Earlier this week (April 25, 2023), I saw a Twitter exchange that demonstrated to me two things: (a) some mainstream media commentators are now understanding some of the principles of Modern Monetary Theory (MMT) and relating that knowledge to practical matters that concern them (lens being applied to values); and (b) high profile financial market players still command a platform in the media but have little understanding of what MMT is and consistently issue false statements. A lot of...

Read More »Zero Hedge — China Is Quickly Becoming One Of The Largest Automobile Exporters In The World

When I was a world traveler in my twenties back in the 60s, I was struck by the prevalence of Japanese cars and pickup trucks with US cars owned almost exclusively by the elite and no US pickups visible. The rest is history. China may be in a similar position now.Zero HedgeChina Is Quickly Becoming One Of The Largest Automobile Exporters In The WorldTyler Durden

Read More »I may be quitting

Thoughts about this channel and trying to grow. Not happening. Trade and invest using the concepts of MMT. Get a 30-day free trial to MMT Trader. https://www.pitbulleconomics.com/mmt-trader/?s2-ssl=yes Mike Norman Twitter https://twitter.com/mikenorman Mike Norman Economics: https://www.pitbulleconomics.com Understanding the Daily Treasury Statement video course. https://www.pitbulleconomics.com/understanding-daily-treasury-statement-video-course/?s2-ssl=yes

Read More »Kremlin explains seizure of foreign assets — RT

Tit for tat. Not quite, yet.The [Kremlin] spokesman [Dmitry Peskov] added that the move “mirrors the attitude of Western states towards foreign assets belonging to Russian companies.”“The main goal of the step is to create a compensation fund for potential use in tit-for-tat measures in response to the expropriation of Russian assets abroad,” Peskov said. He added that a number of states systematically carry out a rapid transition from temporary administration to actual confiscation..The...

Read More »Balancing Individualism with Egalitarianism — Michael Hudson

Video and transcript.Michael Hudson — On Finance, Real Estate And The Powers Of NeoliberalismBalancing Individualism with EgalitarianismMichael Hudson | President of The Institute for the Study of Long-Term Economic Trends (ISLET), a Wall Street Financial Analyst, Distinguished Research Professor of Economics at the University of Missouri, Kansas City, and Guest Professor at Peking University

Read More »In The Seeds War Who Is Burying Whom? — John Helmer

About Russian agriculture, specifically seed production. Longish and detained but the basic idea is important. Russian seed production was literally wiped out by the liberal government under Yeltsin, making Russian agriculture fully dependent on the West. Russia is now trying to develop self-sufficiency in seed production after having become otherwise self-sufficient in food production. Seed production is a weak link right at the beginning of the chain. Russian agriculture is already a...

Read More »Argentina currency collapse

Argentina peso in collapse wrt USD:In #Argentina, the peso has tumbled to a 12-year low of 462 ARS/USD in the parallel market. The pathetic peso has lost 52% of its value against the USD since Jan 2022. Arg. needs to mothball the Central Bank of Argentina and the peso and place them in a museum. pic.twitter.com/uPXm9kIYAI— Steve Hanke (@steve_hanke) April 25, 2023 Interest rates at 81% … better keep increasing rates and stick with it …. maybe it will work this time… come up with some new...

Read More »Japan moon fail

Lots of long faces… ie back to the drawing board…BREAKING: Japan's ispace says Moon landing may have failed, no contact with spacecraft pic.twitter.com/afscUiPSJ9— BNO News Live (@BNODesk) April 25, 2023 If they had Art Degrees instead they would simply do the same thing without making any adjustments and see if it worked the next time or the time after that.. or the time after that… dogmatically advocating for this original configuration…. would be a lot easier …

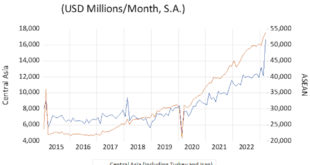

Read More »China’s exports shifting from West to Global South — David P. Goldman

That [refers to data in the article] represents a geopolitical point of no return of sorts, the moment when China’s economic dependence on the United States in particular and developed markets in general slipped behind its economic standing in the developing world.Global economic growth is now coming from the Global South/East as these countries develop. China is in a position to capitalize (pun intended) on this trend, which appears to be long term owing to lower costs than prevail in the...

Read More »Hope you bought today. It was the bottom.

Tax drain almost over. Net positive fiscal flows to resume until mid-May. Look for a market rally. Trade and invest using the concepts of MMT. Get a 30-day free trial to MMT Trader. https://www.pitbulleconomics.com/mmt-trader/?s2-ssl=yes Mike Norman Twitter https://twitter.com/mikenorman Mike Norman Economics: https://www.pitbulleconomics.com Understanding the Daily Treasury Statement video course....

Read More » Mike Norman Economics

Mike Norman Economics