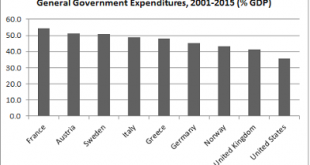

Source: WEO, IMF Nothing earth shattering. Just the size of the average government spending as a share of GDP between 2001 and 2015 in a few developed countries, all of which, but one, have comprehensive health coverage. So it's reasonable to assume that if the US wanted that (healthcare for all), it would have to increase spending to something closer to 40% of GDP, for all levels of government, rather than the current 35% or so. Nothing implausible about that (wink, wink, nudge, nudge,...

Read More »Frank Knight on unemployment equilibrium

Luca Fiorito, my sometimes co-author, and Carlo Cristiano have published (subscription required) class notes from Frank H. Knight's business cycle course in the fall of 1936, that used Keynes' General Theory (GT) as one of his references. Two quotes from the notes by Perham Nahal are reproduced below. The main postulate of Keynes: the supply curve for labor should be drawn in terms of money, with no reference to the value of money (real vs. money wages). There is no tendency for the price of...

Read More »Lord Eatwell in the Financial Times

A short Letter to the Editor, but worth reading. He clearly explains the policy failure since the global crisis and the reasons for the current problems in financial markets in developed and developing countries. He says: The adage that, in the absence of the prospect of growing demand, cheap money amounts to “pushing on a string” has been once again confirmed in advanced economies by the slowest recovery from any modern recession. Instead of funding real investment, monetary expansion has...

Read More »Crazy as Adam Smith: the Media Discovers the Kaldor-Verdoorn Effect

So Kevin Drum at Mother Jones discovers the Kaldor-Verdoorn effect, and the fact that growing demand might be the main cause of rising productivity, and idea as old as Adam Smith in his vent for surplus model (chapter 3 of the Wealth of Nations says that the division of labor, that is, productivity, which is the basis for development, is limited by the extent of the market, that is, by demand). I posted extensively on that here (all post by date here), and produced, as far as I know, the...

Read More »Getting history right: Krugman continues his disinformation campaign

So Krugman continues to argue that Friedman's calculations are implausible. Well sure. But that's the point to some extent as Galbraith discussed here. The Plan involves huge (read yuge; wink, wink, nudge, nudge) spending, and it should have almost by definition implausible results looking from the perspective of recent history. Imagine the implausible effect that Social Security had on old age poverty. Or the incredible reduction in inequality that the New Deal policies had.If you were in...

Read More »On Bernie Sanders and the Democratic Establishment Economists at the Rick Smith Show

[embedded content]

Read More »Jamie Galbraith’s response to the critics of Gerald Friedman’s paper on the impact of Bernie Sanders policies

There has been a debate following the NYTimes piece on left of center economists against Bernie Sanders. Doug Henwood replied here and Dean Baker here. Henwood does not discuss the Gerald Friedman paper that led to the whole discussion. Now Jamie Galbraith provided a nice reply to the left of center economists that suggested that Bernie's plans are not realistic. He says: "What the Friedman paper shows, is that under conventional assumptions, the projected impact of Senator Sanders'...

Read More »Davidson on Temin and Vines

Paul Davidson debates Peter Temin and David Vines in this INET working paper. I had criticized Temin and Vines before here and here. Although in general I agree with Paul, in my view, there is a problem with Keynes’ Bancor Plan kind of solution, that is the one that puts an emphasis on the need for surplus countries to carry the burden of external adjustment. It is really, in the world we live with a hegemonic currency, the role of the issuer of the international reserve currency to carry...

Read More »The Big Short and post-film debate with Geoff Schneider and @NakedKeynes

Showing at The Campus Theatre this Saturday, Feb 20th, 4:00pm – THE BIG SHORT – This funny, fact-based film explores the very serious recent collapse of Wall Street and the insiders who saw it coming. Mondragon Bookstore and Susquehanna Valley Progressives are pleased to sponsor this film and a discussion panel of economic and business experts, immediately following the film. Panelists include Dr. Geoffrey Schneider, Professor of Economics, Bucknell University and Dr. Matías Vernengo,...

Read More »Scalia, Partisanship bias, and Long Term Stagnation

So a student asked me if the nomination for the Scalia vacancy at the Supreme Court would have any macroeconomic impact. Can't imagine what kind of effect he was thinking about, but there is a relevant question on what are the effects of the inability of the legislative to get things done. The most obvious is the inability to pass a budget that deals with the slow recovery.It used to be the case that both parties had a a very different fiscal agenda, with Democrats being for tax and spend,...

Read More » Naked Keynesianism

Naked Keynesianism