By Thomas PalleyThe US is currently enjoying another stock market boom which, if history is any guide, also stands to end in a bust. In the meantime, the boom is having a politically toxic effect by lending support to Donald Trump and obscuring the case for reversing the neoliberal economic paradigm.For four decades the US economy has been trapped in a “Groundhog Day” cycle in which policy engineered new stock market booms cover the tracks of previous busts. But though each new boom...

Read More »Summers on secular stagnation, the ISLM, and the liquidity trap

Two short clips from Lawrence Summers talk at the ASSA meeting in San Diego. So he first says that secular stagnation is more plausible now than before. He sees that it can be explained as a shift of the IS curve backwards. His IS has a somewhat marginalist foundation, with a natural rate, and a fairly conventional story for investment. Of course, the negative shift has bee compensated by some sort of stimulus, that is now weaker. I would say a smaller multiplier that affects the slope of...

Read More »James K. Galbraith’s Veblen-Commons award

Ritual and prestige among the Institutionalists Jamie got the Veblen-Commons award, something his father received back in 1976. I introduced him, and as expected discussed a bit his contributions to economics, and the understanding of institutions. His most important contributions are on the field of inequality, and the work he has done with the University of Texas Inequality Project (UTIP).There are many contributions that Jamie and UTIP have made. His use of the UNIDO payroll data,...

Read More »Raúl Prebisch as a Central Banker and Money Doctor

Here we edited with Esteban Pérez and Miguel Torres some unpublished manuscripts from Prebisch related to the Federal Reserve missions, led by Robert Triffin, to the Dominican Republic and Paraguay, in which he emphasizes the need of capital controls in peripheral countries that did NOT have the key hegemonic currency. There is also a discussion of Keynes and White's plans for Bretton Woods, which were partially published before. In Spanish. Happy New Year!

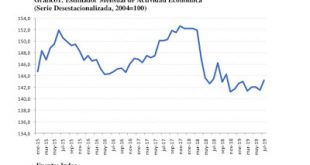

Read More »What to expect from the incoming government in Argentina

The government in Argentina has less than two weeks at this point. It is too early to pass judgment. But we can look at the legacy of the Macri administration, and indicate a few things about the current strategy. A paper I have just received from Fabian Amico, that will soon be published in Circus, will be invaluable for my very brief comments here (the new issue of Circus and his paper will eventually be linked here, in Spanish).The first thing that should be evident is that the 4 years...

Read More »A Conservative win will create a neoliberal hot zone and dissolve the UK: here’s how to stop it

By Thomas PalleyI could not get this op-ed (written November 6, 2019) published as it was a mix of too dull & didactic, and too partisan or not partisan enough. Anyway, in the wake of the election, I think it was analytically spot on so I have decided to post it. Also, it makes clear the very special circumstances of the UK election. It is a gross distortion to extrapolate from the UK to the US. Unfortunately, that is exactly what elite US media (e.g. New York Times) and neoliberal...

Read More »Central Banks, Development and the Argentinean Economy

[embedded content] My interview (in Spanish) on central banks, development and some moderate optimism about the forthcoming Argentinian government of Alberto Fernández.

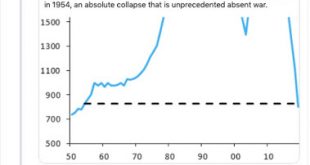

Read More »Paul Volcker’s legacy

Paul Adolph Volcker (1927-2019) Paul Volcker has passed away, and many obits (NYTimes here) and blog posts will be published in the next couple of days. Most likely, the majority will suggest how Carter appointed him to bring down inflation, a courageous decision, that might have costed him the election, and how Volcker went on to stabilize the so-called Great Inflation. Volcker was the head of the New York Fed from 1975 to 1979, before he was appointed chairman of the Fed in that...

Read More »Argentina and the IMF

Alberto Fernández, who will assume as the next president in less than two weeks, has said he will not accept the next tranche of US$ 11billion that were part of the US$ 57 billion deal signed by the outgoing Macri administration. Many progressives see this as a good sign, in particular given the history of the IMF with Argentina. I've emphasized, against a lot of heterodox discussion on the subject, that the IMF remains essentially unchanged when it comes to policy prescriptions. So I...

Read More »Venezuela and the embargo

Should have posted this a while ago. I had a conversation with the World Bank economist above on how much of the problems of Venezuela are the result of the embargo. Here a paper by Francisco Rodríguez. Worth reading.

Read More » Naked Keynesianism

Naked Keynesianism