Last January the Association for Evolutionary Economics (AFEE) sessions at the Allied Social Sciences Association (ASSA) meetings revolved around the theme of "Inside Institutions," meaning that within institutions there are many actors with different sets of interests, so one must look under the hood, so to speak, of the institution itself to understand its actions. My paper followed my previous discussion of the historical evolution of central banks, and a brief discussion within the...

Read More »Latin American corner: When will they ever learn?

By Naked Keynes (Guest Blogger)The latest IMF World Economic Outlook (April 2016) projects stagnation in World Growth (3.1% and 3.2% in 2015 and 2016) both in advanced economies (4.0% and 4.1% in 2015 and 2016) and emerging market and developing economies (1.9% and 1.9% for 2015 and 2016). The prospects for 2017 are hardly any better with an estimate of 3.5% for global output and continuing stagnation of advanced economies. But things could get worse.The current outlook scenario depends on...

Read More »A Terse Elucidation of Marx’s Concern with Alienation in the Mature Writings

By David FieldsNote: The references below are drawn from The Marx-Engels Reader, edited by Robert C. Tucker.Is Marx’s concern with aspects of alienation subsumed in his mature writings? To suggest so is a falsity. Marx’s depiction of the proletariat becoming, in the Hegelian sense, emancipated from the objective conditions of estranged labour, is not withered as the analysis moves toward the technical conditions of production. Marx’s humanism is still apparent.In Wages, Labour, and...

Read More »Maurice Obstfeld and the IMF push structural reforms

Spot the difference The new World Economic Outlook (WEO) is out, now under the direction of Maurice Obstfeld, after the retirement of Olivier Blanchard. They suggests many reason for why the global economy has been Too Slow for Too Long, as the title of the report indicates. In the forward Obstfeld tells us that part of the solution would be to promote: "structural reforms in product and labor markets [since this] can be effective in boosting output, even in the short term, and...

Read More »On the Panama Papers at the Rick Smith Show

[embedded content]

Read More »A Short Account of The Rise of Neoliberalism

By David FieldsBetween roughly the early 1940’s and early 1970’s, the financial architecture of the world economy centered on a US engineered Keynesian accumulation agenda, as a response to the devastation wrought by the Great Depression. The capitalist institutional structure, or social structure of accumulation (Kotz, McDonough, and Reich, 1994), rested on finance being subservient to the promotion of industrial enterprise. With socially-engineered capital-labor compromises in...

Read More »A Brief Sketch of the Classical-Keynesian Perspective

By David Fields, originally posted hereFrom a Classical-Keynesian perspective (Bortis, 1997, 2003), rates of interest regulate rates of profits (Panico, 1980, 1985), and, thus, real wages are endogenously determined. The presence of financial instruments, which represent titles to future flows of income, makes it so that the actual center of distributive conflict in capitalism lies not in the technical conditions of production, but is rather governed by the real rate of interest, which is...

Read More »Tom Palley on Inequality, the financial crisis and stagnation

From the abstract: This paper examines several mainstream explanations of the financial crisis and stagnation and the role they attribute to income inequality. Those explanations are contrasted with a structural Keynesian explanation. The role of income inequality differs substantially, giving rise to different policy recommendations. That highlights the critical importance of economic theory. Theory shapes the way we understand the world, thereby shaping how we respond to it. The...

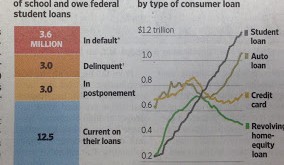

Read More »The student loan crisis

The student loan situation is critical, and the WSJ (subscription required) suggests that there are increasing worries that a large number of borrowers will default. The numbers are indeed concerning with 43% in default already, delinquent or in postponement as shown below. This has had strange implications. But while I think that the increase in student loan debt is part of the increasing inequality in the country, and one might add, the increasing costs of college education, that forces...

Read More »Economists don’t read (enough) books

So Ann Petiffor twitted a link to a post on why economists do not read Polanyi's The Great Transformation (or the other GT; yes the one is Keynes' General Theory) The author, Marko Grdesic, basically suggests that economists do not read books, period.* I would add, let alone Polanyi that was always at the fringes of mainstream economics. He estimates that about 3 percent of economists have read Polanyi. That reminded me of a story that Eichengreen had told me about a course he taught...

Read More » Naked Keynesianism

Naked Keynesianism