Virtual seminar in México, and in Spanish. To attend go to the Zoom page and register. And, yes, it should be Vernengo, with e.

Read More »New issue of ROKE is out

The April Issue of the Review of Keynesian Economics is now out. The issue contains a collection of articles covering a spectrum of important issues. It opens with a debate over New Developmentalism which pits development relying on macro prices (especially the exchange rate) against historical state-led development policies. Next, there is an article on the role of the wage share in determining exchange rates. Thereafter, there are several articles on Post Keynesian growth theory. One...

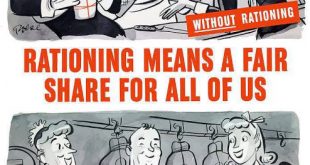

Read More »World War II, not the New Deal, is the model for COVID-19 macroeconomic policies

Central planning (Socialism?) in democratic societies There is a lot being written on the causes and cures for the economic consequences of the Coronavirus (COVID-19). The predictable distinction is among those that think that this is essentially a demand shock, mostly to services, and those that are concerned with the disruption to supply chains. And to some extent both are correct. But that is not the more relevant problem here, which is whether we need just more government or a...

Read More »From Truncated Developmental State to Failed State in Latin America

I gave a talk last year in Argentina that forced me to think about the notion of the developmental state and its limits for Latin America. I discussed it in Mexico too, and I added a bit more about the notion of failed states, also discussed in my first presentation. This week I presented at Boston University, for the first time for a mostly English speaking audience. This is a brief summary of some of my ideas, based on those presentations.National state formation in Latin America,...

Read More »Obamacare With a Public Option: Fool Me Twice Shame on Me

By Thomas PalleyThere is an old saying “Fool me once shame on you, fool me twice shame on me.” That saying is relevant for the current healthcare debate in which former Vice-President Biden and elite Democrats are touting a reheated version of Obamacare with a public option. It is a case of trying to fool the American public twice.Adding an Obamacare public option will not solve the healthcare problem. Worse yet, it misses an historic opportunity to heal the festering wound of healthcare...

Read More »Housing and Inequality in Utah

From the recent report, written to a great extent by David Fields: Rising housing costs and stagnating real wages are the primary causes of worsening housing affordability in Utah. From 2009 to 2016 real income only grew at 0.31% per year while rent crept upward at a rate of 1.03% per year in 2017 constant dollars. Now, more than 183,000 low-income Utah households pay more than half their income for rent, becoming more likely to be evicted and moving closer to homelessness. Housing has...

Read More »Bernie Sanders: Nothing to Fear Except Fear Itself

By Thomas Palley“The only thing we have to fear is fear itself.” Eighty-seven years ago those were the words of Franklin Delano Roosevelt in his 1933 inaugural speech. Today, they resonate with Senator Bernie Sanders’ presidential campaign, which confronts a barrage of attack aimed at frightening away voters.Fear is the enemy of change and the friend of hate. That is why both sides of the political establishment are now running a full-blown campaign of fear-mongering against Sanders. The...

Read More »Scott Carter’s talk on Sraffa

If you are in London go see Scott Carter talk on Sraffa tomorrow, organized by Andrés Lazzarini. Time: Friday Feb. 14, (11:30 to 13:30). Location: Margaret McMillan Building, MMB room 224, Goldsmiths University of London, New Cross, SE14 6NW

Read More »Robert Shiller’s Godley-Tobin Lecture

Godley-Tobin Lecture later this month in Boston, during the Eastern Economic Association Meetings.

Read More »Do current times vindicate Keynes and is New Keynesian macroeconomics Keynesian?

Thomas I. Palley, Esteban Pérez Caldentey and Matías Vernengo Professor Robert Rowthorn delivered the second annual Godley–Tobin lecture in New York City on 1 March 2019. The title of his lecture was ‘Keynesian economics – back from the dead?’ and it is published in this issue of the Review of Keynesian Economics. The lecture was attended by a large audience and the Question & Answer session provoked a stimulating discussion. Prompted by that discussion, we thought it would be...

Read More » Naked Keynesianism

Naked Keynesianism