[embedded content]

Read More »Trump’s budget

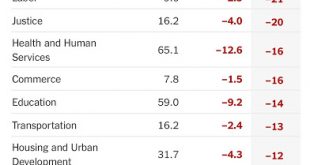

The figure from the New York Times shows the changes in spending by category. More defense and less social spending. Not a surprise there. Schumpeter long ago (in his The Crisis of the Tax State) suggested that it is the fiscal history of a society that explains the spirit of the people and the character of the government, since it is there plain to see by those that can read it what they are trying to achieve. The surprise to me, at least so far, is that the increase in defense seems to...

Read More »Latin American Corner: Neo-Fisherism, New Keynesianism and monetary policy in Latin America (I)

By Naked Keynes (Guest Blogger)*Since the 2000s, like other countries in the region, Brazil adopted inflation targeting. The results are not encouraging. Brazil has, without doubt, the highest interest rate levels of Latin American economies. Brazil also has probably the widest interest rate spread in the region. In the first months of 2017, the monetary policy rate stood at 12.25%. Available data for interest rates for the year 2016 show that the deposit rate is around 12.43%, while the...

Read More »Kalecki: Forgotten Genius

A documentary about Kalecki can be seen here (no way to embed, sorry). H/t to Franklin Serrano.

Read More »What economists do?

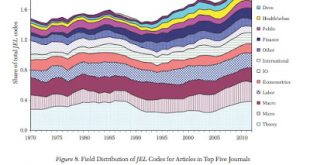

Nothing more profound here on the perils of being an economist. And nothing (not in this post, at least) on the interest rate hike (more on that later; it will be announced at 2pm). Just a table I came across from a paper by Card and DellaVigna (see here) on the fields of papers published in the five top mainstream journals.*The authors suggest that "the relative shares of the different fields are fairly constant over time: theory is the largest field, accounting for about 30 percent of all...

Read More »Post Keynesian Summer School in Toronto

The Summer School is at the same time than the Annual Meetings of the History of Economics Society, and it is sponsored by ROKE.

Read More »Job numbers and more at the Rick Smith Show

[embedded content]

Read More »Quantitative Easing (QE), changes in global liquidity and financial instability

New paper by Esteban Pérez. From the abstract: This paper argues that QE led to significant changes in the global financial system, which, are not conducive to greater financial stability. Through a policy of reserve accumulation, QE disconnected base money from the money supply and deposits from loans. Jointly with the deleveraging process of global banks, QE contributed to restrain the supply of bank credit growth throughout the world. Also global banks continued to expand their trading...

Read More »The theory of endogenous money and the LM schedule

By Tom Palley. From the abstract: Money is at the center of macroeconomics, which makes understanding the money supply central for macroeconomic theory. this paper presents the Post Keynesian theory of endogenous money supply and shows how it is fundamentally different from the conventional money supply theory. the conventional approach relies on the money multiplier and bank lending is invisible. Post Keynesian theory discards the money multiplier and focuses on bank lending which drives...

Read More »More on Trumponomics and Globalization at the Rick Smith Show

[embedded content]

Read More » Naked Keynesianism

Naked Keynesianism