Since the blog is now almost 5 years old, and several issues have been discussed before, I decided once in a while to post links to old entries. This one actually with two posts one from Triple Crisis, which started the year before, and in a sense pushed me to start my own blog.Since yesterday the Donald had an op-ed in the Wall Street Journal on currency manipulation here my two cents on how much China is really a problem.Currency Wars and Global RebalancingOn China and Jobs

Read More »The Argentinean election, the economy and more

On Sunday, November 22, Argentineans are going to the polls. The two candidates represent significantly different projects, and not just in economic terms. On the one hand, there is Daniel Scioli, governor of Buenos Aires, ex-vice-president during Néstor Kirchner’s presidency and (even if not completely trusted by those closer to President Cristina Fernández de Kirchner) the candidate of continuity. On the other hand, Mauricio Macri—wealthy scion a business family with origins as public...

Read More »Grenoble Post Keynesian Winter School

For more info go here.

Read More »On the job numbers at the Rick Smith Show

[embedded content]

Read More »Full time employment finally above previous peak!

By the way, if you count workers employed full time only in August this year we surpassed the December 2007 peak, and after a fall in September, we're over again now. So it took only about 8 years to get back were we were. Yes, the economy is peachy.

Read More »The economy is performing well; good to know

New Employment Situation Report is out. Not bad, given the last couple of months. In October, total nonfarm payroll employment increased by 271,000 and the unemployment rate is at 5%. The employment-population ratio, which seemed to start to inch up last year, however, now looks again stagnant. Even though it seems markets are happy with job creation above 200k per month, we need something more like 400 for a healthy recovery, and to bring the employment-population ratio up. Earnings have...

Read More »Debtors’ Prisons

Recently NPR had a story about the criminalization of poverty in the US, and the fact that now poor people that get a parking ticket and the fees that go with that for processing, for court expenses, and what not, may end up in jail. At least now a series of lawsuits are challenging this kind of abuse.

Read More »Bowles on Capitalism and Institutions

As I noted before I've been teaching a Political Economy course, which I assumed right before classes began, and, I decided to keep the textbook, since it was already ordered. The book is written by Bowles, Edwards, and in the last edition, Roosevelt and is titled Understanding Capitalism. I discussed before the meaning of capitalism here (see also this on the use of the term capitalism as a proxy for free market policies).Here just a brief comment on the use of the idea of modes of...

Read More »No government shutdown and no default, but still slow growth

[embedded content]

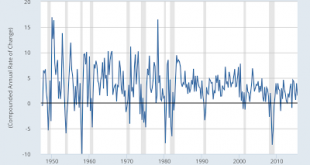

Read More »Growth slowsdown in the third quarter

BEA released the advanced estimate for GDP growth in the third quarter, 1.5%, well below the 3.9% growth of the second quarter. One can see that the recent recovery is slow even when compared to the Clinton and Bush II recoveries. So, nothing new, the slow recovery continues. If the budget deal gives some hope that at least we're not going to shutdown the government, and as a result avoid an even worse slowdown, there is very little reason to hope for the kind of fiscal stimulus we need.

Read More » Naked Keynesianism

Naked Keynesianism