Thirlwall and McCombie The new issue of ROKE is out. Three papers are freely downloadable (linked below). Check it out!Thirlwall's law at 40 by Esteban Pérez Caldentey and Matías VernengoWhy Thirlwall's law is not a tautology: more on the debate over the law by J.S.L. McCombieThoughts on the balance-of-payments-constrained growth after 40 years by A.P. Thirlwall

Read More »MMT in Developing Countries at the Real News Network

[embedded content] Full transcript of the short interview here. Paper was linked before. Note that we say that Functional Finance does apply to developing countries, but that the insistence of the advantages of flexible exchange rates, as opposed to managed regimes with capital controls, are not correct.

Read More »Real World Economics Review

So the RWER has a whole issue on Modern Money Theory (MMT). I haven't read the whole thing yet (barely started). At nay rate on that later. Whole issue can be downloaded here. Enjoy!

Read More »Modern Money Theory (MMT) in the Tropics

Paper has been published as a PERI Working Paper.From the abstract: Functional finance is only one of the elements of Modern Money Theory (MMT). Chartal money, endogenous money and an Employer of Last Resort Program (ELR) or Job Guarantee (JG) are often the other elements. We are here interested fundamentally with the functional finance aspects which are central for any discussion of fiscal policy and have received more attention recently. We discuss both the limitations of functional...

Read More »Official Reforms and India’s Real Economy

By Sunanda Sen (Former Professor, Jawaharlal Nehru University; Guest Blogger)That the Indian economy is currently experiencing a slowdown is more than evident, both with the deliberations in different private circles and with official statements signalling a series of remedial measures , mostly focused on the ailing financial sector! However, as we point out, the ailing Indian economy has concerns that go beyond flagging GDP growth and the ailing financial sector. Downturn in the economy ...

Read More »New Book on Roy Harrod

Esteban Pérez Caldentey has just published a new book on Roy Harrod for the collection edited by Anthony Thirlwall. From the description: This landmark book describes and analyzes the original contributions Sir Roy Harrod made to fields including microeconomics, macroeconomics, international trade and finance, growth theory, trade cycle analysis and economic methodology. Harrod’s prolific writings reflect an astounding and unique intellectual capacity, and a wide range of interests. He...

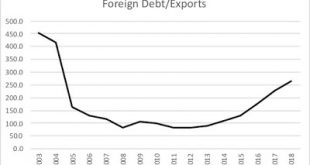

Read More »Some brief thoughts on Argentina’s ongoing crisis and the IMF’s role in it

Argentina's peso depreciated significantly after the primary elections last month, with the clear victory of the opposition. The crisis has come full circle now with the re-imposition of capital controls, and with the default on domestic bonds, the latter a puzzling and clearly unnecessary measure, since it was in domestic currency (Standard & Poor's says it's a selective default, whatever that means, and Fitch called it a restricted default). So here a few things that might be useful...

Read More »Central Bank Independence: A Rigged Debate Based on False Politics and Economics

No pressure! By Thomas Palley (guest blogger)The case for central bank independence is built on an intellectual two-step. Step one argues there is a problem of inflation prone government. Step two argues independence is the solution to that problem. This paper challenges that case and shows it is based on false politics and economics. The paper argues central bank independence is a product of neoliberal economics and aims to institutionalize neoliberal interests. As regards economics,...

Read More »50 years of the journal Problemas del Desarrollo

I'll be in Mexico, with a group of distinguished local economists for this event. In Spanish, but very likely it will be streamed. Will post more about it.

Read More »Interview for the Argentinian Radio

I was interviewed yesterday about the situation in the country (Cítrica Radio, Siempre Es Hoy). Interview was cut short as a result of a bad connection. The audio of the part of the program I appear is here.

Read More » Naked Keynesianism

Naked Keynesianism