year and earlier this year about how they had to get ‘ahead of the curve’ with their interest rate hikes just in case wage demands escalated and inflationary expectatinos became ‘unanchored’. Over the last 18 months, I consistently noted in various blog posts that this was all a ruse to create a smokescreen to justify the unjustifiable rate rises – given that the inflationary pressures were almost all coming from the supply side and those...

Read More »Links — 23 April 2023

Pragmatic Economics — ForbesDebt-Ceiling MadnessJohn T. Harvey, ContributorCaitlinJohnstone.comThe Empire Of Hypocrisy: Notes From The Edge Of The Narrative MatrixCaitlin Johnstone RT — Question More (Russian state-sponsored media)Kirill Strelnikov: Western ‘experts’ thought they would destroy Russia’s economy. They failed. [As Andrei Martyanov said from the get-go. It's national capacity, stupid, not NGDP.]Kirill Strelnikov, RIA NovostiMarginal RevolutionWar by Other Means [review of Aaron...

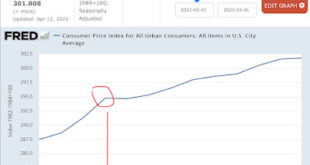

Read More »CPI

Once we get to the one year anniversary of the upward inflection point last year due to Brandon’s Russia sanctions then their “inflation!” is going to go away… looks like May or June …. 295 to 301 is 2%… then what are they going to do?

Read More »MAGA: $2.5 Trillion Of Interest Payments YEARLY On Americans’ Horizon According To CBO’s Spending Projections

Over 2X a Social Security…. 3X a DoD…LFG!!!! ?????

Read More »Central Bank Independence As A Secret Ingredient? — Brian Romanchuk

Following up on my comments on the paper: “Deficits Do Matter: A Review of Modern Monetary Theory” by Farah Omran and Mark Zelmer, I am going to do a high level discussion about their claims about the value of an independent central bank. (For new readers, I am discussing this paper as I will be on a panel about Modern Monetary Theory (MMT), and Mark Zelmer is one of the participants. I am using my articles here as a way of thinking about my prepared remarks.)The headline of this article is...

Read More »Links — 20 April 2023

Sixth Tone (China)AI Is Starting to Replace Humans in China’s Creative SectorYe ZhanhangSixth Tone (China)Can Work Survive the ChatGPT Era?Yu Mingfeng, associate professor of philosophy at Tongji University in ShanghaiCaitlinJohnstone.com (Australia)Tech Would Be Fine If We Weren’t Ruled By Monsters: Notes From The Edge Of The Narrative MatrixCaitlin Johnstone Southfront (sanctioned by the US Treasury Department)How Can I Use The Digital Yuan With Ease?Katehon (Russia)Limits To Supply Chain...

Read More »$255 bln tax drain so far this month.

I still think the market is holding up well in spite. Looks like early to mid-May as the beginning of a rebound. But there's still the debt ceiling to worry about.

Read More » Mike Norman Economics

Mike Norman Economics