<br /> Lecture at the Renner Insitute in Vienna, October 6.

Read More »On the Way to the Great Depression: The Demand Regime of the US Economy (1900-1929)

New Working Paper by Ahmad Borazan. From the abstract: It has become commonplace to raise the analogy between the recent experience of the dynamics of income distribution and growth, and that of the era before the Great Depression. However, no study of the demand regime has been done for the early twentieth century period; this study attempts to fill that gap in the literature. Based on a Kaldorian model, I estimate whether the demand regime of the pre-Great Depression era for private...

Read More »Amit Bhaduri and Diane Elson win the 2016 Leontief Prize

Tufts Global Development and Environment (GDAE) Institute announced the Leontief winners for next year. From the press release: GDAE will award its 2016 Leontief Prize for Advancing the Frontiers of Economic Thought to Diane Elson and Amit Bhaduri. This year's award, titled "Development and Equity," recognizes the contributions that these researchers have made to economic understandings of development, power, gender, and human rights.“As the free market and waves of globalization have left...

Read More »Causality and the new World Economic Outlook (WEO)

I often say that causality is the main, but not the only, difference between mainstream and heterodox approaches in macroeconomics. It's true for differences between Say's Law versus the Principle of Effective Demand, for discussions of exogenous/endogenous money, and also for interpretations of the relation between growth and productivity.The new WEO is out (here). This one the first under Maurice Obstfeld, who substituted Oliver Blanchard. The explanation for lower growth in Obstfeld's...

Read More »A Post-Keynesian Interpretation of the Spanish Crisis

New paper with Esteban Pérez published by the Levy Economics Institute.From the abstract: The Spanish crisis is generally portrayed as resulting from excessive spending by households, associated with a housing bubble and/or excessive welfare spending beyond the economic possibilities of the country. We put forward a different hypothesis. We argue that the Spanish crisis resulted, in the main, from a widening deficit position in the nonfinancial corporate sector—the most important explanatory...

Read More »On inequality and the Democratic debate at the Rick Smith Show

[embedded content]

Read More »Centro Sraffa Lectures

Franklin Serrano will deliver the Pierangelo Garegnani Lecture 2015 titled "Notes on Garegnani, Kalecki and effective demand." Paper not yet available. Also, Christian Gehrke will deliver three lectures in the Phd programme in Economics of Roma Tre University. For those not in Rome, the papers on which the lectures are based are available here.

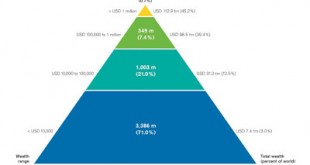

Read More »The plutonomy is doing fine

Double posting on the Credit Suisse Global Wealth Report (2015) (other post here). I had discussed the previous issue here. Below the Global Wealth Pyramid. Not much difference with previous one, but a bit worse. Now 71% of the population holds 3% of the wealth (before it was the 67% at the bottom held 3.3% approximately). And the top 0.7% of the population holds slightly more than 45% of total wealth.By the way, the US has added more people at the top, while Japan and Europe have lost a...

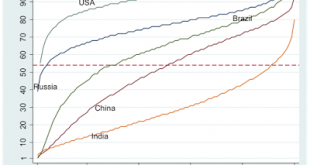

Read More »Branko Milanovic on Global Inequality

You can hear the podcast of this interview at Bloomberg's Taking Stock here. You can also read this interview from last year. Graph below is from the latter. As he explains: The graph (for year 2008) shows on the horizontal axis a person’s position in their own country’s income distribution, and on the vertical axis, a person’s position in global income distribution. Thus, the poorest Americans (points 1 or 2 on the horizontal axis have incomes that put them above the 50th percentile...

Read More »Wealth Concentration, Income Distribution, and Alternatives for the USA

New paper by Lance Taylor, Özlem Ömer and Armon Rezai. From the abstract: US household wealth concentration is not likely to decline in response to fiscal interventions alone. Creation of an independent public wealth fund could lead to greater equality. Similarly, once-off tax/transfer packages or wage increases will not reduce income inequality significantly; on-going wage increases in excess of productivity growth would be needed. These results come from the accounting in a simulation...

Read More » Naked Keynesianism

Naked Keynesianism